- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- Preview: the Bank of Canada rate decision

News & analysisOne of the must-watch economic events this week will be the Bank of Canada interest rate decision. The rate decision is due to be announced at 15:00 PM London time on Wednesday.

Why is the announcement important?

A bank interest rate is a rate at which a country’s central bank lends money to local banks. The interest rate is charged by the nation’s central or federal bank on loans and advances to control the money supply in the economy and the banking sector. The Bank of Canada has an inflation target of 1% to 3% (currently 1%). The interest rates are changed accordingly to meet the target. The decision to increase, decrease, or maintain the interest rate has a significant impact on the financial markets so it is one of the most closely watched economic events in the calendar.

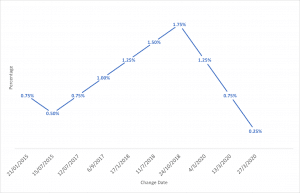

Bank of Canada interest rate changes since 2015

Expectations

All eyes will be on the Bank of Canada governor, Tiff Macklem on whether the interest rate remains unchanged at 0.25% or reduced closer to 0%. Canada has had one of the strictest lockdown measures in the world in its fight to defeat the Coronavirus in recent months, which has had a considerable impact on the country’s economy.

Despite that, the rates are expected to remain unchanged, according to economists.

Brett House, vice-president, and deputy chief economist at Scotiabank:

”We do not expect a rate cut from the Bank of Canada at its next meeting as rate-sensitive sectors don’t need an additional boost. For instance, Governor Macklem noted before the holidays that we should watch how housing is faring … Canadian home sales were up 7.2 per cent month-over-month in December to set a record for the month, which completed an annual gain of 12.6 per cent year-over-year. In other areas, retail sales have been above year-ago levels for several months.”

”Although some immediate risks to the economy have gone up with intensified restrictions to stem the spread of COVID-19, medium-term risks relevant for setting monetary policy have abated. Vaccines are being delivered about a year ahead of the Bank of Canada’s earlier expectations; the U.S. stimulus and funding bill passed and a government shutdown was averted, which will provide some positive spillover effects into Canada; and financial conditions remain favourable to growth.”

The Monetary Policy Report is set to be released shortly after the rate decision.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

COTD: FTSE100

FTSE100 – Point & Figure The FTSE 100 looked to ride the tailwinds of positive sentiment sweeping through US markets today but instead failed to maintain a reasonable start, ending the session down and 7 points in the red. However, the longer-term picture looks brighter for the Index as we study the latest point & figure chart shown ...

January 20, 2021Read More >Previous Article

Week Ahead: Equity markets take a breather, US dollar strength and Crypto pullback

Major Indices took a breather last week, with US equity markets closing down more than 1% after posting record highs the week prior. In economic new...

January 18, 2021Read More >Please share your location to continue.

Check our help guide for more info.