When will the AUD find support?

27 September 2022The AUD has fallen to lows not since the beginning of the Covid 19 pandemic and does not look like stopping anytime soon. With global commodity prices coming down and fears of a recession causing panic sell offs the AUD has been victim to a two-fold attack. The general recession fears push growth assets including the Australian dollar downward as investors look to put their money into safer assets. In addition, as the USD has increased commodity prices have come down.

Going forward, with presumably with recessionary fears only set to get worse globally and inflation in Europe and the UK potentially reaching 20% central banks have had no choice but to be aggressive with their monetary policy. The slowing growth has been a cause for concern as growth assets alongside the AUD have sold off. Therefore, until there is really a peak in inflation or signs from the Federal Reserve that it intends to back off its hawkish stance, the AUD may very well continue to dive.

Technical Analysis

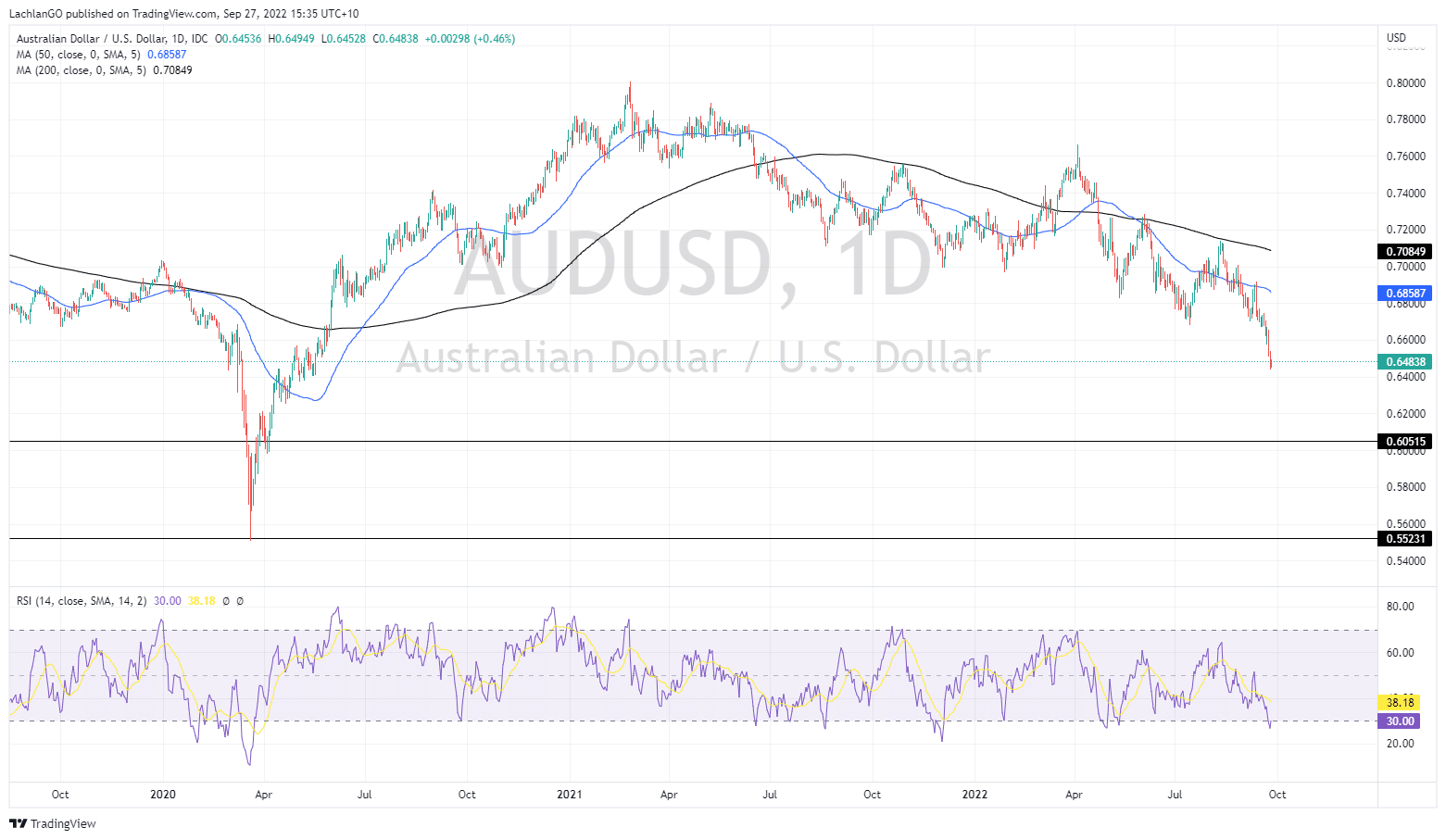

On the weekly chart the price currently in a nosedive with no obvious support in sight. The closest support in still $0.04 away at $0.60 which were the GFC lows. If that level goes, then the next target is $0.55 which was the price during the initial stages of the Pandemic. Just as concerning is the fact that the 50-week moving average is almost ready to cross below the 200 week moving average. This is a lagging indicator that shows that the pair is very much being controlled by the sellers. In addition, the RSI also still has room to drop further down to reach the level of the Covid 19 levels.

The daily price chart confirms the analysis above and if anything shows a more systematic down trend. With both 50 day and 200 day moving averages trending down it does not bode well for a reversal any time soon.IN addition, the price has not been able to breakthrough both averages at for a significant period since June 2021.

Whilst the market can turn quickly, there is still s much fear and panic around that it is hard to see the AUD turning in the short term.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What are Bonds and how do you trade them?

Maturity, Yields, Par Values and Coupon payments. These are words that everyone has heard of but not many have a good understanding of what they mean. In this article all these complicated terms will be explained. Please note that while this information is most relevant for physical bonds, it is still important to understand when dealing with CFD�...

Previous Article

US stocks extend sell-off, yields spike, GBP flash crashes

Wall St extended its sell-off in Mondays session, continuing on from Friday (albeit not as pronounced) against a backdrop of spiking bond yields, grow...