- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Amazon Q4 financial results are in

4 February 2022Amazon.com (AMZN) announced its fourth quarter results after the closing bell on Thursday.

The company reported total revenue of $137.412 billion (9% increase vs. the same period in 2020) in the previous quarter, which was just shy of analyst forecast of $137.682 billion.

Earnings per share reported at $27.75, above analyst forecast of $3.61 per share.

Amazon CEO, Andy Jassy, commented on the latest financial results: ”A big thank you to employees across Amazon who overcame another quarter of COVID-related challenges and delivered for customers this holiday season. Given the extraordinary growth we saw in 2020 when customers predominantly stayed home, and the fact that we’ve continued to grow on top of that in 2021, our Retail teammates have effectively operated in peak mode for almost two years. It’s been a tremendous effort, and I’m appreciative and proud of how hard our teams have worked to serve customers.”

”As expected over the holidays, we saw higher costs driven by labor supply shortages and inflationary pressures, and these issues persisted into the first quarter due to Omicron. Despite these short-term challenges, we continue to feel optimistic and excited about the business as we emerge from the pandemic. When you combine how we’re staffing and scaling our fulfilment network to bring even faster delivery to more customers, the extraordinary growth of AWS with 40% year-over-year growth (and now a $71 billion revenue run rate), the addition of marquee new entertainment like The Lord of the Rings: The Rings of Power and Thursday Night Football, and a plethora of new capabilities that we’re building in areas like Alexa, Ring, Grocery, Pharmacy, Amazon Care, Kuiper, and Zoox, there’s a lot to look forward to in the months and years ahead,” Jassy added.

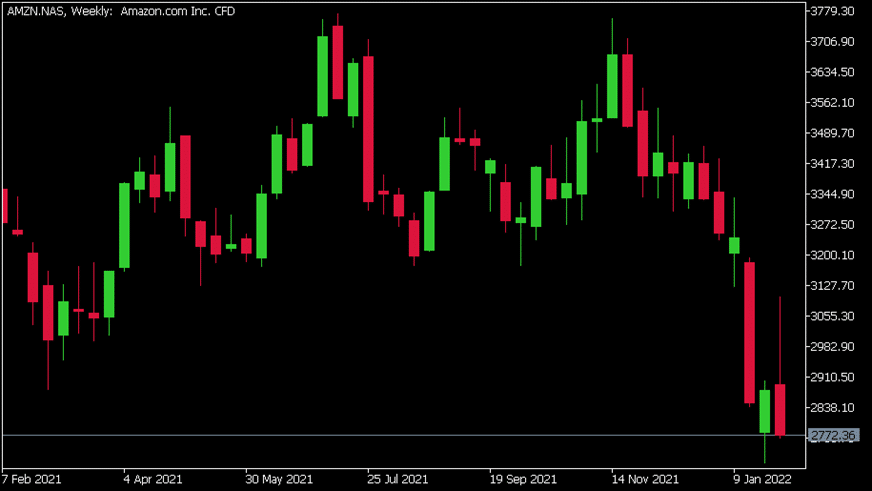

Amazon.com (AMZN) chart (Weekly)

Shares of Amazon were down by 7.81% at the of the trading day on Thursday at $2772.36 a share. The share price jumped by around 17% following the solid Q4 results in the after-hours trading.

The stock is down by 16.17% in the past year.

Amazon is the 5th largest company in the world with a total market cap of $1.408 trillion.

You can trade Amazon.com (AMZN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Amazon.com, TradingView, GO Markets MT5, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Share buybacks and Dividends. How do they compare?

As a shareholder of any company, you can be rewarded by that company in the form of share buybacks and dividend pay-outs. These actions would often occur when a company is performing well and thus have the means to reward their shareholders. The company’s profits would also often be used to invest back into the company. Dividends have been...

February 7, 2022

Read More >

Previous Article

Bitcoin’s first official legal tender

On June 5th 2021, El Salvador President Nayib Bukele declared that Bitcoin, the first cryptocurrency, would become legal tender in El Salvador. A few ...

February 4, 2022

Read More >