US stocks fall ahead of CPI, Hawkish Central bank speak and debt limit limbo

10 May 2023US indices finished modestly lower on a light news day with traders cautious ahead of upcoming US CPI figures and following hawkish rhetoric from numerous ECB and Fed officials. There is also the US debt limit negotiations on the back of traders’ minds as agreement remains in limbo and talks look likely to be protracted.

The Dow Jones was down 57 points or 0.17% while the good run of the Nasdaq came to an end, being the worst performing index and down 77 points, or 0.63%

Central bank speakers overnight from the ECB struck a hawkish tone regarding the pace of rate hikes and the stubbornness of inflation, while the Fed saw governor Williams pushing back against a rate cut this year and noted the Fed is prepared to raise rates again if needed. Not what the bulls wanted to hear and adding another headwind to risk assets.

FX Markets

The USD was stronger on the session, with the Dollar Index pushing through it’s resistance at 101.65 to hit a high of 101.83 before pulling back. We’ve had a couple of pretty quiet sessions news wise, so look for some volatility in the days ahead as the news flow ramps up.

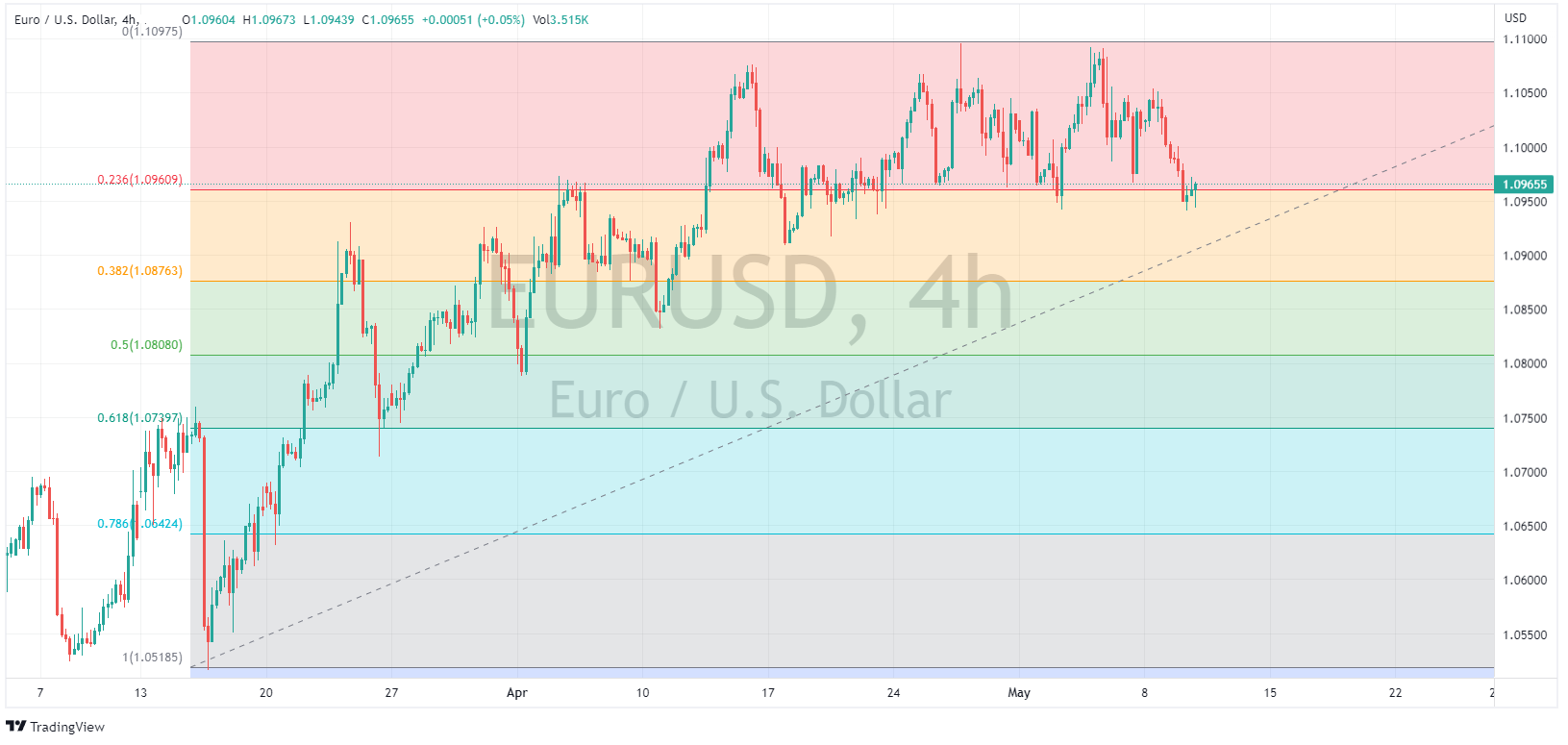

EURUSD was down on the session as even hawkish rhetoric from ECB speakers failed to lift the Euro, falling beneath the psychological 1.10 handle to a low of 1.0942 before finding support and moving above a fib level of 1.0965. The Euro wasn’t helped by a report that according to CFTC data the Euro is the most overbought currency in G10, which certainly will make traders nervous about getting long, in the short term anyway.

