- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

August – A Challenging Month for Markets

29 August 2019August – A Challenging Month for Markets

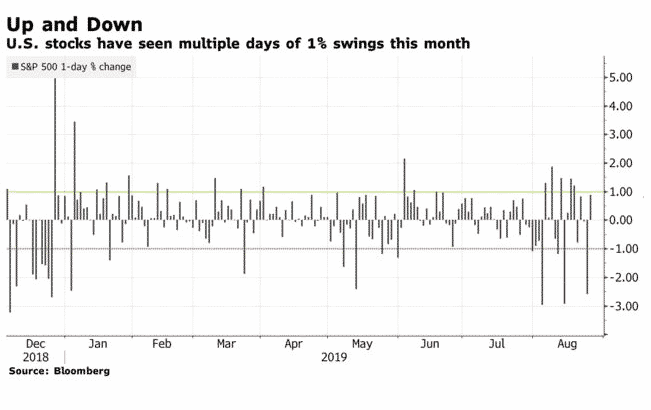

A wave of volatility swamped the markets in August. Recession fears, yield curve inversion, and the big breach of the Yuan were the dominant headlines that alarmed investors throughout the month. Bearing the brunt of the tit-for-tat tariff hikes, the stock market saw multiple days of 1% swings with a couple of sharp pullbacks above 2%. Money was flowing into safe-havens- and Gold rose above the $1,500 mark for the first time in six years.

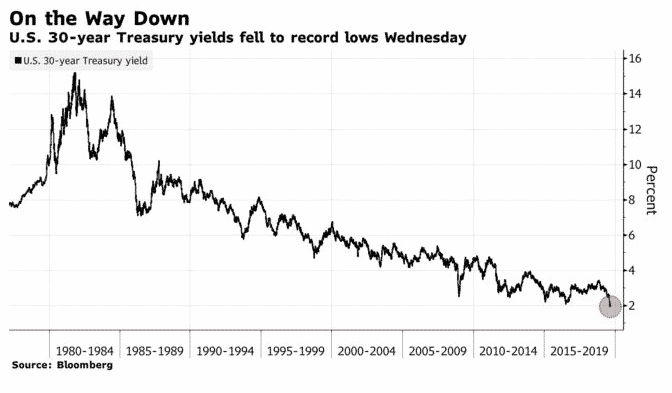

Yield Curve – A Warning Signal

Probably, the most closely watched indicator of an impending recession is the Yield Curve. Over the course of the month, the warning signals from the bond market has revived fears of a recession. When an investor starts demanding a higher yield for short-term Treasuries, it generally means that the investor thinks it is riskier to hold such assets over the short-term.

The inversion of the yield curve is therefore hard to ignore as it has a particular track record for preceding downturns.

Earlier this month, the 2-Yr US government bonds dropped below the 10-Yr yields for the first time since the financial crisis while the 30-yr Treasury yield fell to a record low. The inversion of the yield curve has deepened over the past few days.

