US stocks finish in the green on weak data and regional bank short squeeze

16 May 2023Major US indices finished broadly higher after weak Empire State manufacturing figures fed into the “bad news is good news” for equities narrative, and a surge higher in regional bank stocks allayed fears of further crises in that sector in the short term. The Russell 2000, being the home of most of these mid-sized banks outperformed, finishing up 1.19%, KRE (the regional banking ETF) rose 3.16% on the day.

The NY Fed’s Empire State Manufacturing survey saw a sharp fall in business activity for May, collapsing to second lowest reading of the post-COVID cycle , with the headline index coming in at -31.8 from April’s +10.8, well below the expectation of -3.75.

FX Markets

The USD drifted lower after two strong up days weighed down by the dismal NY Fed manufacturing survey and an improved risk environment throughout the afternoon. Debt ceiling negotiations being at an impasse also seem to be a headwind for the Greenback, though that could change if the market turns solidly risk off.

EUR saw gains thanks to the weaker Dollar with EURUSD trading between 1.0846 and 1.0890 but failing to breach the psychological resistance level at 1.09. EUR also seemed to be limited by a weak industrial production print for March. Attention on Tuesday will turn to the Q1 GDP flash estimates and German ZEW for May.

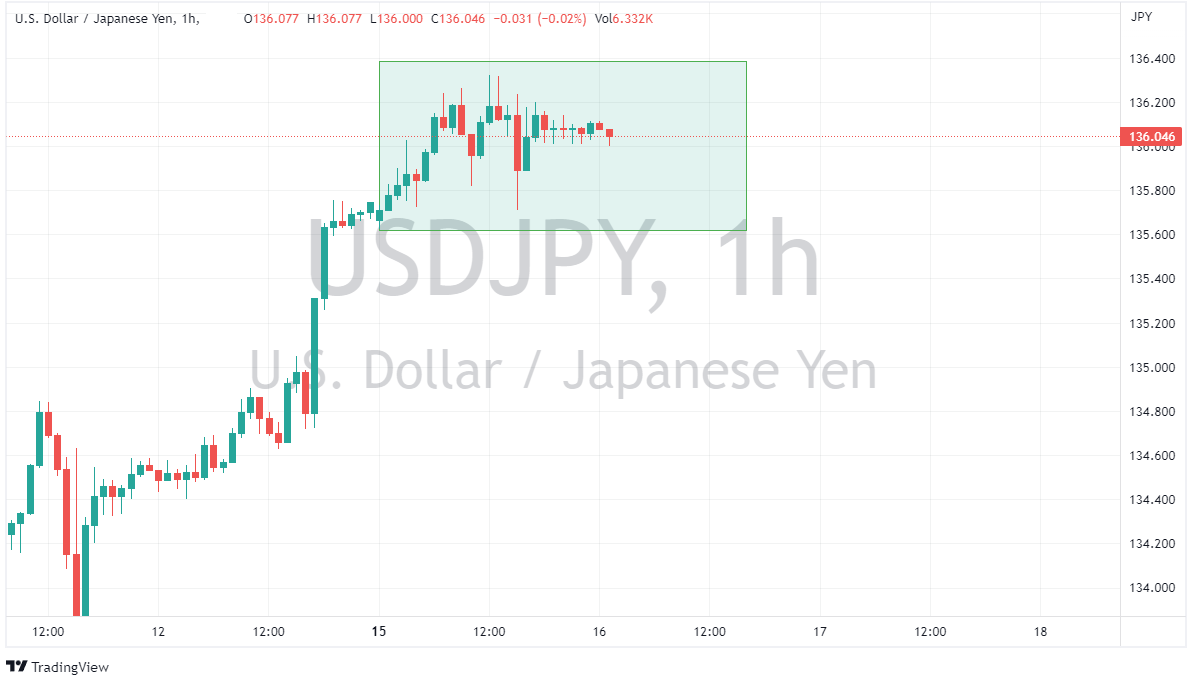

JPY was weaker vs the Dollar on improved risk sentiment and April inflation data out of Japan showed a slowing once again, suggesting CPI could return to BoJ target but without a big change to their current ultra easy policies.

