- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – CAD, AUD rate decisions ahead, Fed enters blackout period

5 December 2022With US equities flip flopping recently on the market’s perception of a Fed Pivot (or not) and seemingly changing with the wind on any inflation data or jaw boning from Fed members, the week ahead might offer a welcome respite as the Fed goes into its black out period and US data is light on the ground.

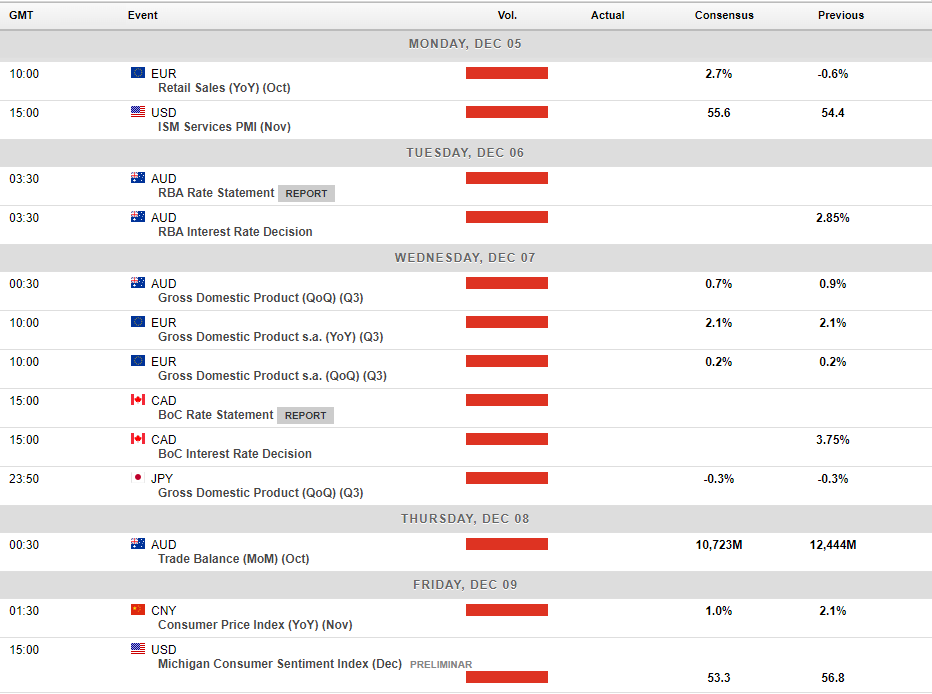

The major risk events for FX traders look to be the RBA and BoC policy meetings on Tuesday and Thursday respectively, both decisions are on a knife edge with rates markets evenly spilt on the size of the hikes, or in the RBA’s case, whether they hike at all.

