- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Netflix beats Q3 expectations

20 October 2021Netflix reported its third-quarter financial results after the closing bell on Tuesday, delivering solid numbers and beating Wall Street analyst predictions.

The online streaming service reported earnings per share at $3.19 per share vs. $2.56 a share expected. The total revenue was $7.48 billion (up 16.3% from the same time last year) in the third-quarter of 2021, in line with analyst estimates.

Global paid net subscriber additions grew by 4.4 million in Q3, above analyst forecast of 3.84 million.

”After a lighter-than-normal content slate in Q1 and Q2 due to COVID-related production delays in 2020, we are seeing the positive effects of a stronger slate in the second half of the year. In Q3, we grew revenue 16% year over year to $7.5 billion, while operating income rose 33% vs. the prior year quarter to $1.8 billion. We added 4.4m paid net adds (vs. 2.2m in Q3’20) to end the quarter with 214m paid memberships. We’re very excited to finish the year with what we expect to be our strongest Q4 content offering yet, which shows up as bigger content expense and lower operating margins sequentially.”

”Assuming no new Covid waves or unforeseen events that result in large scale production shutdowns, we currently anticipate a more normalized content slate in 2022, with a greater number of originals in 2022 vs. 2021 and a release schedule that is more balanced over the course of the year, as compared to 2021,” Netflix said in a letter to shareholders.

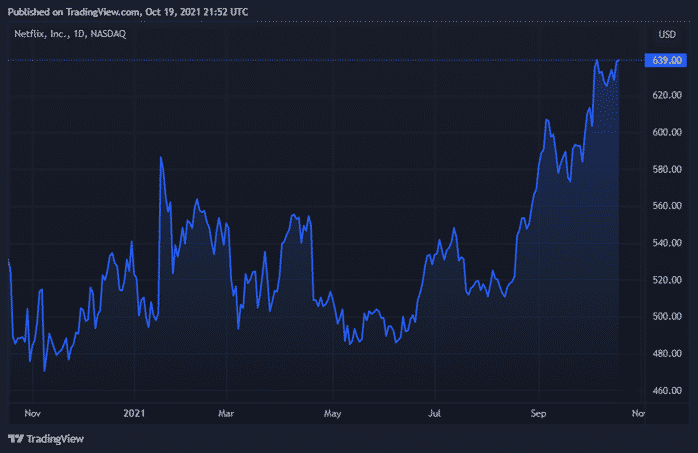

Netflix chart (1Y)

Shares of Netflix were trading lower in the after market trading hours following the latest financial report, down by 1.11% at $639 a share. The share price reached its all time high of $646 last month and is up by 20.40% in the past year.

You can trade Netflix (NFLX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Netlfix, Refinitiv, TradingView

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tesla beats Wall Street expectations in Q3

Tesla, world’s largest automaker (by market cap) reported its third-quarter financial results after the closing bell on Wall Street on Wednesday, topping analyst estimates. The company reported total revenue of $13.76 billion in Q3 vs. $13.63 billion expected. Earnings per share was at $1.86 a share vs. $1.59 per share expected. ''Total rev...

October 21, 2021

Read More >

Previous Article

Goldman Sachs top Q3 expectations

Goldman Sachs reported their third quarter financial results before the opening bell on Friday. The company topped Wall Street analyst expectations, b...

October 18, 2021

Read More >