Commodities

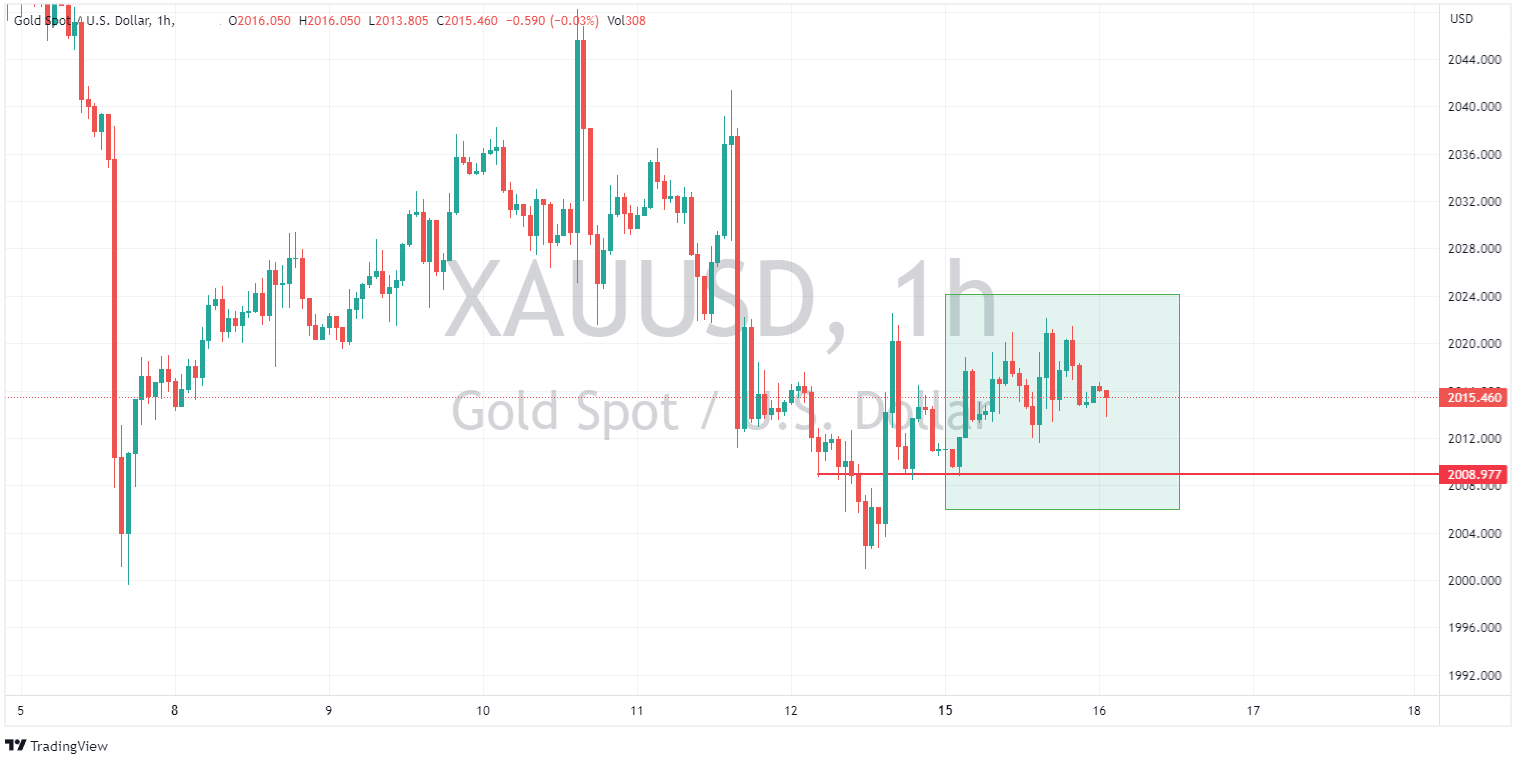

Gold rallied modestly on a weaker USD and despite improved risk sentiment. No doubt uncertainty over the US debt ceiling issues giving the precious metal a bid.

