- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Back-To-Back Interest Rate Cuts

2 July 2019Second Rate Cut

The Reserve bank of Australia (RBA) cut interest rate by 25 basis points which marks the first back-to-back rate cut since 2012. The RBA also sets the interest rate to a record low at 1%:

“Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy. It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target. The Board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

The RBA highlighted the persistent downside risks to the global economy, but the tweaks in the labour market stood out.

“There has, however, been little inroad into the spare capacity in the labour market recently, with the unemployment rate having risen slightly to 5.2 per cent.”

Housing Sector

The housing sector was a significant risk for the Australian economy, and cutting interest rate was a double-edged sword. However, the statement brings some optimism on the housing sector despite conditions in most housing sector remain soft:

- “Tentative Signs” that house prices in Melbourne and Sydney are now stabilizing.

- The growth in housing credit also steadied.

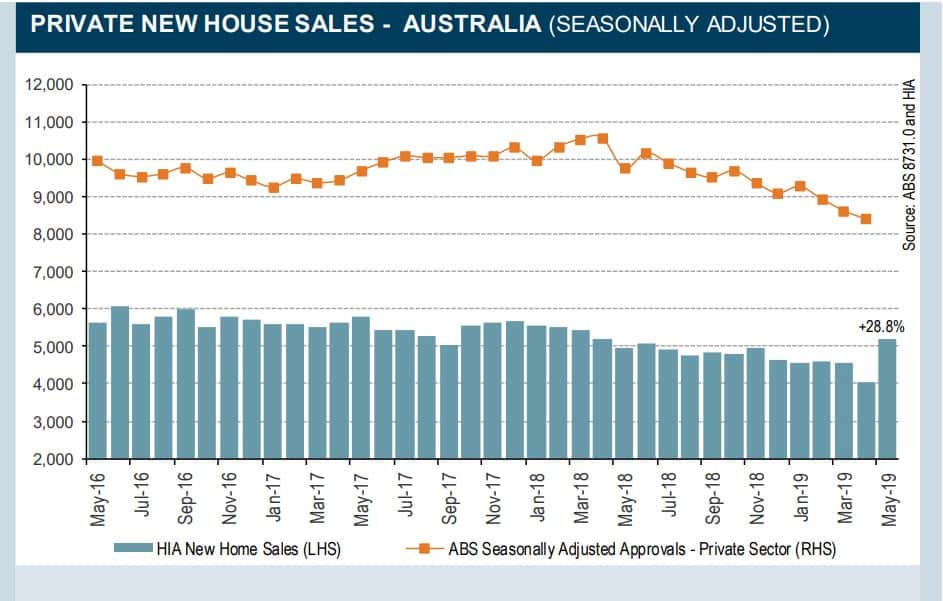

On the economic front, the HIA New Home Sales for the month of May was released today. New Home Sales climbed from -11.8% to 28.8%.

It is a significant rebound, and the bounce back is before the rate cuts which indicated that it may be fueled by the optimism post the federal election.

Now, that the RBA has cut rate twice in two months, it will be worth monitoring the housing data in the coming months to assess its impact on the housing sector.

