Stocks, commodities and cryptos bounce, USD dips as risk-on returns

23 November 2022Another low volatility, quiet news day saw risk assets reverse Monday’s price action with US equities steadily rising throughout the session on lack of any obvious catalyst. Tech outperformed on the improved risk outlook with global risk appetite seemingly unperturbed by the continued ramp-up of Chinese COVID restrictions.

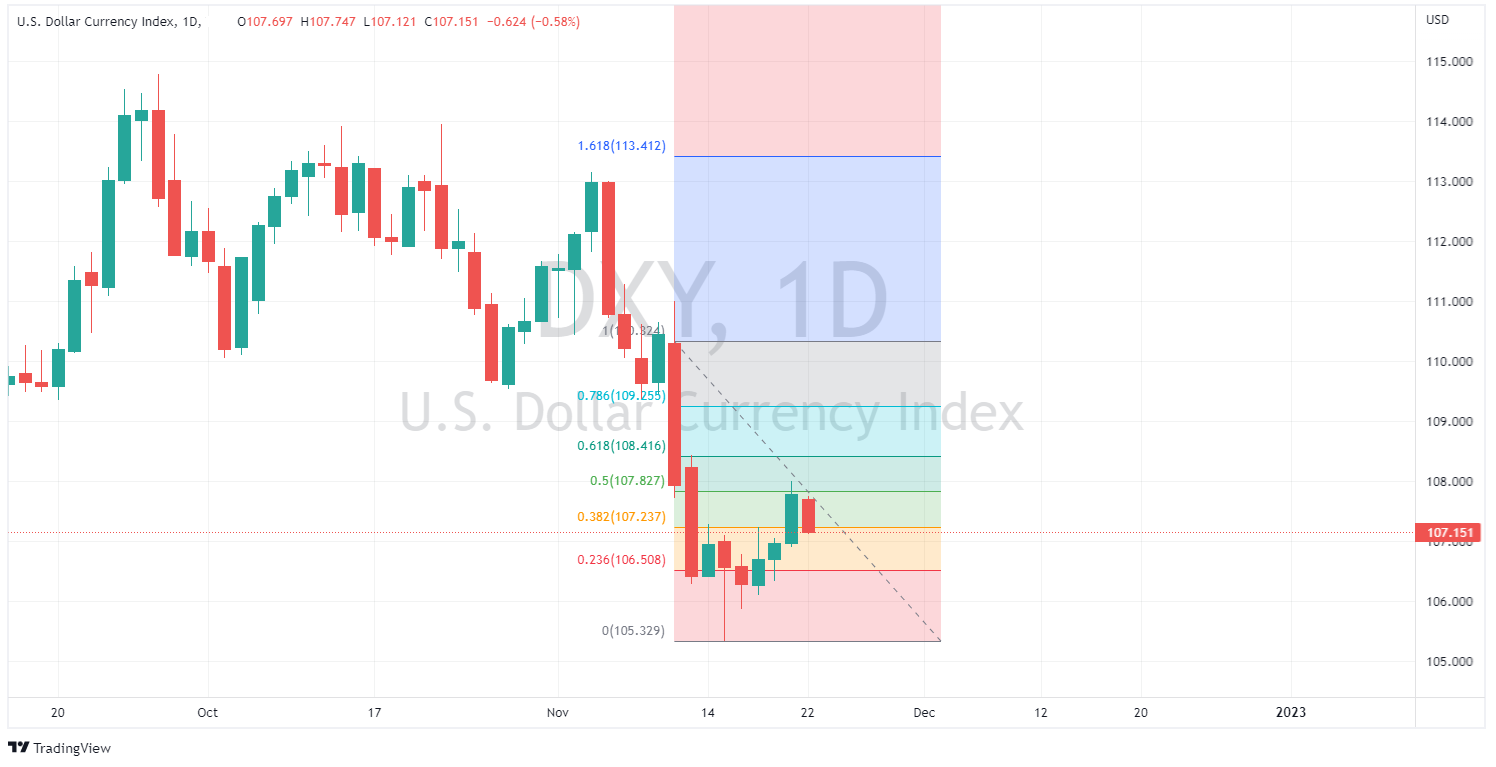

The US dollar softened in Tuesdays session, in line with the risk on narrative, with the US dollar Index finding resistance at the 50% Fib retracement of the post soft CPI reading sell-off.

