- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Australian employment figures beat forecast – Rates markets and AUD reaction

- Home

- News & analysis

- Economic Updates

- Australian employment figures beat forecast – Rates markets and AUD reaction

News & analysisNews & analysis

News & analysisNews & analysisAustralian employment figures beat forecast – Rates markets and AUD reaction

17 November 2022 By Lachlan MeakinAustralian October employment figures released at 11:30 AEDST handily beat expectations with 32.2k jobs added for the month (15k expected), the unemployment rate also unexpectedly fell to 3.4% when it was expected to be unchanged at 3.5%.

Coupled with yesterdays beat in the Wage Price index which showed wages increased 1% in Q3 paints an optimistic view of the Australian labour markets resilience in the face of decades high inflation and rising interest rates.

Today’s figure is the last significant scheduled economic announcement out of Australia before the December rate meeting on the 6th,at this morning’s open futures were pricing in a 59% chance of a 25 bp hike rather than a pause, with the market split todays figure was being closely watched to see if it could tilt the needle either way.

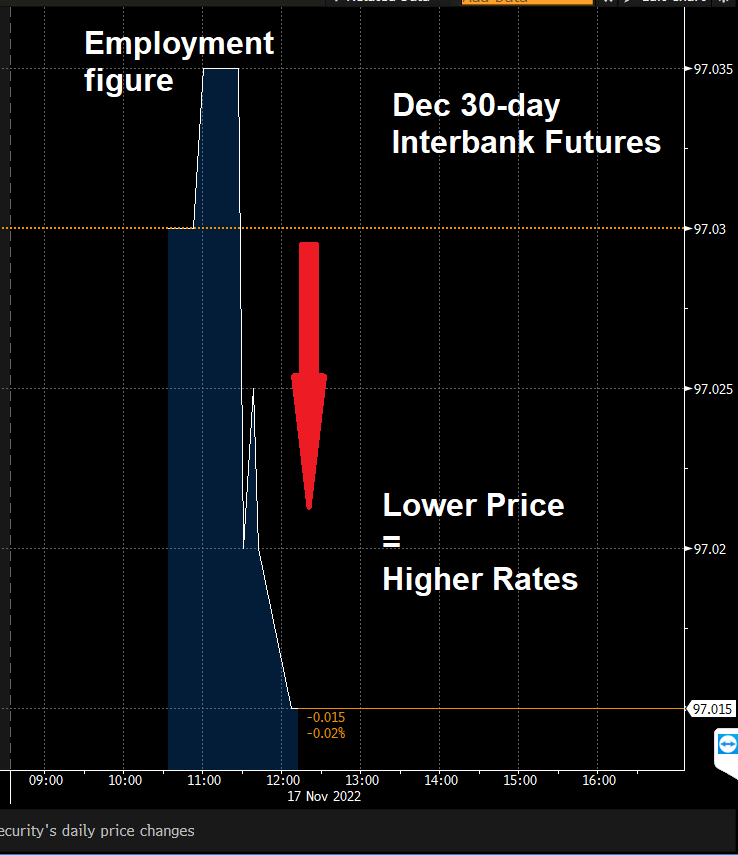

December 30 day interbank futures were priced at 97.03 going into the figure, once a big beat was announced we saw the price drop to 91.015 showing bond traders now expect the RBA to go the 25bp hike with a 63% probability.

AUDUSD had a pop on the employment figure, though quickly retraced despite the repricing of RBA rate hike expectations next month.

On the surface this reaction in the AUD looks surprising, but it has been evident for quite a while now that the RBA and its rate hiking trajectory is very much playing second fiddle to Global risk sentiment when it comes to the direction of the AUD.

I would expect a similar response in the AUD come December 6, if we get a pause a small drop, a hike a small pop, but neither will show any follow through unless the underlying risk sentiment supports it, so trade the AUD with that in mind.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

EUR looking Bullish

The EUR has been on a ‘recovery rally’ since it fell below parity level with USD earlier this year. With inflationary pressures potentially easing across the world the USD has finally taken a breath. The currency which has been haven for many market participants in dealing with the high volatility finally saw a dip after weaker than expected US...

November 17, 2022Read More >Previous Article

NVIDIA results announced

NVIDIA Corporation (NASDAQ: NVDA) reported its latest financial results after the market close in the US on Wednesday. The US technology giant beat...

November 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.