The “Aussie’s” outlook amid Diplomatic tensions with China

11 May 2021The Aussie dollar is on the rise again after the tumble taken after China decided to halt economic dialogues. Apart from becoming a commodity currency pair, Australia offers investors visibility into the health of China’s economy since China is Australia’s largest export client. If Australia’s exports to China are growing, it is fair to assume that China’s economic development is ramping up. A healthy Chinese economy bodes well for the rest of the world and Australia, potentially increasing the Australian dollar exchange rate as demand for Australian commodities increases.

The Australian dollar’s decline after Beijing’s announcement faded a rally in its major commodity exports and demonstrates how trade disputes have a more substantial impact on the currency’s movements. Iron ore, Australia’s largest export is on track to set a new high, although other commodities such as copper and oil also increased in value as indicators of global demand. However, the Aussie has risen to nearly 80 cents against the USD since the initial announcement. It could even be argued that it is poised to rise above it.

First of all, traditionally, a weaker Aussie dollar goes in tandem with a boosted economy, which increases competitiveness in the export markets. However, Australia is in a unique situation where its exports are witnessing unprecedented demand regardless of the Aussie rate. It is also worth remembering that China has an actual demand for Australian commodities such as iron ore, which needs fulfillment, notwithstanding any Chinese diplomatic bravado.

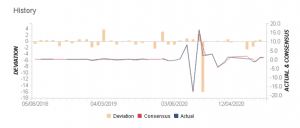

Rising internal inflation could put bullish pressure on the interest rate, even though the month-to-month retail sales came to a tad short of consensus. The close association between retail sales and inflation is one of the primary factors retail sales data will shift markets. High inflation figures often follow retail revenue figures that are high. Similar to how increasing inflation exerts upward pressure on interest rates, higher retail sales figures do the same. In the absence of confounding variables, traders regard higher prices as instantly bullish for a currency.

Australian Retail Sales Consensus vs Actual

Source: gomarkets.com

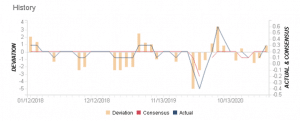

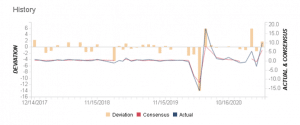

On the US side of the equation, we have several significant announcements this week, some of which would suggest inflationary pressure, such as consumer price indices and increasing consumer confidence. Nevertheless, mixed retail sales readings could deter a rate hike, lest the Fed wants to risk a gratuitous deflationary period.

US Consumer Price Index Ex Food & Energy – Month on month

Source: gomarkets.com

US Retail Sales – Month on month

Source: gomarkets.com

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Week Ahead: Equities remain jittery as inflation fears remain, Crypto crashes

Equity Markets US equity markets are coming off a mixed week. The S&P 500 registered a second straight down week for the first time since February, while the Dow posted its fourth negative week in five. The NASDAQ gained 0.31% last week after a 4 week losing streak as dip buyers finally appeared to snap up beaten-down tech stocks. Analysts ...

Previous Article

Bond yields stabilise as US dollar dumps, equity markets hit all-time highs

April was a bumper month for world markets as major equity indexes across all regions rallied strongly. US markets smashed through all-time highs on s...