RBA

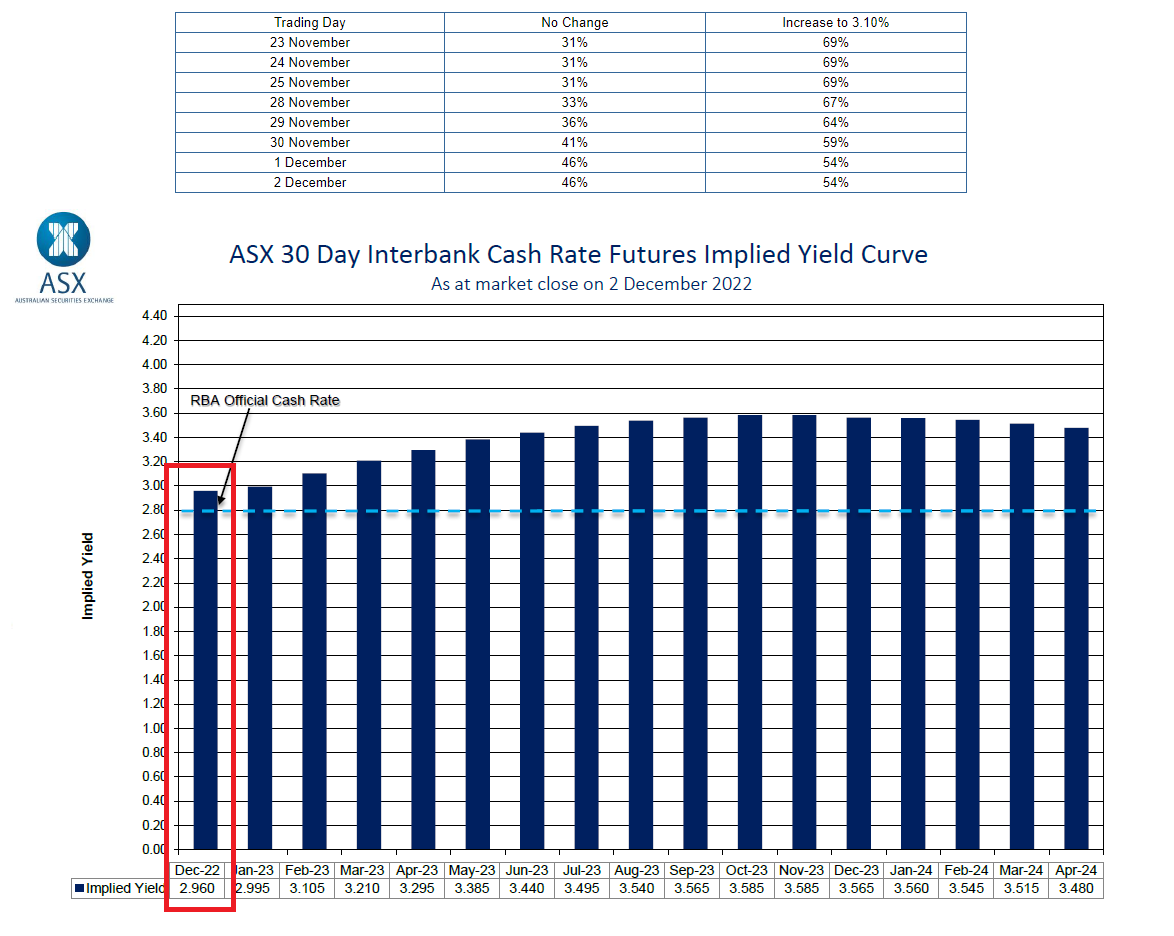

With a shock miss on the Australian CPI figure last week, coming in significantly lower than expected and fuelling hopes that inflation has peaked, unsurprisingly the odds for no hike in tomorrow’s meeting have increased dramatically in the last seven days. The week started with rates futures giving a near 70% chance of a hike, by Fridays close that has come down to a 54% chance of a 25bp hike.

This set’s up Tuesday’s meeting as a pivotal one, only a couple of short months ago 50bp hikes seemed the new norm and now there is an almost 50% chance of no hikes coming out of this meeting. Whatever the RBA does volatility in the AUD and ASX 200 are very likely.

AUDUSD has performed well in recent weeks but has seen some resistance around the 68.4c level, consolidating in a range. A hike at Tuesday’s meeting could see it break through this level and with improved risk sentiment get more traders convinced it’s on a bull run.

