- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Up next: Bank of England rate decision

18 March 2021With Bank of Canada and the Fed interest rate announcements wrapped up, it’s time for Bank of England to announce their decision whether to increase, decrease or leave the interest rate unchanged. The decision is set to be announced at 12:00 PM London time on Thursday.

About Interest Rates

Interest rates are set by Bank of England’s Monetary Policy Committee which is made of nine members – The Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Bank’s Chief Economist and four external members appointed directly by the Chancellor.

Bank of England has an inflation target of 2% (currently 0.9%), which is set by the Government – the Bank of England’s monetary policy is set to achieve the Government’s target.

Expectations

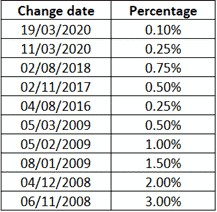

The UK economy, like most in the world, has taken a hit over the last year since the COVID-19 pandemic began. The last time Bank of England changed its key interest rates was last year on 19 March, from 0.25% to 0.10%.

Bank of England interest changes since 2008

Despite UK still being in lockdown, the pace of the vaccination program (25 million people vaccinated so far) is giving a glimmer of hope of the economy getting back to some sort of normality in the coming months.

It is highly unlikely that the interest rates will be changed in the upcoming meeting, but all eyes will be on the policy meeting minutes and the outlook on the economy with restrictions starting to get lifted from next month.

Remaining Bank of England rate announcement dates for 2021

- 6th May

- 4th June

- 5th August

- 23rd September

- 4th November

- 16th December

You can keep up to date with economic announcements and events by clicking here for our GO Markets Economic Calendar.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Rising yields have markets seesawing, US dollar rising

Equity markets US markets dropped sharply overnight as inflation fears returned on the back of Treasury yields hitting their highest levels in more than a year. Investors are concerned the Federal Reserve will allow inflation to accelerate, after Wednesday’s policy meeting where they reaffirmed their commitment to easy money policies....

March 19, 2021

Read More >

Previous Article

Dow Jones rally Q1 2021

2021 has been a profitable year for stocks in the Dow Jones Index. Since the turn of the year, the Dow has seen what appears to be a roaring rally wit...

March 17, 2021

Read More >