Coinbase reports disappointing results for Q2 – the stock is falling

10 August 2022Coinbase Global Inc. (COIN) released its financial results for Q2 after the market close in the US on Tuesday.

The company reported revenue that fell short of Wall Street expectations at $808.325 million for Q2 vs. $873.82 million expected.

Coinbase reported a loss per share of -$4.98 per share vs. -$2.47 loss per share expected.

”Q2 was a test of durability for crypto companies and a complex quarter overall. Dramatic market movements shifted user behaviour and trading volume, which impacted transaction revenue, but also highlighted the strength of our risk management program. We are focusing on our top business priorities and more tightly managing expenses.”

”The decline in crypto asset prices significantly impacted our Q2 financial results, which were consistent with the outlook provided in May. Net revenue was $803 million, down 31% compared to Q1, driven by lower trading volume. Total operating expenses were $1.9 billion, up 8% compared to Q1. Net loss was $1.1 billion and was heavily impacted by non-cash impairment charges. Absent non-cash impairment charges, net loss would have been $647 million. Adjusted EBITDA was negative $151 million,” the company wrote in a letter to shareholders.

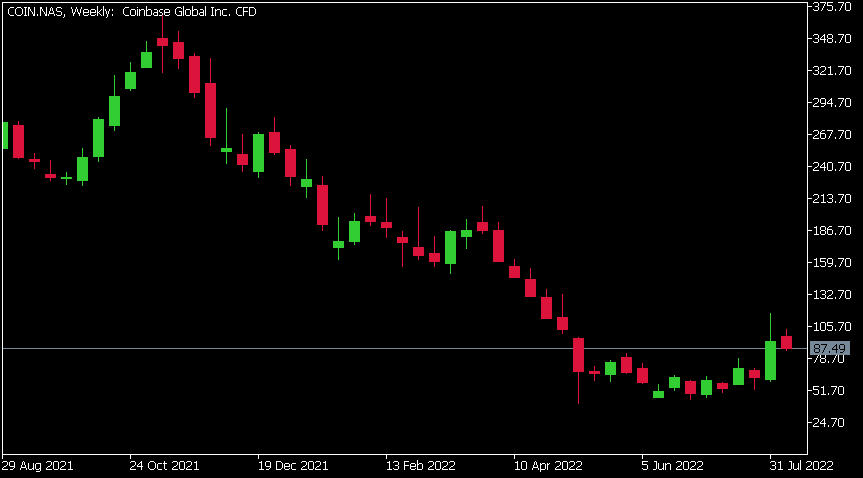

Coinbase Global Inc. (COIN) chart

Share price of Coinbase was down by 10.55% on Tuesday, trading $87.49 a share.

The stock fell further in after-hours following the release of the latest financial results, down by around 3%.

Here is how the stock has performed in the past year:

- 1 month +61.65%

- 3 months +20.13%

- Year-to-date -65.26%

- 1 year -67.49%

Coinbase price targets

- Citigroup $105

- DA Davidson $90

- Mizuho $42

- JMP Securities $205

- Atlantic Equities $54

- Goldman Sachs $45

- JP Morgan $68

Coinbase Global Inc. is the 754th largest company in the world with a market cap of $22.96 billion.

You can trade Coinbase Global Inc. (COIN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Coinbase Global Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Disney company tops Wall Street estimates

The Walt Disney Company (DIS) reported the latest financial results for its third fiscal quarter after the closing bell on Wednesday. World’s largest entertainment company reported revenue of $21.504 billion for the quarter (up 26% year-over-year), topping Wall Street forecast of $20.994 billion. Earnings per share reported at $1.09 per sha...

Previous Article

US equities and bonds drop ahead of key US CPI figure and Rate-hike odds rise

US equity markets were jittery on Tuesday as traders await todays closely watched inflation figures out of the US. All major Indices declined with t...