- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Mastercard Q3 numbers are in

29 October 2021Mastercard reported their financial results for Q3 before the opening bell on Thursday. The company beat Wall Street expectations – let’s take a closer look at the numbers.

The financial services company reported net revenue of $5 billion in the third-quarter of 2021, up by 30% year-on-year. Earnings per share at $2.37 per share vs. $2.19 a share expected.

”We saw continued momentum across the business as we delivered strong revenue and earnings growth again this quarter. Our performance was driven by the execution of our strategy, healthy domestic spending and solid growth in cross-border spending which has recently returned to pre-pandemic levels,” said Michael Miebach, Mastercard CEO.

”We are extending the scale and power of our trusted network through innovations like our new Mastercard Instalments program. And, we continue to add to our efforts in cryptocurrency services and open banking through the acquisition of CipherTrace and the planned acquisition of Aiia,” he continued.

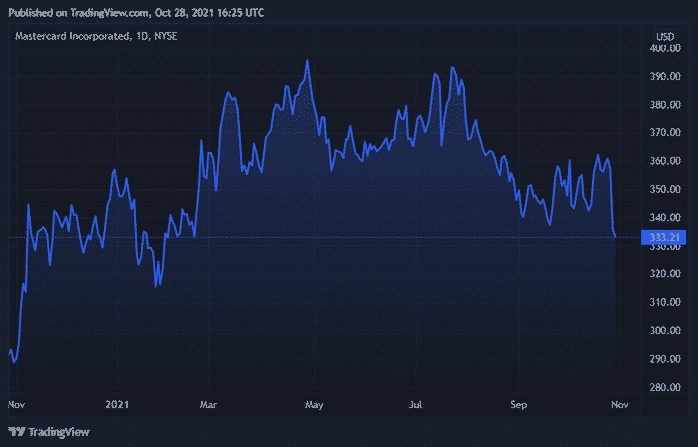

Mastercard chart (1Y)

The share price of Mastercard saw little change during the trading day on Thursday, trading at around $333 per share. The stock is up by 14% in the past year.

Mastercard is the 27th largest company in the world with a total market cap of $329.04 billion.

You can trade Mastercard Inc. (MA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Mastercard, Refinitiv, TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Apple reports Q3 results

Apple reported their Q3 financial results after the closing bell on Thursday, missing Wall Street analyst expectations. The company reported revenue of $83.36 billion on the third-quarter (up by 29% year-over-year), below analyst forecast of $84.85 billion. Earnings per share at $1.24 a share, in line with the forecast. iPhone revenue at $3...

October 29, 2021

Read More >

Previous Article

Coca-Cola beats Wall Street estimates for Q3

The Coca-Cola company reported their Q3 financial results before the opening bell on Wednesday. The company reported total revenue of $10 billion o...

October 28, 2021

Read More >