- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US Stocks finished mostly down on bank stress – Nasdaq lifted by tech earnings

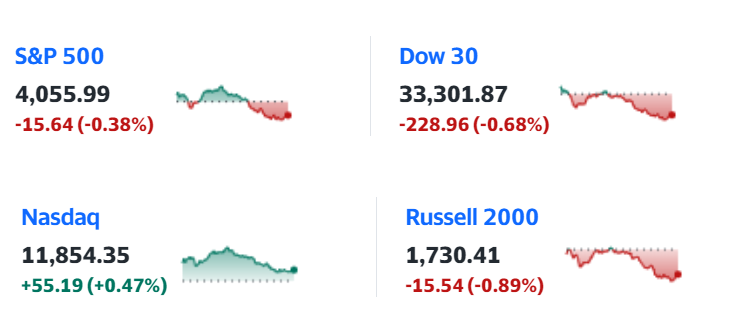

27 April 2023Major US Stock indices were mixed in Wednesdays session after further banking woes dragged down the Dow, S&P500 and Russell while the Nasdaq held up thanks to strong earnings from Microsoft and Alphabet.

The Russell 2000 was again the underperformer as mid-sized bank worries continued, seeing First Republic Bank (FRC) dump another 30%, dragging down the whole sector and the Russell as it becomes more evident that the banking crisis is not over yet.

FX Markets

Banking woes weighed on the USD as the seemingly imminent failure of FRC would likely tighten financial conditions and take the pressure off the Federal Reserve to keep hiking rates in their battle against inflation, on this , bond markets repriced a more dovish Fed policy going forward and saw the US Dollar Index fall to 101 before finding support.

The Euro was firmer thanks to a weaker USD with EURUSD attempting to rise above 1.11 but hit a high of 1.1095 before pulling back later in the session. EURUSD was also helped by some commentary from ECB officials that was to the hawkish side ahead of the ECB meeting next week.

Risk sensitive currencies NZDUSD and AUDUSD were both weaker on the session on deteriorating sentiment in the broader market. Soft Aussie CPI figures on Wednesday saw a dovish repricing of bets on the RBA move next week, seeing the AUDNZD dip below 1.08 briefly before paring losses later in the session.