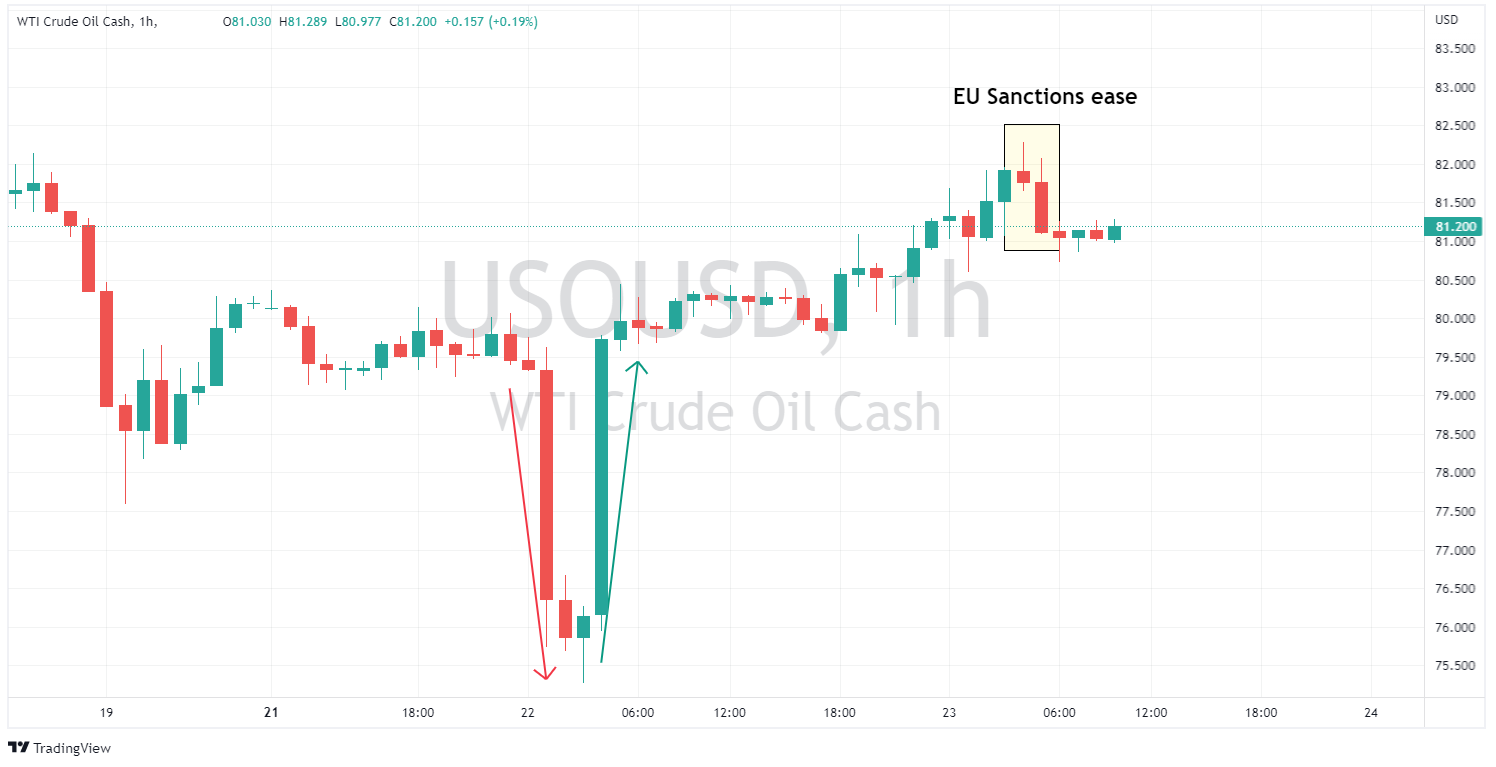

Crude Oil was bid on risk appetite, continuing its rally after the OPEC+ denials of any production increases and a bigger than expected draw on inventories. Though there was some late weakness in the session as the EU eased sanctions on Russian oil.

Gold had a roller-coaster of a session, finishing pretty much unchanged after Asian session gains were sold during the EU and US sessions.

Bitcoin managed to hold the November lows which have proven to be short term support zone, bouncing back above 16k in a positive session.

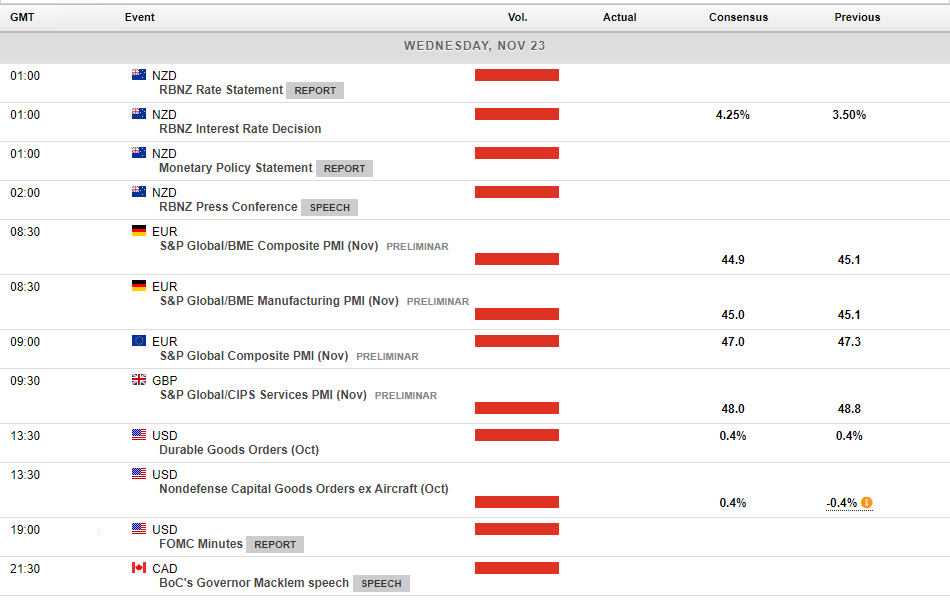

Today’s economic calendar is a lot busier, starting with a RBNZ rate decision where a supersized 75bp hike is expected, though some commentators are predicting a 50bp move, so we could see some volatility in the NZD.

The next biggest risk event will be the FOMC minutes from their November meeting where they hiked 50bp, any clues in these minutes could see a re-pricing of future Fed moves, putting the market into risk on or off mode for the late half of the US session.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How to trade in low volatility conditions

The market in recent months has created exceptionally difficult conditions to trade. Low volatility and obscure price action has reduced the volatility available for traders to capitalise on. These conditions have affected FOREX, Equity, and Index trading. It has been specifically difficult for momentum and trend following traders as a certain leve...

Previous Article

Medtronic posts mixed results

Medtronic posts mixed results Medtronic Plc (NYSE: MDT) reported latest financial results for its second quarter of fiscal year 2023, which ended O...