- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Why Trade Gold with GO Markets?

1 May 2023Gold has always been one of the most popular and highly traded markets for CFD traders, especially recently as its price has risen to test its all-time highs. It’s easy to see why, Gold has been a store of value throughout history and now with institutional grade spreads and zero commission there has never been a better time for GO Markets clients to trade this exciting market.

At GO Markets we offer our clients the world’s most popular gold trading platforms in Metatrader 4/5 and C-Trader, as well as ultra-fast execution for manual traders these CFD trading platforms also give you the ability to automate gold trading strategies.

Advantages of trading gold CFDs with GO Markets:

- Institutional grade spreads and ZERO commission for all account types.

- Trade 23 hours a day, unlike an ETF or gold miner listed on a stock exchange that is only open while that stock exchange is open.

- Leverage – from 20:1 to 500:1 depending on your account type.

- Flexibility in position sizing starting from 0.01 lots.

Fundamental forces that drive the price of gold

While no one reason can be fully attributed to movements in the price of gold, there are an important few fundamental drivers that will influence the price of gold and whose relationship has been time tested. None of these on their own should be used as a sole reason to enter a position, but having the fundamentals on your side will certainly give you an advantage.

The main fundamental drivers in my experience are (not an exhaustive list by any means!)

- The gold price relationship to US bond yields

- Safe haven flows

- Central Bank buying

Real Yields and Gold

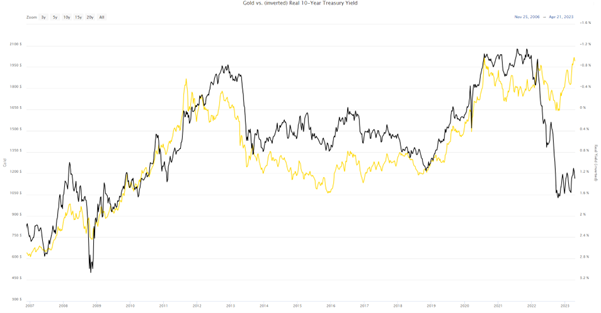

The inverse relationship between bond yields and the price of gold is well established, especially the real yield on the US 10-year bond. The reason for this mainly is because the real yield (the real yield is calculated by subtracting inflation expectations from the actual yield of the US 10-year government bond) is seen as the “risk free” rate on an investment, the higher the “risk free” rate is, the less attractive a non-yield paying asset like gold is. As both gold and bonds are seen as safe havens, they are competing for the same investors. See the screenshot below to illustrate this point.

Source: longtermtrends.net

The gold line is the price of gold, the black line is the inverted real yield of 10-year treasuries. This chart stretches back 16 years, but the close relationship has gone back much longer than that. This chart is showing that historically, gold is expensive at the moment as compared to real yields as can be seen by the growing gap between the two recently, this interesting decoupling has been mainly caused by our second fundamental driver – safe haven flows.

Safe Haven Flows

Geopolitical strife with war in Ukraine and doubts over the health of the global economy got things started with the surge we have seen in gold prices in the last 5 months, but things went into overdrive in March 2023 when Signature bank and Credit Suisse collapsed, bring into question the integrity of the banking system and massive safe haven flows into gold which has pushed the price to within touching distance of hitting all-time highs. With the banking crisis seemingly under control (for now maybe?) gold has lost some momentum, but the fact it is holding around these elevated prices indicates some investors may not think the crisis is over just yet.

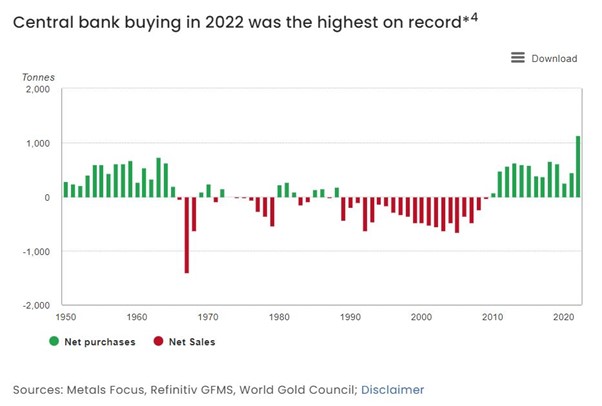

Central Bank Buying

Central banks are some of the biggest buyers of gold on the open market, and 2022 saw the most central bank buying of gold on record.

Whatever the reasons for this, such massive amounts of buying would be seen as a bullish sign for the gold price (if it continues).

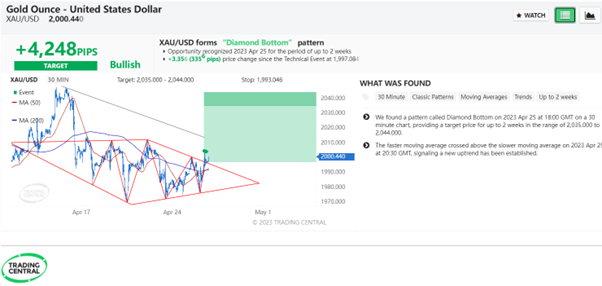

GO Markets clients also have access to Trading Central which automatically detects technical set ups for our traders to add to their decision making. Trading Central can be accessed by account holders through their Client Portal.

Trading Central Pattern example below:

Feel free to contact the GO Markets team if you have any questions on trading gold CFDs.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Natural Gas analysis – another bull run coming?

Natural Gas price action has had an amazing two years, with the usually pretty boring commodity showing extreme volatility pushing it to all time highs before a dramatic collapse seeing it back where it started in 2020. Like all the energy complex, Oil being a good example, the start of the Covid panic saw wild price fluctuations as traders came...

May 1, 2023

Read More >

Previous Article

BoJ Governor Ueda’s first monetary policy meeting

The Bank of Japan is due to hold its first monetary policy meeting under new Governor Ueda on the 29th of April 2023. Since his appointment, Governor ...

April 28, 2023

Read More >