- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Disney tops Wall Street expectations

11 February 2022The Walt Disney Company (DIS) reported its first fiscal quarter ended January 1, 2022 after the closing bell on Wednesday.

The US media giant reported total revenue of $21.819 billion (34% increase year-over-year), beating analyst estimate of $20.27 billion.

Earnings per share at $1.06 vs. analyst forecast of $0.74.

”We’ve had a very strong start to the fiscal year, with a significant rise in earnings per share, record revenue and operating income at our domestic parks and resorts, the launch of a new franchise with Encanto, and a significant increase in total subscriptions across our streaming portfolio to 196.4 million, including 11.8 million Disney+ subscribers added in the first quarter,” said Bob Chapek, the CEO of The Walt Disney Company.

”This marks the final year of The Walt Disney Company’s first century, and performance like this coupled with our unmatched collection of assets and platforms, creative capabilities, and unique place in the culture give me great confidence we will continue to define entertainment for the next 100 year,” Chapek added.

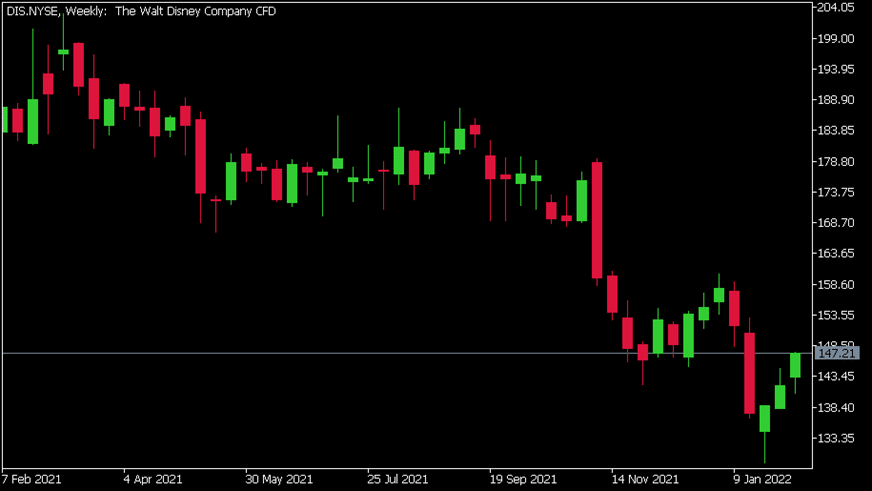

The Walt Disney Company chart (weekly)

Disney shares were up by 3.33% at market close on Wednesday at $147.21 per share. Here is how the stock has performed in the past year –

- 1 Month: -5.28%

- 3 Month: -9.18%

- Year-to-date: -4.95%

- 1 Year: -22.88%

Walt Disney is the 31st largest company in the world, with a total market cap of $268.02 billion.

You can trade The Walt Disney Company (DIS) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Walt Disney Company, TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What just happened to Mark Zuckerberg’s Facebook and Meta?

Mark Zuckerberg and his company Meta Platform Inc (formerly known as Facebook) have been in the news recently, and it is often not good news. They might be able to attract some positive attention through their futuristic demonstrations of the Metaverse, but it is often the controversial news that gets the most attention. For example, how Instagram ...

February 11, 2022

Read More >

Previous Article

Coca-Cola tops Wall Street estimates for Q4

The Coca-Cola Company (KO) reported its fourth quarter financial results before the opening bell on Wall Street on Thursday. The US beverage company t...

February 11, 2022

Read More >