- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Firebrick Pharma debuts on ASX

28 January 2022

An Australian pharmaceutical firm that’s developing a world first virus-killing nasal spray has made its debut on the ASX. It was founded in 2012 by Dr Peter Molloy and Dr Stephan Goodall with the mission to develop a nasal spray that killed all germs (viruses or bacteria) such as the common cold.

It plans to bring its latest breakthrough Nasodine Nasal Spray which contains the active ingredient povidone-iodine found in Betadine throat gargle. If approved for sale, it will be the first commercial nasal to the market.

It has already successfully raised $7 million in its ASX initial IPO and is listed under code ‘FRE. The IPO was priced at 20 cents per share and almost half the investors were doctors and scientists said the company.

The Melbourne based Firebrick will have a market cap of $44.8m and about $11m in cash reserves with funds raised in the IPO to be used to support clinical trials later this year.

It has already completed one phase 3 clinical trial as a treatment for the common cold and will work towards regulatory approval.

There are 200 or more viruses from at least six major groups. While ’rhinovirus’ is responsible for most common cold infections, other groups of viruses can cause colds, including some coronaviruses. These are seasonal coronavirus strains and are not to be confused with pandemic strains, such as SARS-CoV2.

Dr Molloy cautioned Nasodine had yet to undergo second round of phrase three clinical trials and is not yet approved for sale, with no published evidence yet that it could be effective in the real world against COVID-19.

Patents have been filed worldwide on its use as a treatment and preventative for the common cold, however, it is not yet approved for sale in Australia. It also holds a patent for use of povidone-iodine till 2034 and expects to make the nasal spray Nasodine available in Australian pharmacies within 3-years’ time.

It is predicted in Australia alone it could exceed $75 million per annum, generating positive earnings in the second year on the market. Although the scope of its business is huge, its success depends on approvals and market acceptance.

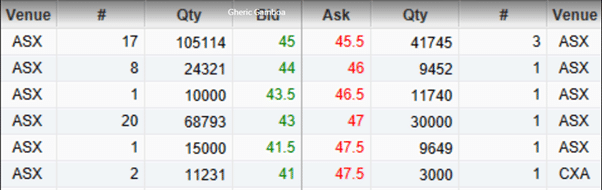

The company share price is currently trading at around $0.45 cents per share.

You can buy shares in FirebrickPharma with a GO Markets share trading account. There are over 2500 ASX shares available to trade. Pay zero brokerage on your first 20 share trades.

More information can be found here on how to open an account – https://www.gomarkets.com/au/share-trading/

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What is an NFT?

A Non-Fungible Token (NFT) is a non-interchangeable unit of data stored on a blockchain, a form of digital ledger.[1] Types of NFT data units may be associated with digital files such as photos, videos, and audio. Because each token is uniquely identifiable, NFTs differ from blockchain cryptocurrencies, such as Bitcoin. NFT ledgers claim to ...

January 28, 2022

Read More >

Previous Article

Tesla earnings have arrived

Tesla Inc. (TSLA) reported its Q4 2021 results after the market close on Wednesday. The world’s largest automaker exceeded analyst expectations on b...

January 27, 2022

Read More >