- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

New UK Prime Minister Labelled “Britain Trump”

24 July 2019“Britain Trump”

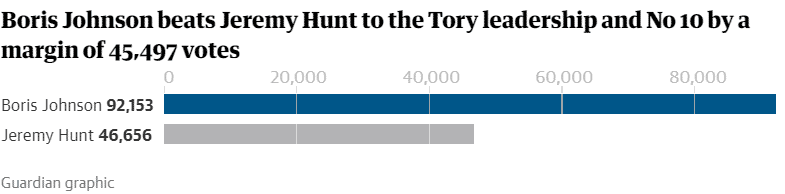

Britain has a new Prime Minister and as highly expected, Boris Johnson won the race over his opponent, Jeremy Hunt to become the new Tory leader. It was a convincing win despite the controversial headlines about Boris Johnson.

Again as widely expected, we saw a few ministerial resignations following Boris’s victory:

Sir Alan Duncan’s resignation came in the wake of Boris Johnson’s victory. He described Brexit as a “dark cloud” and wanted to free himself from his position as the Foreign Office minister to freely express his views on Brexit.

Anne Milton resigned as Skills and Apprenticeships minister citing “grave concerns about leaving the EU without a deal” after the election of Boris Johnson. She believed the “departure from the European Union should be centred around future cooperation”.

David Gauke, the UK Justice Secretary, swiftly resigned as the new leader was confirmed. He tweeted his congratulations to the new Prime Minister and mentioned that he looked “forward to returning to backbenches” to serve the people of South West Hertfordshire.

Philip Hammond, the Finance minister, has previously vowed to resign if Boris Johnson becomes the Prime Minister.

“Assuming that Boris Johnson becomes the next prime minister, I understand that his conditions for serving in his government would include accepting a no-deal exit [of the European Union] on the 31st of October, and it’s not something I could ever sign up to.”

Rory Stewart, the International Development Secretary also confirmed its intention to return to the backbench to serve Cumbria.

Markets will be on the Resignation Watch in the coming days to examine the extent of Boris Johnson becoming the new Prime Minister.

Markets Reactions

A new Prime Minister does not eliminate the uncertainties about Brexit, but the appointment of Boris Johnson amplifies the uncertainties. All in all, the reactions in the markets were largely priced-in. Rather than focusing on the economic policies and the potential investment opportunities that will come with the new leader, investors will likely continue to proceed with cautious as an orderly Brexit becomes more challenging than ever.

The US President was quick to refer to Boris Johnson as the “Britain Trump”. Will Britain Trump has a similar outcome on the stock market that President Trump had?

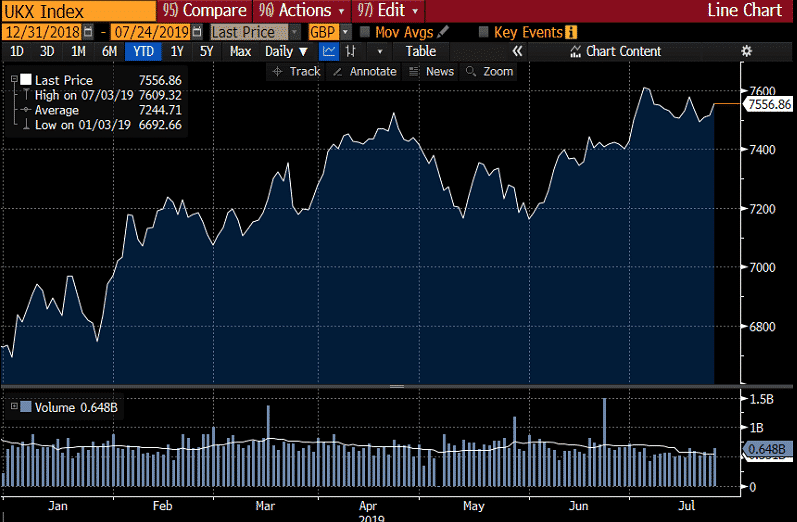

The new Prime Minister will likely increase Brexit uncertainties which will most probably push the FTSE 100 higher:

- If Britain remains in the European Union, we can expect the FTSE to rally.

- If Boris leads a no-deal Brexit, the uncertainties in the domestic markets and a slowing economy will also eventually push the FTSE 100 higher.

A look at the year-to-date chart shows that despite the ongoing Brexit drama and political chaos, the FTSE 100 traded higher since the beginning of the year.

Source: Bloomberg Terminal

However, it is important to note that the UK stock discount to Europe, which is the greatest since 20116.

