- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US CPI preview – the chart to watch

10 May 2023Today’s US CPI number is the most important US data release this week. With the FX markets coming into this release with relatively low energy and searching for a catalyst any surprise will likely trigger significant intraday volatility in FX and other risk assets.

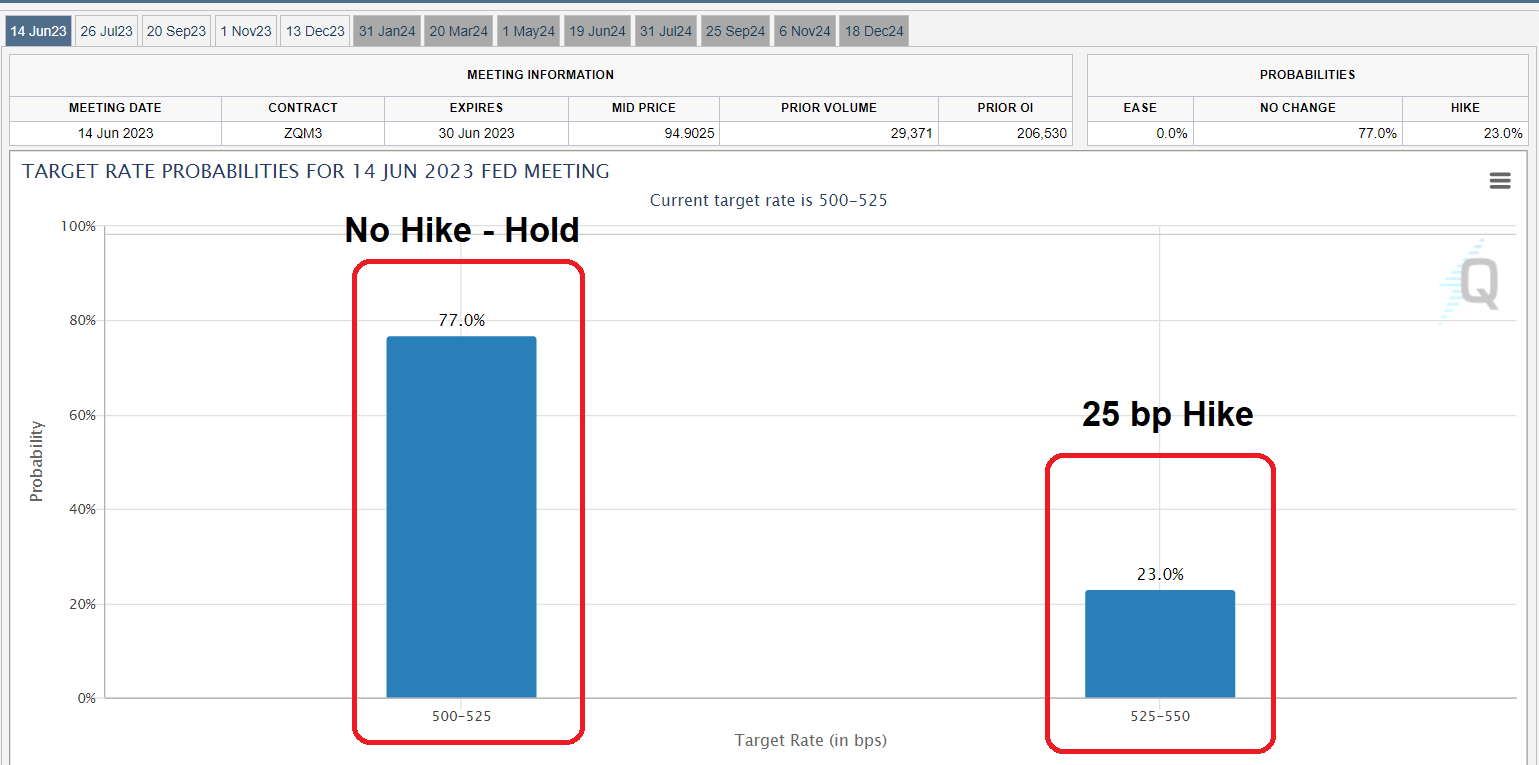

We’re also coming into this release with a market split on the Feds next rate move, with recent hawkish talking heads seeing the probability rise to around 23% for a hike at the June meeting, meaning that inflation data especially will play a big part in the pricing of those odds as we head towards that meeting on June 16.

Fed Funds future pricing below:

To see a significant volatility injection into this market, we’ll likely need to see a surprise in the core data, most notably the M/M expectations (0.3% in this case.). An upside surprise should be USD positive, while a downside surprise should be USD negative as rates markets and bond yields re-price, this will also be dependent on how wider risk sentiment reacts to the figures.