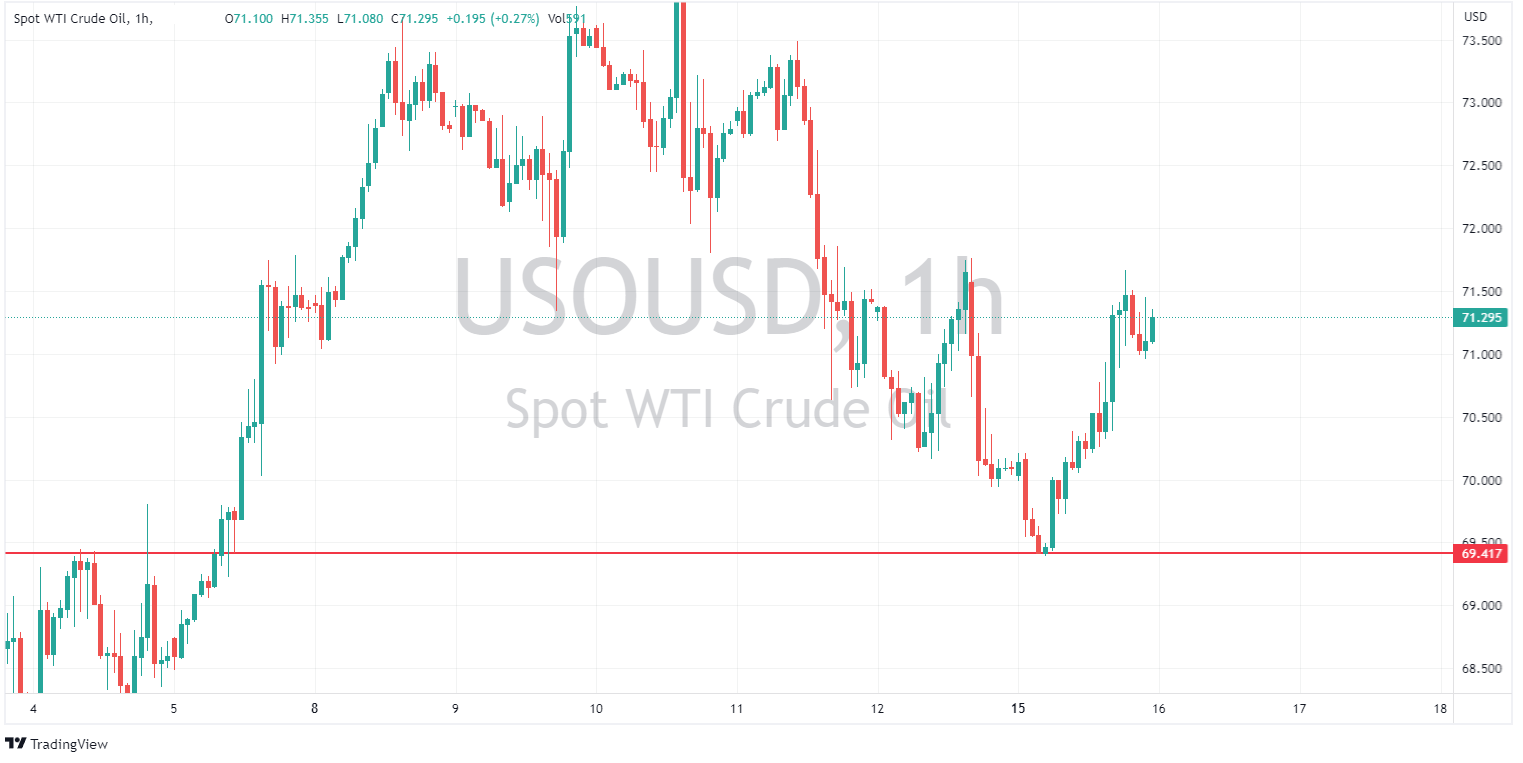

Crude Oil prices climbed through the session on Monday, starting the week on the front foot with broader risk appetite, Dollar weakness and Iraq-related supply issues tailwinds. USOUSD dipped to test support at 69.41 a barrel before rallying during the US session.

Risk Events:

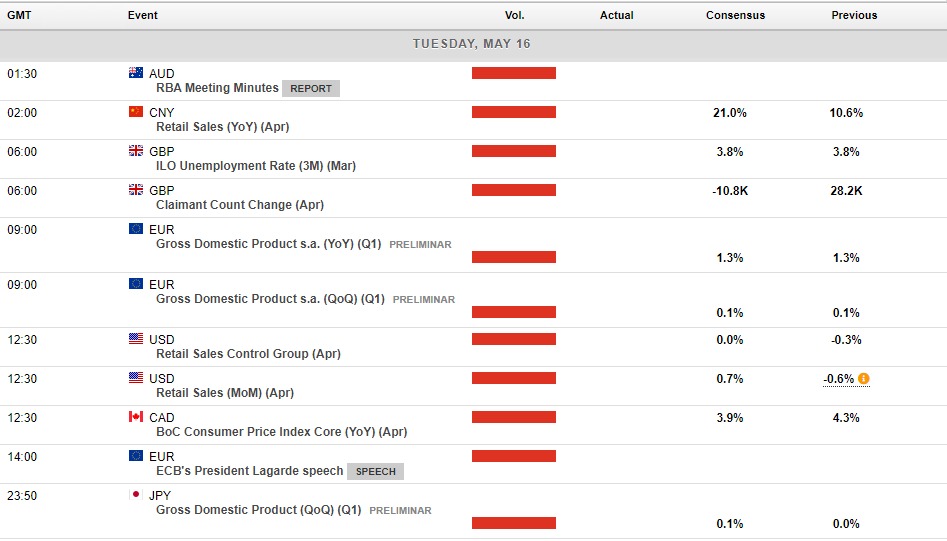

In today’s economic announcements, Canadian CPI will be one to watch for CAD traders, and US retail sales should see a bit of volatility in risk markets when released. With the markets in “good news is bad news mode” a miss in retail sales will likely see a (temporary at least) rally in equities and risk sensitive currencies (AUD, NZD etc..) Aussie dollar traders as well have the RBA minutes at 11:30 AEST.

Charts Source: Tradingview.com

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US equities finish in the red after retail sales miss and ongoing debt ceiling concerns

US stocks finished mostly lower in what was a risk-off session amid mixed data releases from the US and ongoing debt ceiling concerns weighing on risk markets. A lackluster forecast from retail giant (and Dow component) Home Depot (HD) also didn’t help. The Dow led losses, ending up down over 300 points while the Nasdaq was the least worst of ...

Previous Article

The Week ahead – US retail sales, jobs data from UK and Australia, RBA minutes.

Global markets enter the 3rd week of May against the backdrop of rising market concern regarding the ongoing US debt ceiling impasse as well as ongoin...