The British Pound

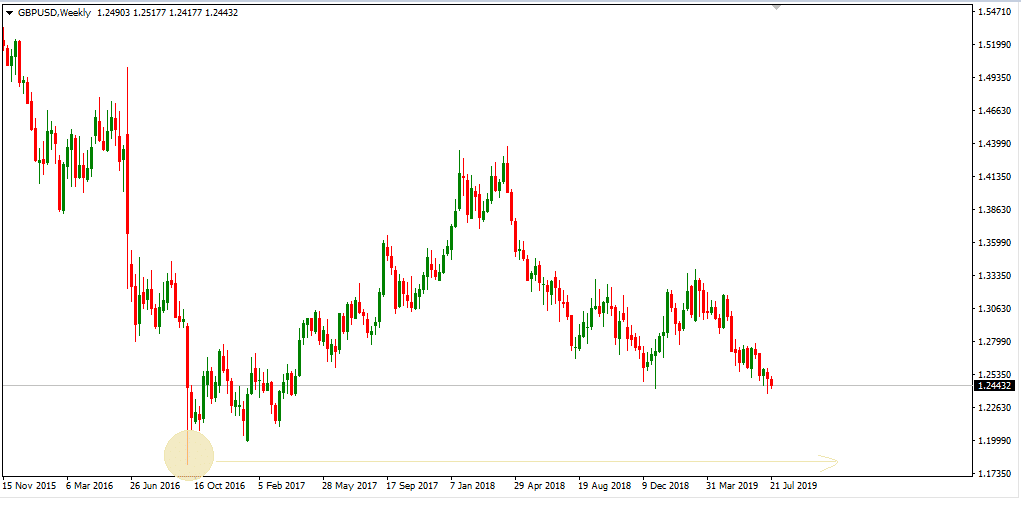

Brexit is the primary downside risk oscillating sentiment for the local currency. The British Pound was a source of Britain’s stability within the members of the European Union. Since the Brexit referendum, the local currency was unable to recover to the levels seen before the referendum. Last week, the Pound dropped to a two-year low to $1.24.

The GBPUSD is trapped in a downtrend. The new leader will have only a couple of months to try to secure a divorce deal, and from what we know, it will be challenging. The Pound could be sent lower as pressure over the negotiations increased. We could see the local currency dropping to the low levels seen post-Brexit.

GBPUSD (Weekly Chart)

Source: GO MT4

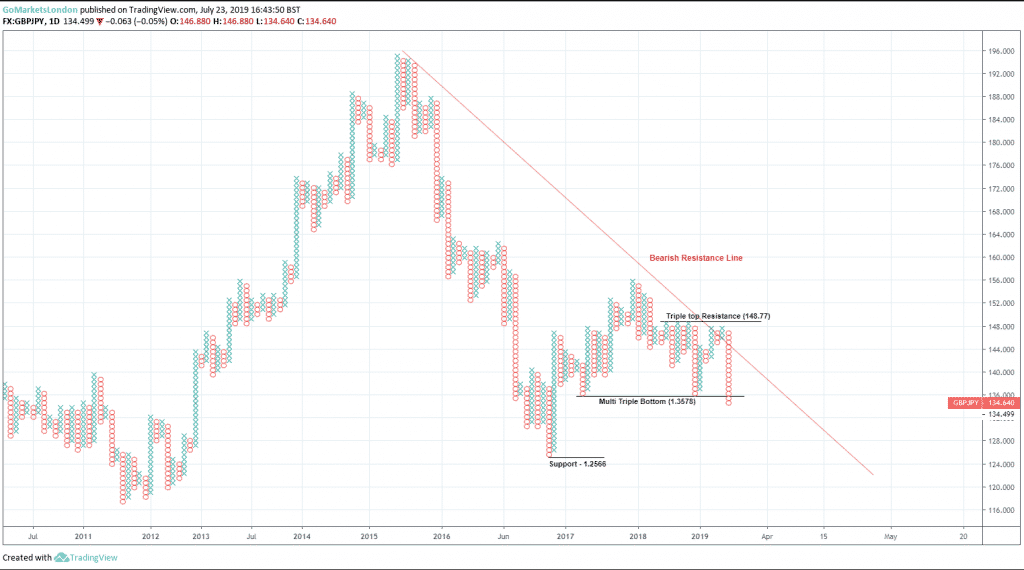

Our in-house analyst, Adam Taylor also reviewed a popular pair- the GBPJPY.

Using the Point & Figure methodology, the chart below indicates just how weak the British Pound has fared compared to the Japanese Yen longer-term. Nothing highlights this weakness more than the bearish resistance line in red, which depicts a steady downtrend for a considerable length of time.

At one stage it appeared GBPJPY might be producing a change in direction as the pair began creeping up into the 144.00 regions. However, as soon as the pair looked sure to breakout above the trend, it nose-dived back towards the familiar bearish territory.

We also notice a bearish signal forming as supply slipped past the multi-triple bottom area of 1.3578. Downside targets are few and far between now with the psychological level of 130.00 potentially finding some demand, and a further decline closer to the previous significant support of 1.2566.

If Mr Johnson succeeds in his quest to re-ignite the UK economy, then we may see Pound Sterling appreciate quite considerably. Until such time, the triple top resistance level of 148.77 should keep demand in check.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tesla Second Quarter 2019 Update

Tesla Second Quarter 2019 Update Tesla, the electric car maker, reported its second-quarter earnings on Wednesday in late US trading hours. Despite record production and deliveries, Tesla missed revenue estimates. The company reported a net loss of $408 million. Its share price fell by more than 20% since the beginning of the year after reaching ...

July 25, 2019

Read More >

Previous Article

Why THIS US earnings season may be of interest to Forex traders

The traditional relationship between equity markets and forex is complex and often not particularly well correlated. As a result company ear...

July 23, 2019

Read More >