Commodities

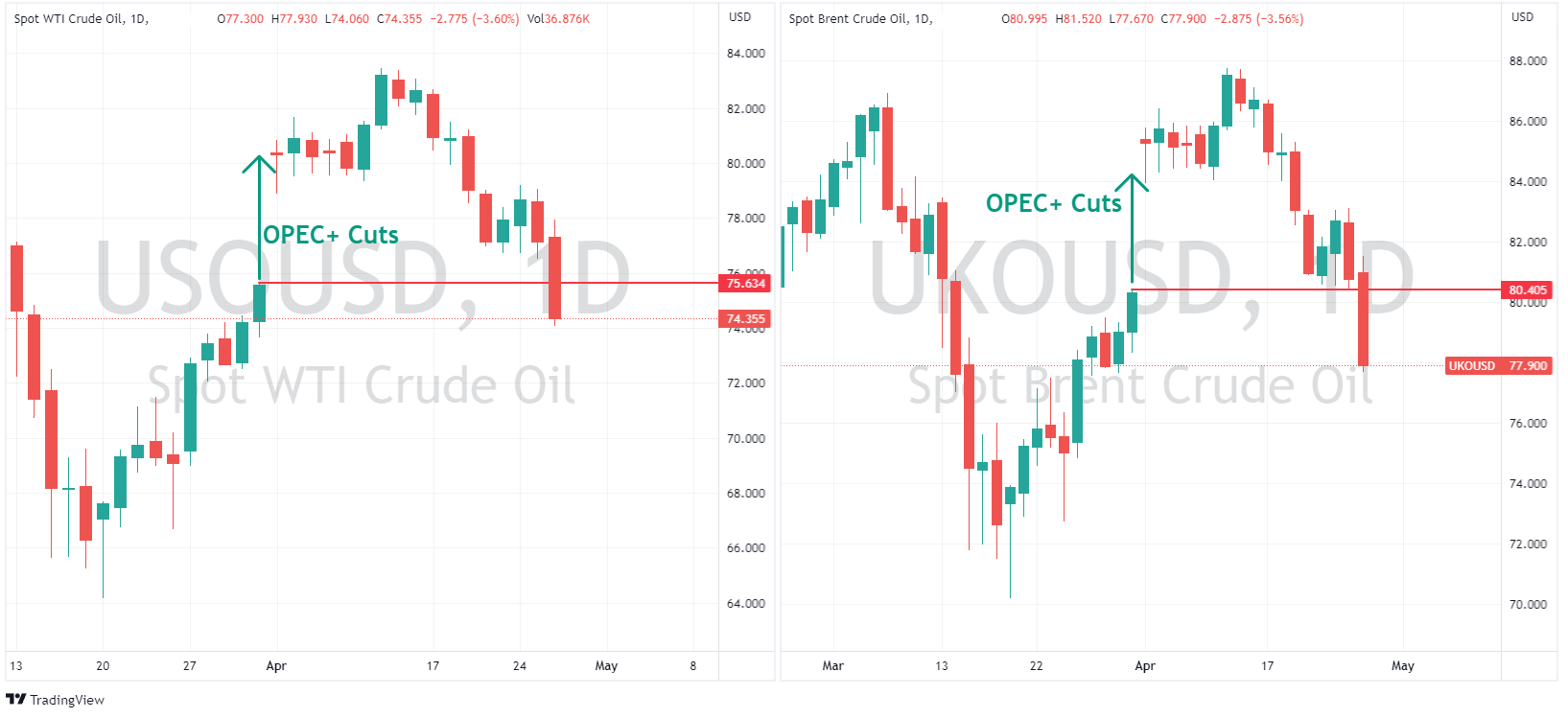

WTI and Brent crude both tumbled on recessionary fears after the woes of FRC, the gap ups from the OPEC+ surprise cuts have now been fully filled in both contracts, Crude prices also not helped by reports of potential Iraq/Turkey supply progress and increased Russian refinery runs.

Gold ended lower on the day after an initial rally on safe haven flows testing above the pivotal 2000 USD an ounce level on numerous occasions but unable to maintain it with the bears winning the battle this day.

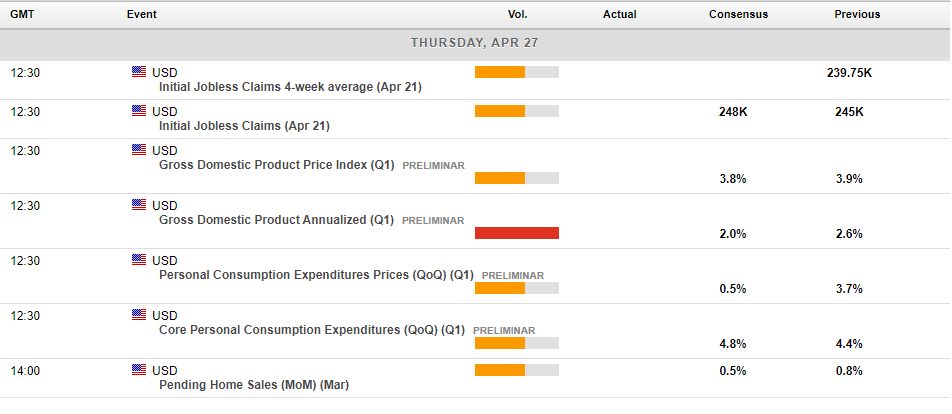

In today’s economic announcements, GDP and Unemployment claims out of the US are the main risk events, though I suspect neither will do much to sway the Fed decision next week, but future pricing in of Fed actions later in the year if these figures come well outside of range sould see some volatility in the US dollar.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What are jobless claims?

Jobless claims refer to a weekly statistic published by the U.S. Department of Labor, indicating the number of individuals applying for unemployment insurance benefits. These claims are categorised into two groups: initial claims, encompassing first-time filers, and continuing claims, representing those who were already receiving unemployment benef...

April 27, 2023

Read More >

Previous Article

Boeing results have landed – the stock takes off

The Boeing Company (NYSE: BA) announced Q1 financial results before the market open in the US on Wednesday. World’s largest aerospace company posted...

April 27, 2023

Read More >