Home Depot tops expectations

23 February 2022Home Depot Inc. reported its fourth quarter earnings results before the opening bell in the US today.

The world’s largest home improvement retailer reported total revenue of $35.719 billion for the quarter, beating analyst forecasts of $34.88 billion.

Earnings per share was also slightly above analyst estimate at $3.21 per share vs. $3.18 per share expected.

The Company also announced that it will increase in its quarterly dividend by 15% to $1.90 per share.

“Fiscal 2021 was another record year for The Home Depot. We achieved a milestone of over $150 billion in sales,” said Craig Menear, Chairman and CEO.

“Our ability to grow the business by over $40 billion in the last two years is a testament to investments we have made in the business, our ability to execute with agility, and our associates’ relentless focus on our customers. I would like to thank all of our associates, as well as our supplier partners, for their hard work and dedication to serving our customers, communities and each other,” Menear added.

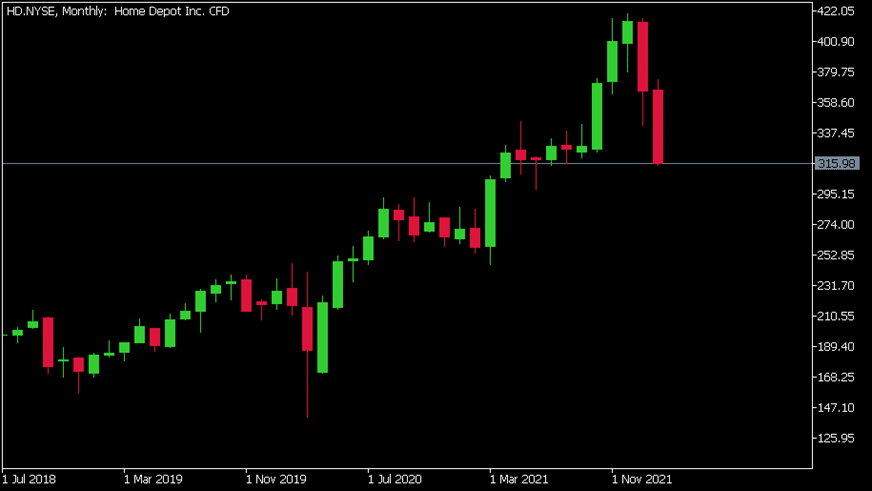

Home Depot Inc. (HD) chart (Monthly)

Shares of Home Depot trading lower during the session on Tuesday, down by around 8% at $315.98 per share.

Here is how the stock has performed in the past year –

- 1 Month: -13.29%

- 3 Month: -22.83%

- Year-to-date: -23.99%

- 1 Year: +14.36%

Home Depot Inc. is the 24th largest company in the world with a market cap of $331.24 billion.

You can trade Home Depot Inc. (HD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Home Depot Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Woodside’s surprising start to 2022

All prices in this article will be in USD unless otherwise stated. Woodside Petroleum Ltd is an Australian petroleum exploration and production company. Woodside is the operator of oil and gas production and is Australia's largest independent dedicated oil and gas company. Woodside Petroleum shareholders will be able to share in the energy pr...

Previous Article

Deere & Co. results are in

Deere & Co. (DE) reported its fiscal first quarter financial results for the quarter ended January 30, 2022, before the opening bell on Friday. ...