Rate Cut Reactions

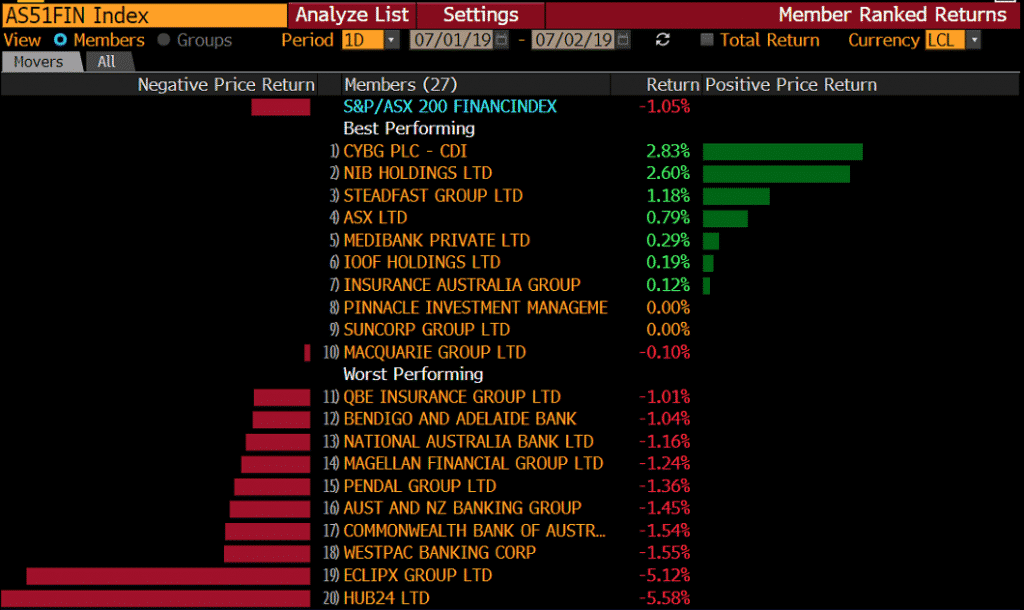

The Australian share market had a solid day ahead of the RBA cut to finish only slightly higher. The financial sector came under pressure and the big four bank shares sold-off in late trade. CBA, NAB, ANZ and Westpac finished the day lower by more than 1%.

Source: Bloomberg Terminal

As of writing, ANZ was the first bank to pass on the full RBA interest rate cut.

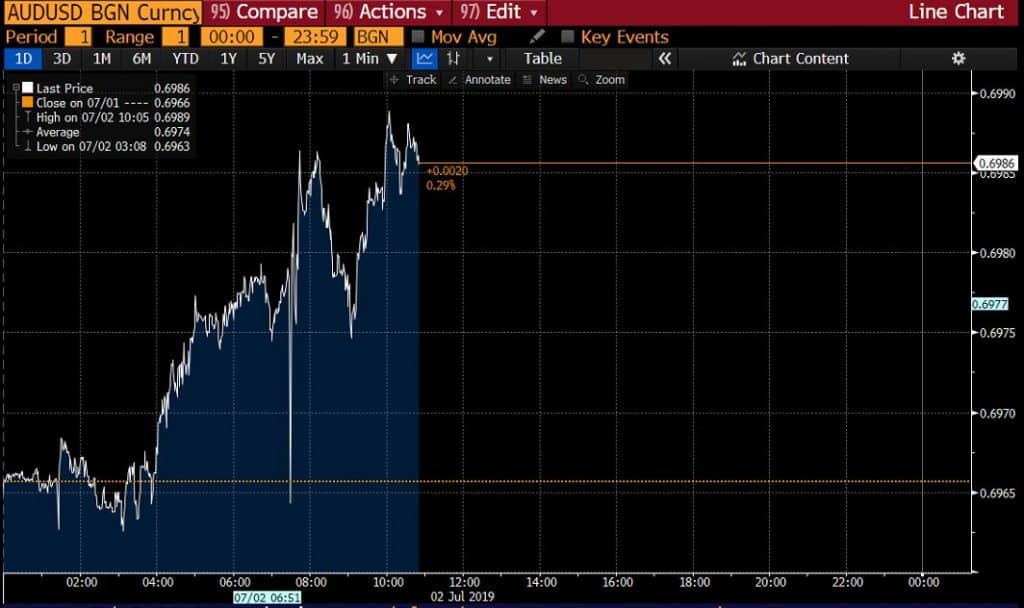

The Aussie dollar was actually firmer at 69.80 US cents as the rate cut was mostly priced-in. The housing data supported the local currency.

AUDUSD

Source: Bloomberg Terminal

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

5 influencing factors on the impact of economic data in your trading

There are few times when the market (irrespective of trading vehicle) is more likely to move in price quickly than on the release of some economic data. Judging potential market response can be complex as often many data points are released in quick succession but is an important component of overall risk management relating to your trading positio...

July 3, 2019

Read More >

Previous Article

Gold to Silver Ratio: Is it useful to commodity CFD traders?

When digging deeper into issues relating to trading precious metals you may come across the idea of using gold to silver ratios as part of decisio...

July 2, 2019

Read More >