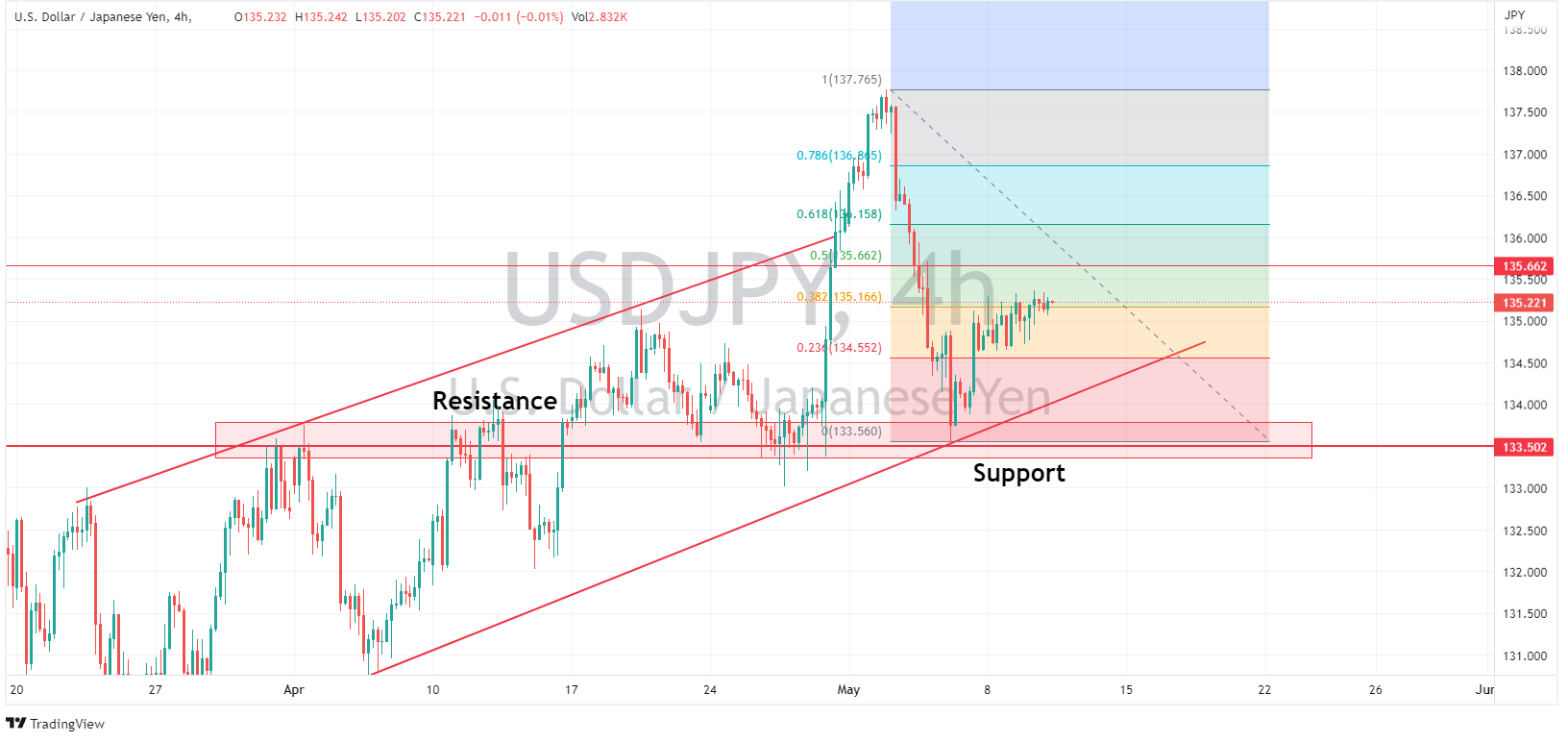

The chart to watch in my opinion over this release in USDJPY, the reasons being, is that some interesting levels have formed on the chart in recent weeks, we have resistance turned support at around the 133.50 level, and some interesting Fib levels (measured from Mays high to lows) coming up, with the normally more reliable 50% level around 40 pips higher than the current level. The other reason is that the USDJPY is very sensitive to US and Japanese bond yield differentials, US yields reacting to the CPI figure will see this differential fluctuate, further driving volatility in USDJPY.

Targets I will be looking at are a test of the 50% Fib level at 135.66 if the CPI reading comes in hotter than expected, if much lower than expected, a test of the lower upward trend line at around 134.29 will be the first line of support.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Rivian results announced – the stock is up

American electric vehicle Rivian Automotive Inc. (NASDAQ: RIVN) reported the latest financial results for Q1 after the market close in the US on Tuesday. Company overview Founded: June 2009 Headquarters: Irvine, California, United States Number of employees: 14,122 (December 2022) Industry: automotive, energy storage Key people:...

May 11, 2023

Read More >

Previous Article

US stocks fall ahead of CPI, Hawkish Central bank speak and debt limit limbo

US indices finished modestly lower on a light news day with traders cautious ahead of upcoming US CPI figures and following hawkish rhetoric from nume...

May 10, 2023

Read More >