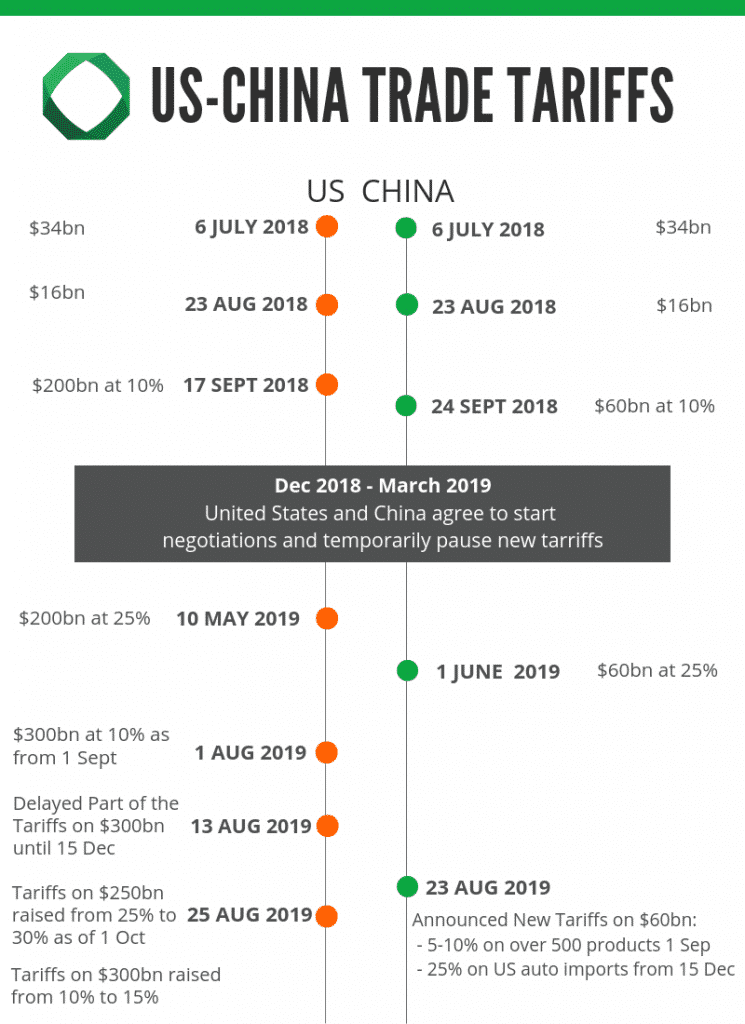

Tit-for-Tat Trade Tariffs

It was another episode of tit-for-tat tariffs between the US and China. President Trump surprised the markets with a new round of tariffs at the beginning of the month. China retaliated after three weeks.

The global economy remains locked in a trade war between the world’s two largest economies with no sign of a concession any time soon.

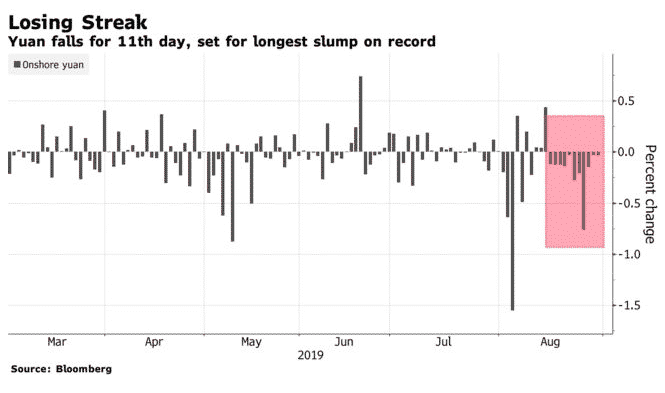

Yuan – The Symbolic Level Breached

The Big Breach of the psychological level of 7 happened after President Trump announced the new round of tariffs, which prompted panic in the markets. China was even labelled as a “currency manipulator”, and tensions between the two countries have worsened. The Yuan hit an 11-year low this week, and markets participants are left wondering how much further China would allow its currency to weaken.

A currency war could be another ballgame for global markets. Headwinds are piling up, providing little respite for investors.

Brexit Drama Turned to a New Page

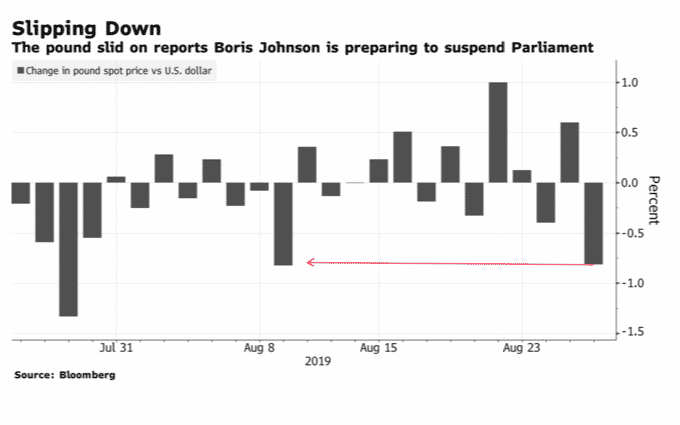

New Prime Minister, Boris Johnson, is seeking to close Parliament next month and prompted a backlash from MPs and opponents of a no-deal Brexit. By announcing the proroguing of Parliament to limit the amount of time MPs would have to prevent a no-deal Brexit from happening, the PM sparked an undemocratic outrage.

We expect the weakness in the British Pound to build as the month winds down in anticipation of the Queen’s final decision to accept or deny the request.

September will start with New Tariffs

The U.S. Trade Representative’s office said in an official notice that collections of a 15% tariff will begin at 12:01 a.m. EDT (0401 GMT) Sunday on a portion of the list covering over $125 billion of targeted goods from China.

Unless there is a last-minute turnaround!

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Making trading choices – A trading journal?

We frequently refer both in the articles we publish and the weekly “Inner Circle” sessions we present, to the benefits of a trading journal. However, the reality is that many traders make the choice not to measure trading despite the logical benefits of doing so. Whether you do or don’t currently, the bottom-line decision you are...

August 30, 2019

Read More >

Previous Article

Margin Call Podcast – S2 E3: Rupert Hackett | Co-Founder and Advisor at Caleb & Brown

Rupert Hackett is the Co-Founder and Advisor at Caleb & Brown, while also a Director at ADCA (Australia Digital Commerce Association). Caleb ...

August 28, 2019

Read More >