- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – RBNZ, UK and US inflation and debt ceiling impasse headline risk events

22 May 2023With Junes FOMC policy meeting still up in the air as far as markets are pricing in, FOMC minutes and US PCE core inflation figures (reportedly the Fed’s favoured measure) released this week will be closely watched and likely go a long way to settling market participants mind as to what the next move from the fed will be. From the UK inflation data that is set to heavily determine BoE’s June decision, and a RBNZ meeting which could be interesting after their last surprise supersized hike.

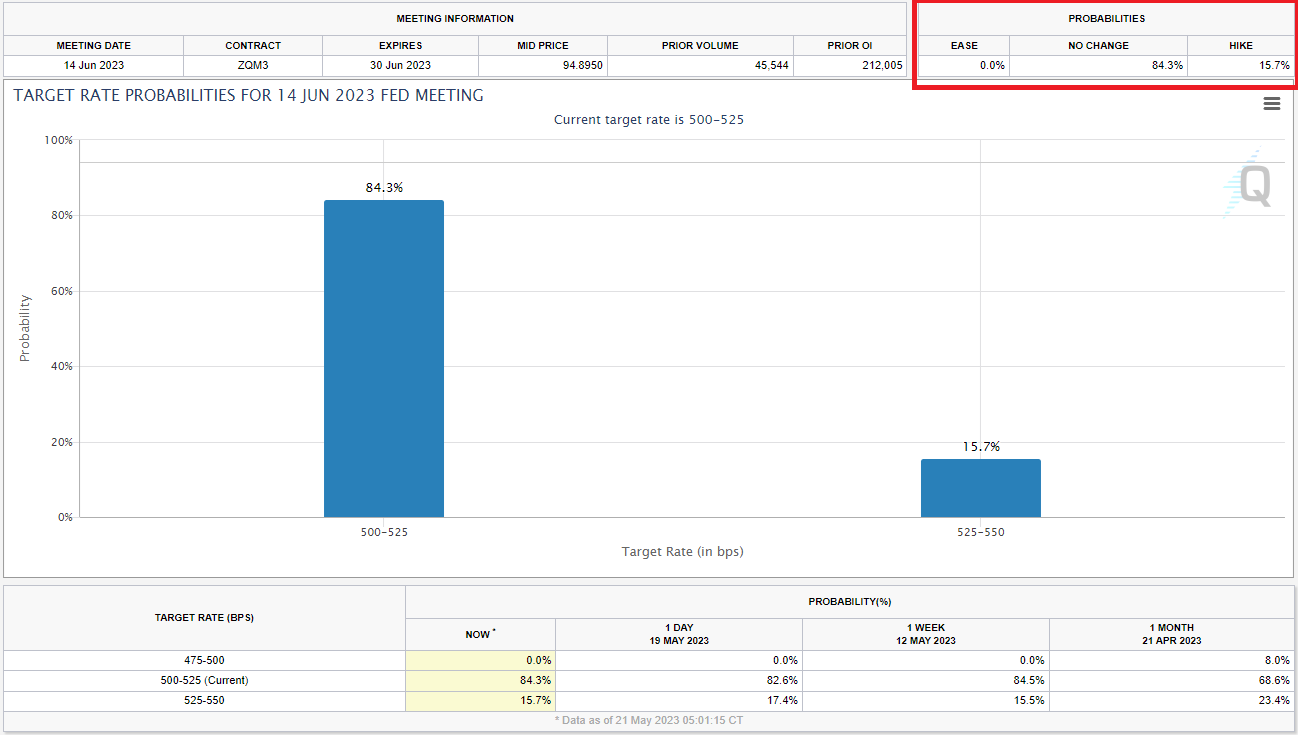

US: June FOMC Rate hold is not a foregone conclusion

The main risk event for the US is Fridays Core PCE Price Index which, along with recent Fed commentary looks to remain elevated. Although the activity backdrop continues to soften and recession risks remain high given the rapid tightening in lending conditions, a high reading here would give the Fed no excuses not to hike again at their June meeting, currently the Fed fund futures market is pricing in only a 15.7% of a hike, though that could change rapidly on the back of this figure, risks are definitely to the upside with the current pricing so we could see some interesting market action on this.

