- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US markets lower as rally takes a breather on disappointing data, Apple underwhelms

- Home

- News & analysis

- Economic Updates

- US markets lower as rally takes a breather on disappointing data, Apple underwhelms

News & analysisNews & analysis

News & analysisNews & analysisUS markets lower as rally takes a breather on disappointing data, Apple underwhelms

6 June 2023 By Lachlan MeakinUS stock indices were broadly lower in Monday’s session after an impressive start to June took a breather on a quiet news day, with the only tier one release being ISM services PMI which had a surprise miss coming in at 50.3 vs an expected 52.6 indicating the US economy is struggling to remain in expansion (a reading above 50).

Apple (AAPL) held its WWDC conference where new products were launched including its much awaited Vision Pro headset, investors seemed a little unimpressed with AAPL stock unwinding earlier strength (hitting record highs) to finish solidly in the red for the session.

FX Markets

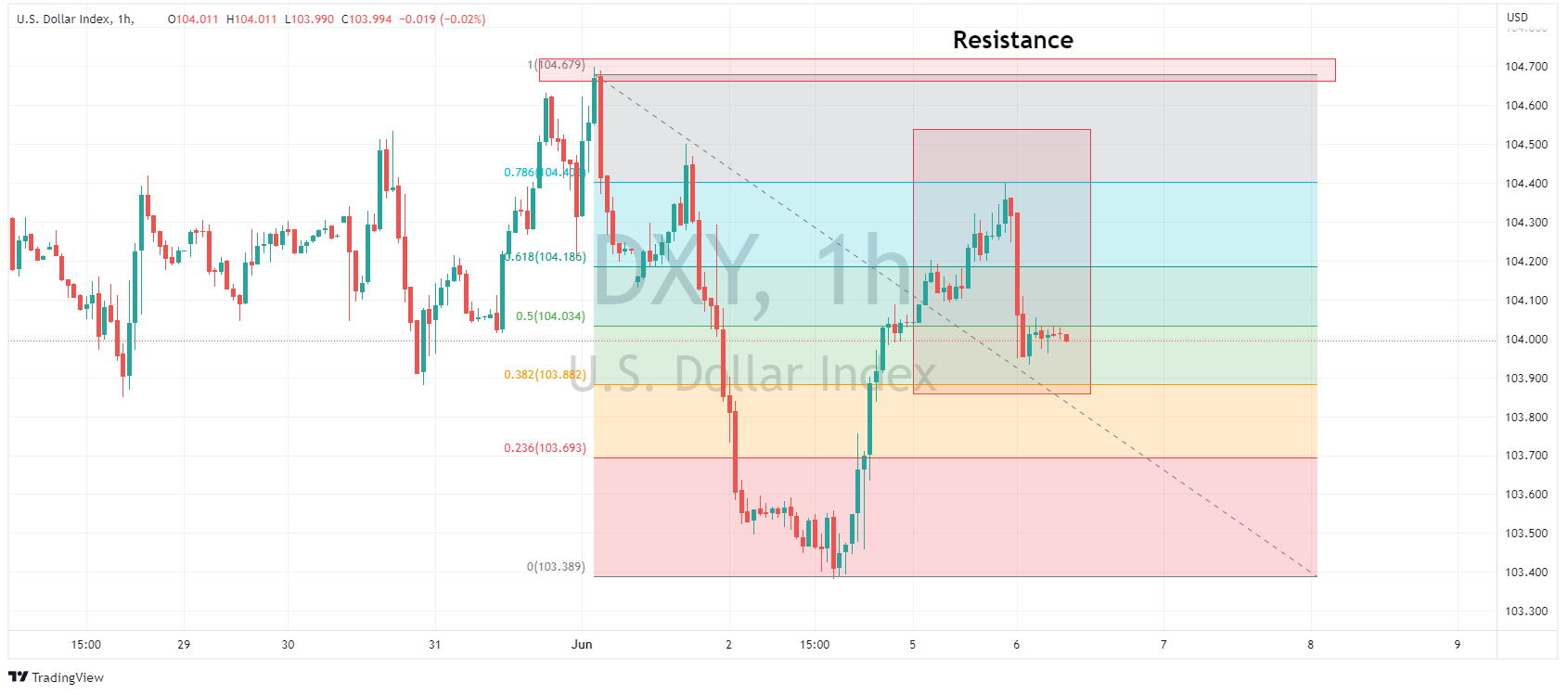

USD was choppy to start the week but ultimately slightly weaker, The US Dollar index trading within a tight range (103.930-104.400) on a slow news day aside from ISM Services PMI. The DXY started the week following through from a strong NFP number on Friday, but the ISM Services miss saw it give up its gains with last week’s high of 104.70 looking like key resistance ahead of the FOMC meeting next Wednesday.

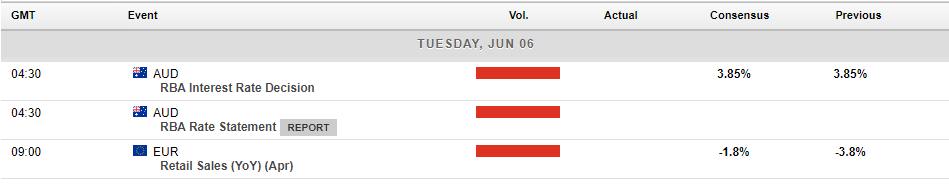

AUD saw upside and took advantage of USD weakness as opposed to anything currency specific, as market participants await the key RBA meeting today. The RBA it is expected to keep the cash rate unchanged at 3.85% although there is a chance of a 25bps hike due to the elevated inflation figures released last week. AUDUSD trading in a tight range between support and resistance zones.