Cyclical currencies were little changed, GBP and CAD were flat vs the USD while AUD underperformed on the back of a Federal Budget release, this saw UADNZD fall further below the psychological 1.07 level, hitting a low of 1.0663.

Commodities

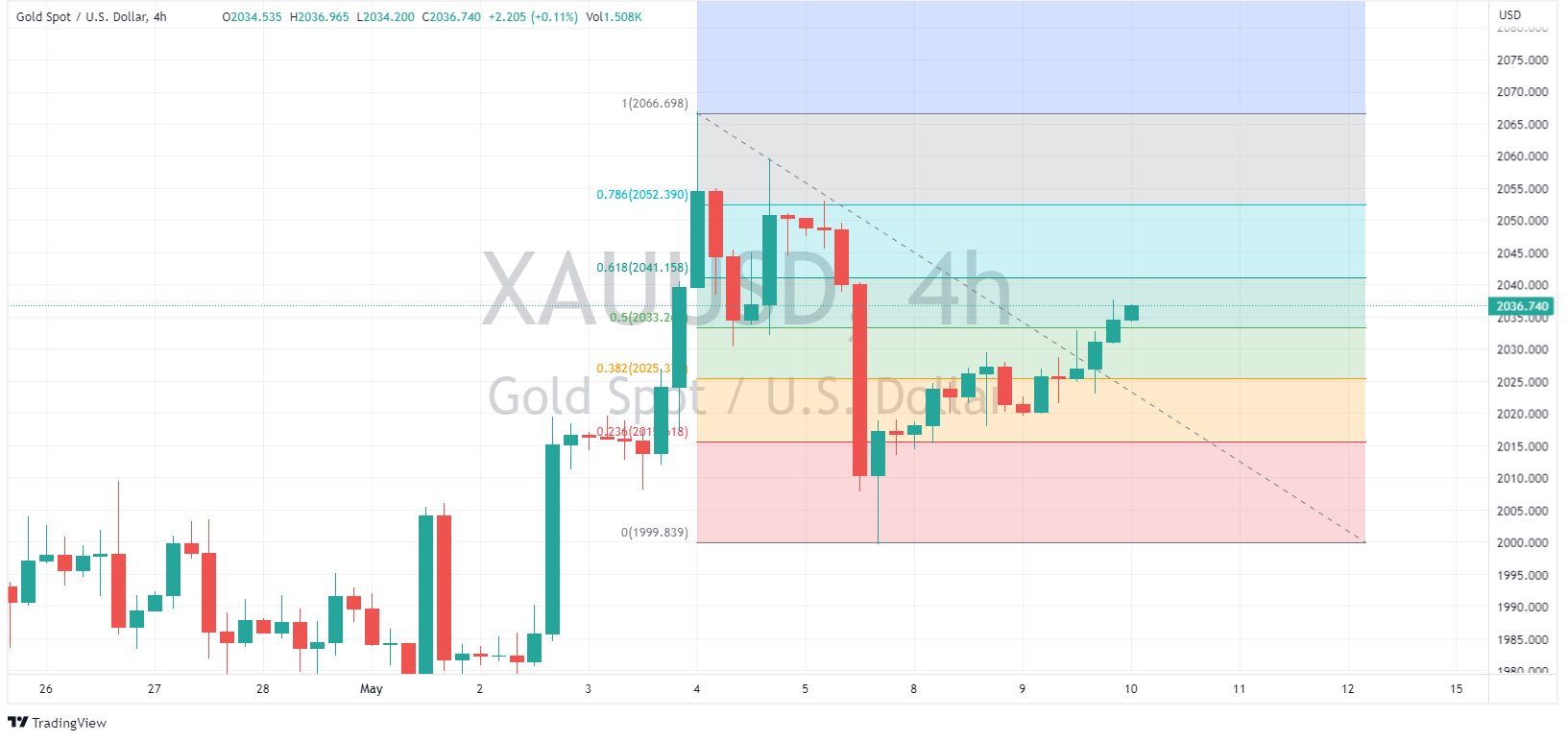

Gold – Despite US dollar strength, gold pushed higher again, with XAUUSD (after some initial resistance) pushing through and holding the 50% Fib retracement from its May high to low.

