- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

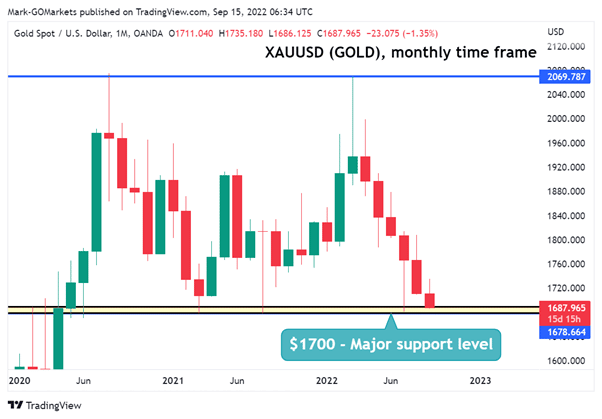

Gold Testing Major Support Level

16 September 2022For the last 2 years, Gold has been bouncing in a range between $1700 and $2070 and is currently testing the major support level around $1700 as seen below.

The price has used the yellow highlighted as an area for support zone and a rejection zone. Over the last 2 years clear rejections have occurred every time the price has reached around $1700’s. These candlestick rejections indicate a high probability of something similar potentially happening.

We find further confluence of this analysis by looking at the weekly time frame, where Gold has broken above the trend line, and has now come back to retest it. This can often result in a bounce off the trendline, creating the start of a new uptrend.

If Gold continues to remain above the trendline and can hold the monthly support, it may indicate that it is in the early stages of a potential reversal. This may lead to another move toward the $2000’s.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Unemployment figures in Australia at record lows for August

Unemployment and Wages are an important metric to a country’s economy, simply put, if there are more members of the population at work and wages are at a good level, it may indicate that people have more purchasing power. This can help economic growth and can improve the health of the GDP. A growing economy should have an employment rate that...

September 19, 2022

Read More >

Previous Article

Adobe announces latest results and Figma acquisition

Adobe Inc. (ADBE) announced its financial results for the third quarter of the fiscal year 2022 before the opening bell in the US on Thursday. The ...

September 16, 2022

Read More >