Commodities

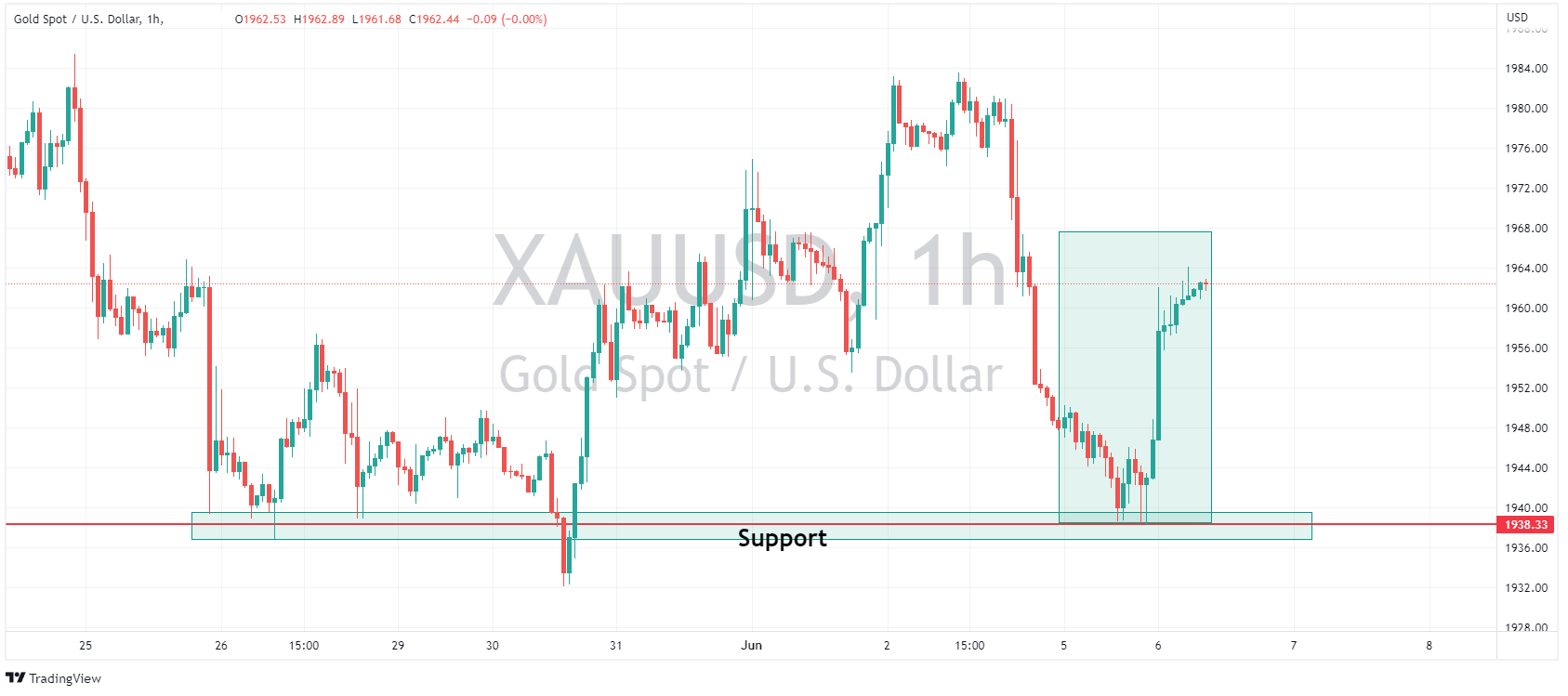

Gold rallied in Mondays session on a weaker USD and falling yields after the ISM miss, XAUUSD finding strong support at 1938 USD once again.

Crude Oil attempted to hold it’s Monday morning gap up on the OPEC+ production cut news on the weekend, but filled the gap almost to the pip, USOUSD finishing flat for the session.

Scheduled economic releases are light on the ground again today, but a potentially very interesting RBA monetary policy meeting is scheduled for 14:30 AEST. Markets are expecting the RBA to hold rates at 3.85% after last month’s surprise hike. Though there is a round a 30% chance priced in of another surprise hike, and after last weeks very hot April inflation figure there is a definite chance of this happening, either way some market participants are going to be on the wrong side so a big move in AUD could be expected.

Join myself and GO Markets Head of Education Mike Smith for a live webinar over the RBA decision, register at the following link.

RBA decision LIVE – The market responds!

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Could the Reserve Bank of Australia hike rates further?

The Australian interest rate is currently at 3.85% and the most recent consumer price index (CPI) released at 6.8% which indicates slightly higher than expected inflation growth (expectation was 6.4% with previous data at 6.3%). This puts more focus on the upcoming interest rate decision from the Reserve Bank of Australia (RBA). While further rate ...

June 6, 2023Read More >Previous Article

Market Analysis 5 – 9 June 2023

XAUUSD Analysis 5 – 9 June 2023 The overall outlook for gold prices is bearish in the short term. As there was a loss of buying momentum ...

June 5, 2023Read More >Please share your location to continue.

Check our help guide for more info.