- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Target falls short in Q2 – the stock is down

18 August 2022Target Corporation (TGT) reported its second quarter earnings results before the opening bell on Wall Street on Wednesday.

The US retailer reported revenue of $26.037 billion (up 3.5% year-over-year), which was slightly above analyst estimate of $26.032 billion.

Earnings per share reported at $0.39 per share (down 89.2% year-over-year) vs. $0.79 per share expected.

”I’m really pleased with the underlying performance of our business, which continues to grow traffic and sales while delivering broad-based unit-share gains in a very challenging environment,” Brian Cornell, chairman and CEO of Target Corporation commented on the second quarter results.

”I want to thank our team for their tireless work to deliver on the inventory rightsizing goals we announced in June. While these inventory actions put significant pressure on our near-term profitability, we’re confident this was the right long-term decision in support of our guests, our team and our business. Looking ahead, the team is energized and ready to serve our guests in the back half of the year, with a safe, clean, uncluttered shopping experience, compelling value across every category, and a fresh assortment to serve our guests’ wants and needs,” Cornell concluded.

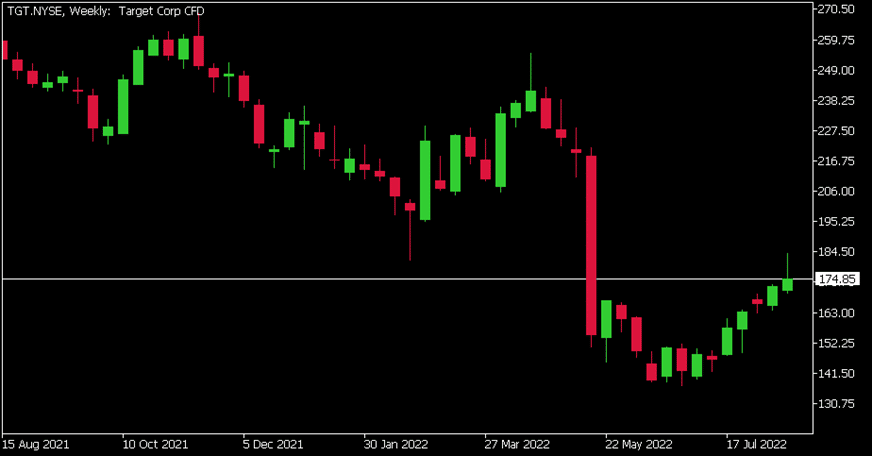

Target Corporation (TGT) chart

The stock was down by 2.69% on Wednesday at $174.85 per share.

Here is how the stock has performed in the past year:

- 1 month +12.04%

- 3 months +8.50%

- Year-to-date -24.24%

- 1 year -29.18%

Target price targets

- JP Morgan $190

- Wells Fargo $195

- Piper Sandler $190

- Barclays $175

- UBS $205

- Deutsche Bank $198

- Morgan Stanley $190

- Goldman Sachs $171

Target Corporation is the 166th largest company in the world with a market cap of $81.37 billion.

You can trade Target Corporation (TGT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Target Corporation, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Less hawkish Fed stems equity losses after UK CPI shock

US equites finished lower on Wednesday after a double digit CPI figure out of the UK saw traders ramping up their hawkish central bank pricing. The July FOMC minutes released late in the session softened the blow somewhat on the back of some participants noting the risk that the Fed could tighten more than necessary, this was seen as dovish, or mor...

August 18, 2022

Read More >

Previous Article

US Indices hit three-month highs on solid Walmart earnings, meme stocks pump and dump

US got off to a flying start in Tuesdays session after retail giant Walmart (WMT.NYSE) reported much better results and forward guidance than the rece...

August 17, 2022

Read More >