- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- RBA cut interest rates

News & analysisUpcoming News

» 6:30pm Construction PMI – GBP

» No release time, GDT Price Index – NZD

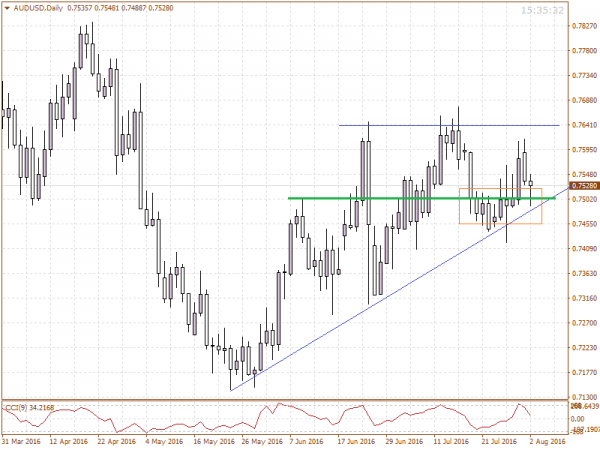

As expected the RBA cut interest rates by 25 basis points. The AUDUSD dropped on the news but has retraced most of its drop. The AUDUSD lost 54 pips to .7488, buyers have come back in taking it back above .7500. The AUS200 lost ground after the disappointing building approvals and trade balance figures. It found some buying support post rates release but is currently still trading lower by 23 points. The USD and JPY have seen quiet trade so far today with small Asain session ranges. Signs did come in we might be some JPY selling but currently, it’s very choppy with little direction.

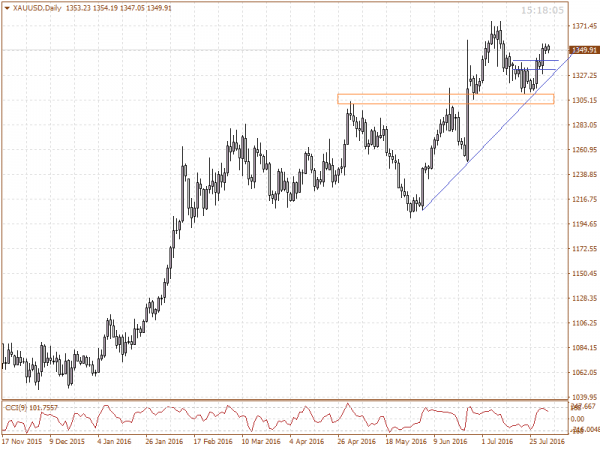

Tonight I’m looking for weaker opens in Europe with strong selling on the GER30 and UK100 overnight. The UK100 has broken out of a trend channel and is sitting around a support base. Gold is showing active sellers at 1354 this could come in as short term resistance off 1355. Price is still in a short-term trend up but I would like to see 1354.20 closed above to show a continuation towards 1366 highs.

AUDUSD – Considering the negative influences today the AUD has held up very well. The rate cut took prices down to .7490, this area has shown support and indecision previously. We have seen this area reconfirm today. I’d be paying attention to this level for the near term. Continued buying could set up a failed low if buying holds out tonight.

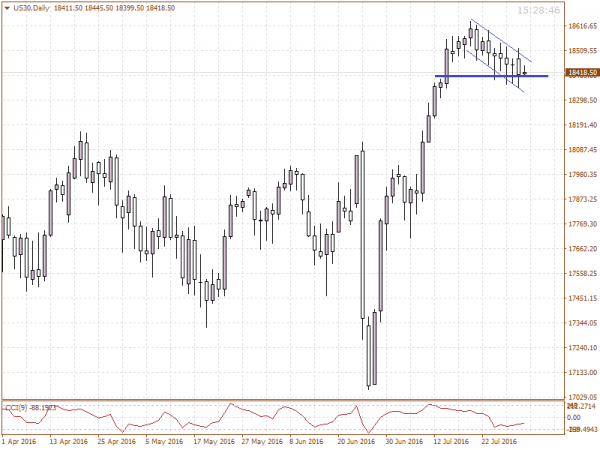

US30 – Today’s price is sitting on a key short-term level. Overall we have a bearish channel. The key level 18395 has seen 5 tests holding up so far. To the top, we have a lot of downward pressure. A break lower set’s in new prices not seen since mid-July. A break above the channel sets up a continuation of the current trend which could offer a buy idea. If we see a break lower, I’d be looking for a test down to 18235.

XAUUSD – Gold is showing a normal trend formation with the current retracement not overlapping its previous high. 1355 is showing short-term resistance. Overall the picture still looks good on the Med term for continued higher prices. I would like to see any short term pull back to find support from 1333 to 1341. A break and close below 1333 could be indicating a lower high is coming in and confirming.

Good Trading.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market StrategistReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Eyes are on the BOE tonight for the rate decision

Upcoming News » 9:00pm BOE Inflation Report - GBP » 9:00pm MPC Official Bank Rate Votes - GBP » 9:00pm Monetary Policy Summary - GBP » 9:00pm Official Bank Rate - GBP » 9:30pm BOE Gov Carney Speaks - GBP » 10:30pm Unemployment Claims - USD » 11:30am RBA Monetary Policy Statement - AUD Eye’s are on the BOE tonight for the rate dec...

August 4, 2016Read More >Previous Article

JPY sees a wild trading session

Upcoming News » 10:30pm GDP - CAD » 10:30pm Advance GDP - USD » Sat 6:00am EBA Bank Stress Test Results - EUR, USD, JPY The JPY saw a wi...

July 29, 2016Read More >Please share your location to continue.

Check our help guide for more info.