source: CME Fedwatch

UK: CPI expected to moderate but Services could surprise

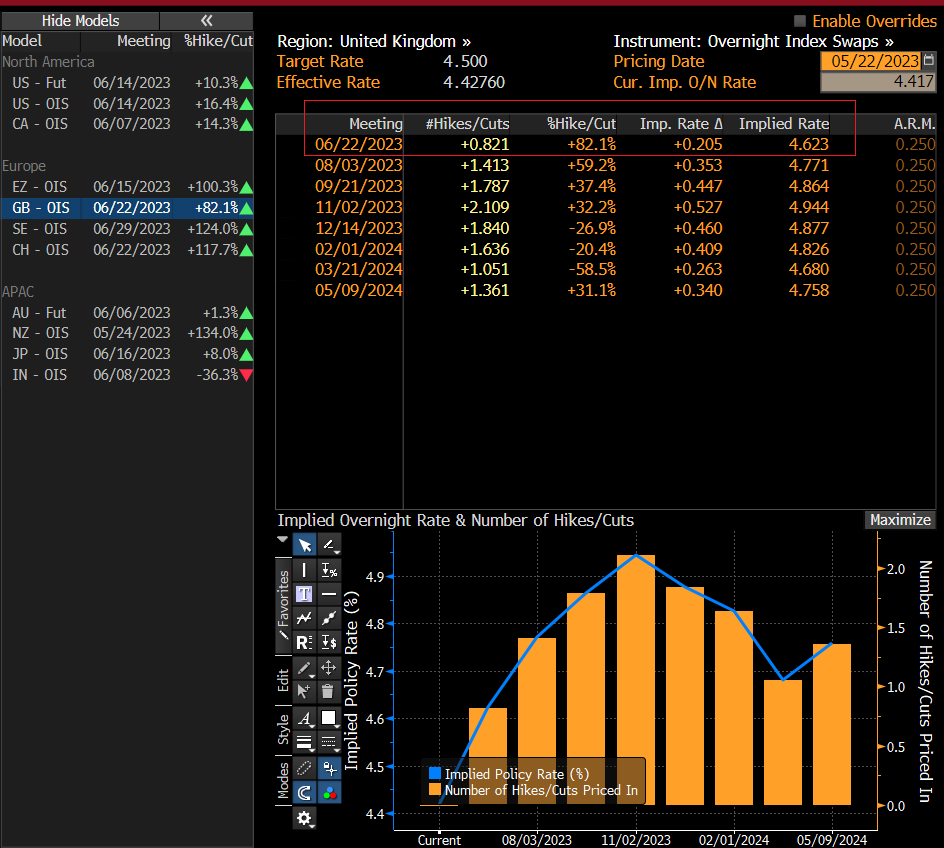

Wednesdays UK CPI figure is one of two such releases ahead of the June 22nd Bank of England meeting where markets are currently pricing in a 25bp hike. While the headline figure is expected to moderate to 8.2% y/y from the previous eye watering 10.1% it’s services inflation component that has been the most stubborn and the one to pay the most attention to for BoE watchers. Governor Bailey is also set to talk a couple of hours after the CPI figure, so Wednesday looks like the day for GBP traders if they’re looking for volatility.

Currently the market is pricing in an 82% chance of a 25bp hike, this weeks data will go someway to shoring up those odds.

source: Bloomberg

NZ: RBNZ set to hike – could they surprise again to the upside?

Wednesday will also see the RBNZ monetary policy meeting where markets have fully priced in the central bank to continue its hiking cycle. The question is by how much after April’s surprise 50bp supersized hike markets are currently split. Futures are pricing in a 57% chance that the RBNZ hikes by 25b 5.50% and a 43% chance of a 50bps increase. A chart to watch is the AUDNZD which has fallen to sub 1.06, a 50bp hike would see rate differentials further favour the Kiwi and probably seeing more (limited in my opinion) downside to AUDNZD. A “small” 25bp hike might give a signal to mean reversion traders that this is a good buy level and see the pair start heading back to its 1.07 mean.

source: Tradingview

On top of these scheduled release, the other overriding risk event is ongoing US debt ceiling negotiations which predictably has seemed to have reached a stalemate as both sides of US politics seem to be favouring brinkmanship in their dealings with each other.

While this continues (I think it will go down to the wire) you would think that risk appetite will be dampened seeing haven currencies such as CHF, JPY and USD get a tailwind. Gold seems to have lost its luster somewhat as a haven recently, but that may change if the markets do experience some real distress due to this impasse.

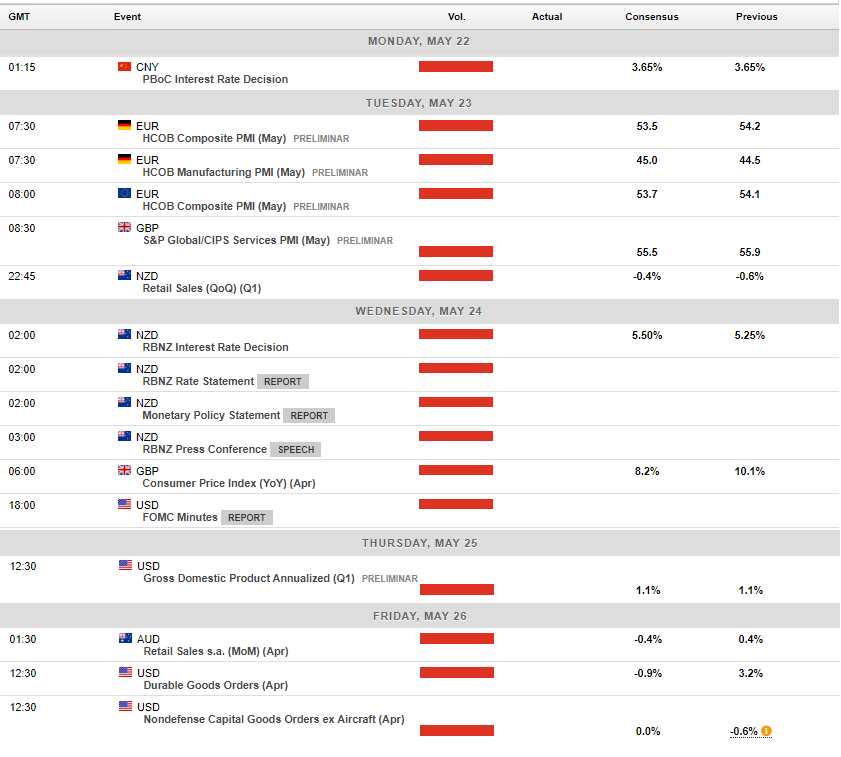

Calendar of this week’s major scheduled releases below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market Analysis 22-26 May 2023

XAUUSD Analysis 22 – 26 May 2023 The gold price outlook is generally positive in the medium term. Although the close of last week's sell pressure bar indicates a significant loss of buying momentum, due to the sell-off during the week but the price is still moving above the 1960 support. After the adjustment has come down to test, the ...

May 23, 2023

Read More >

Previous Article

AUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

The Aussie dollar has been fairly directionless since late February with it seemingly waiting for a catalyst to break it’s ranges and take the next ...

May 18, 2023

Read More >