- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

I’m lovin’ it – McDonald’s tops Q3 expectations

28 October 2021McDonald’s reported their third-quarter financial results before the opening bell on Wednesday, topping Wall Street analyst expectations.

The fast-food company reported total revenue of $6.20 billion in the quarter vs. $6.04 billion expected. Earnings per share at $2.76 a share vs. $2.46 a share forecasted.

The company also reported a 7% increase in its quarterly cash dividend to $1.38 per share.

”Our third quarter results are a testament to our unparalleled scale and agility,” said McDonald’s President and Chief Executive Officer, Chris Kempczinski.

”Our global comparable sales increased 10% over 2019, which was delivered across an omnichannel experience that is focused on meeting the needs of our customers. We continue to execute our strategic growth plan and run great restaurants so that we can drive long-term, sustainable growth for all of our stakeholders,” he added.

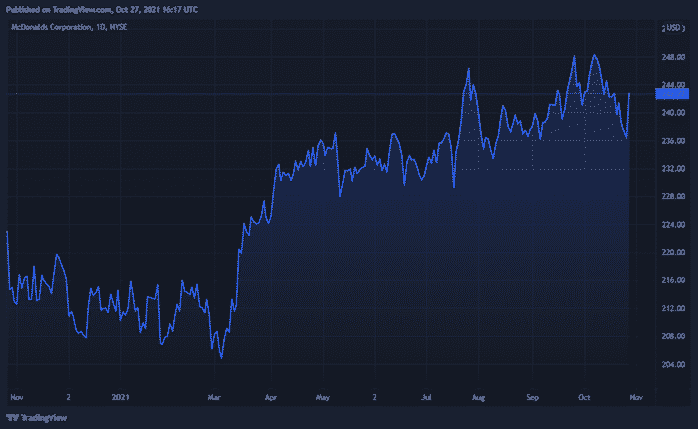

McDonald’s chart (1Y)

Share price of McDonald’s up by around 2% during the trading day on Monday following the Q3 results at $242.77 a share. The stock is up by 9% in the past year.

McDonald’s is the 69th largest company in the world with a total market cap of $181.21 billion.

You can trade McDonald’s (MCD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: McDonald’s, Refinitiv, TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Coca-Cola beats Wall Street estimates for Q3

The Coca-Cola company reported their Q3 financial results before the opening bell on Wednesday. The company reported total revenue of $10 billion on the third quarter of 2021, beating analyst forecast of $9.75 billion. Earnings per share also topped analyst expectations on Wall Street at $0.65 per share vs. $0.58 per share expected. ''Our str...

October 28, 2021

Read More >

Previous Article

Tesla beats Wall Street expectations in Q3

Tesla, world’s largest automaker (by market cap) reported its third-quarter financial results after the closing bell on Wall Street on Wednesday, to...

October 21, 2021

Read More >