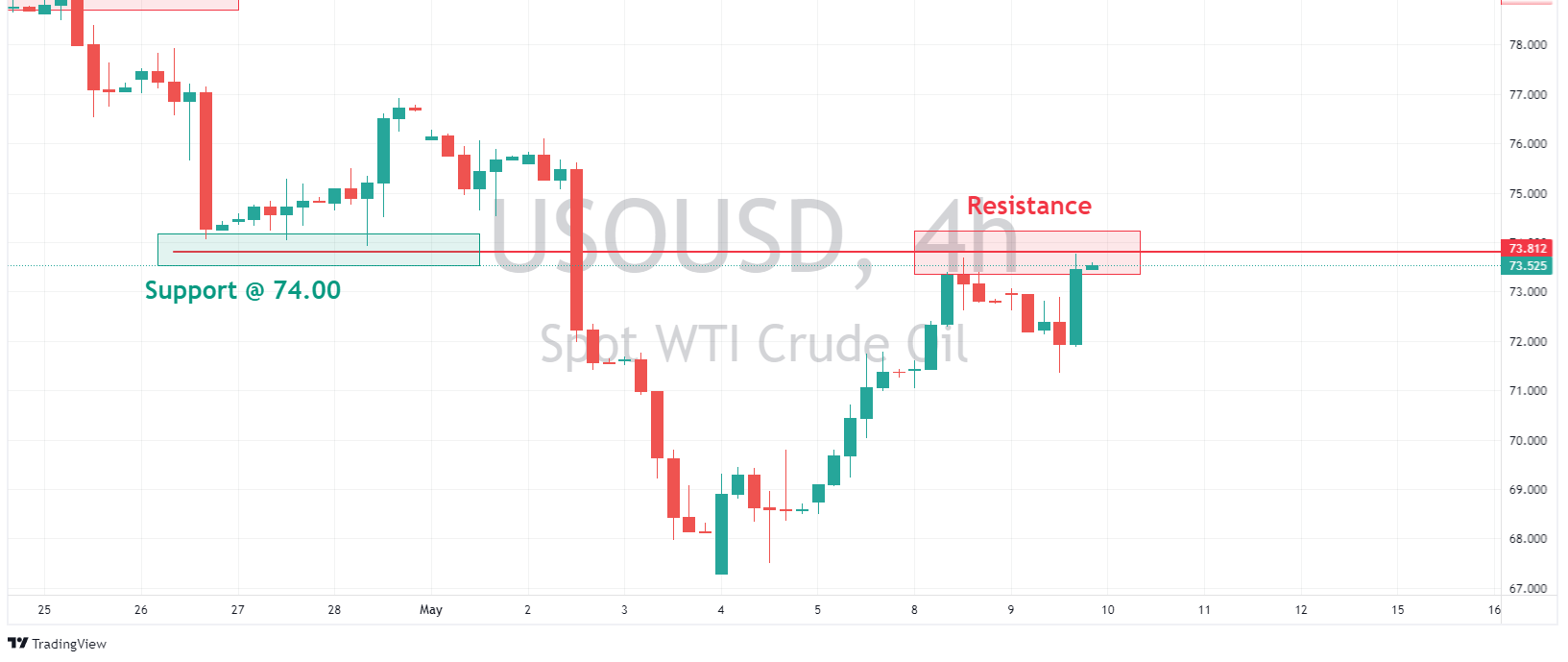

Crude Oil – Crude oil had a volatile session, USOUSD started the session on the backfoot after three straight days of gains as Chinese crude imports reportedly declined in April. But saw strength later in the session on reports that Russian oil output cuts almost hit its pledged goal in April and the US is to start refilling the SPR at these prices after maintenance is completed. USOUSD rallied to test the 73.8 resistance level, a level that was support in late April.

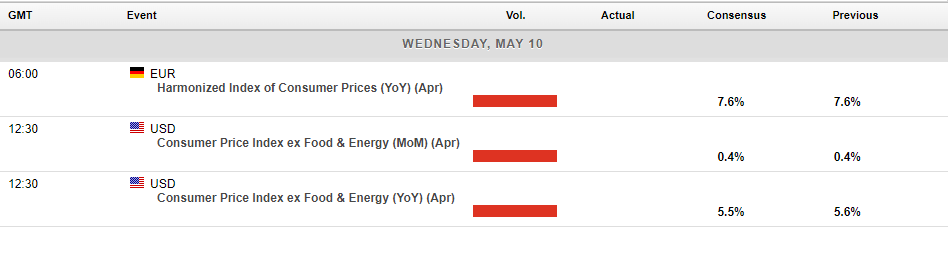

In today’s economic announcements, things are going to get more interesting as the much awaited US CPI figure will be released, with the rates market split on the Feds next move (77% chance of a hold, 23% of a hike) this figure will be pivotal in reshaping those odds and seeing volatility in the USD and US equity markets if they come in outside expectation.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US CPI preview – the chart to watch

Today’s US CPI number is the most important US data release this week. With the FX markets coming into this release with relatively low energy and searching for a catalyst any surprise will likely trigger significant intraday volatility in FX and other risk assets. We’re also coming into this release with a market split on the Feds next rate...

Previous Article

Crude Oil Trading with CFD’s – how to speculate on black gold

Crude Oil has always been one of the most popular and highly traded markets for CFD traders whether it is WTI or Brent, especially recently as geopoli...