Bank of Canada

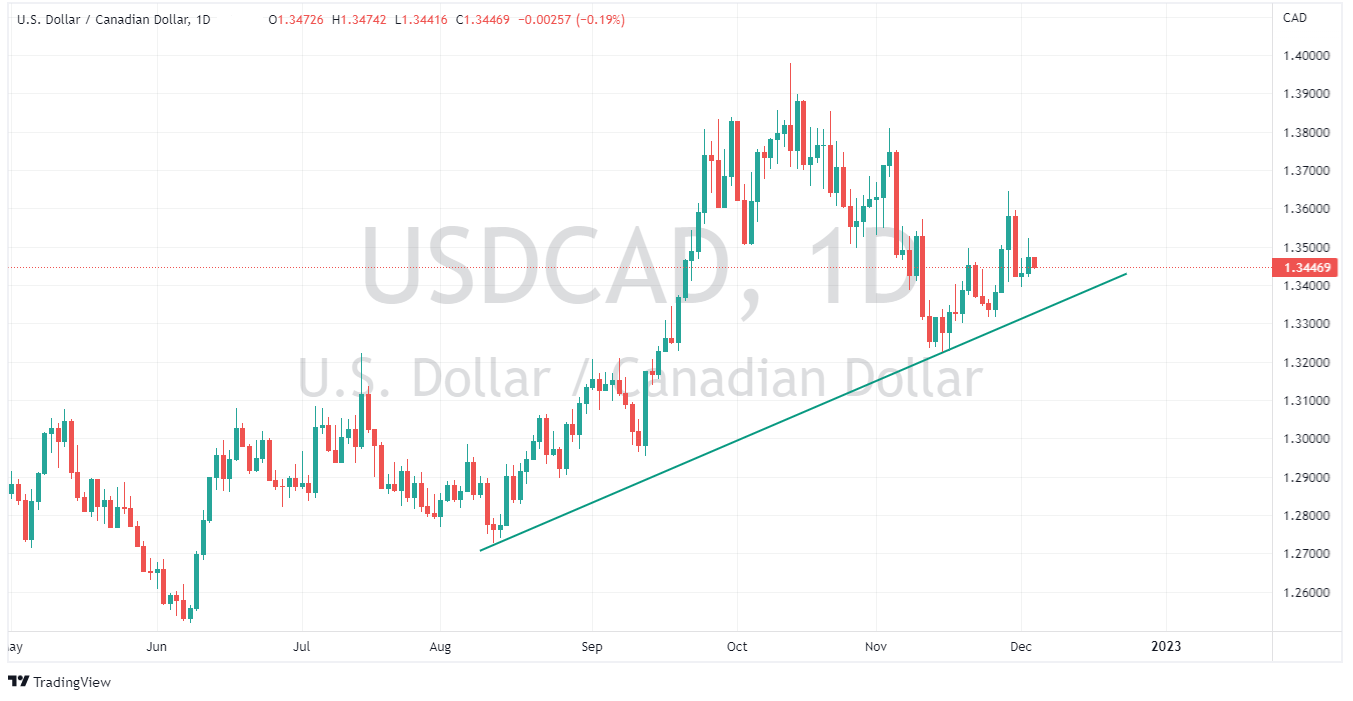

This will be another interesting Central Bank meeting with both markets and economists split down the middle on whether it will be a 25bp or 50bp hike. There is good arguments for both options. with the 25bp camp arguing there are signs of softening in the economy and the housing market looking vulnerable, whilst a robust 3Q GDP outcome, a tight job market and elevated inflation readings having the hawks predicting a 50bp hike.

The CAD has struggled against the USD in recent weeks, even though the greenback has been under pressure and underperformed most other currencies, CAD traders will be watching this BoC rate decision closely as it will likely drive the pair in the week ahead.

Other figures of note this week include Eurozone, Australia and Japan GDP figures which will show how the global economy is recovering along with US consumer sentiment figures later in the week.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How to use a trading a journal to reduce your learning curve

As a new trader, riding the emotional ups and downs can be a very difficult task. It is human nature to feel the pain of a losing trade. The losing often outweighs the positive feeling of any winning trade. Dealing with the emotion of trading can be an incredibly difficult task. It can cause even the best system to fail. A trading journal especiall...

December 6, 2022

Read More >

Previous Article

Hold up, the ASX200 is only 4% of its all-time high

It has been a tough year for the stock market in 2022 with a war in Eastern Europe and record high inflation have dominating the news. Furthermore, th...

December 2, 2022

Read More >