- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

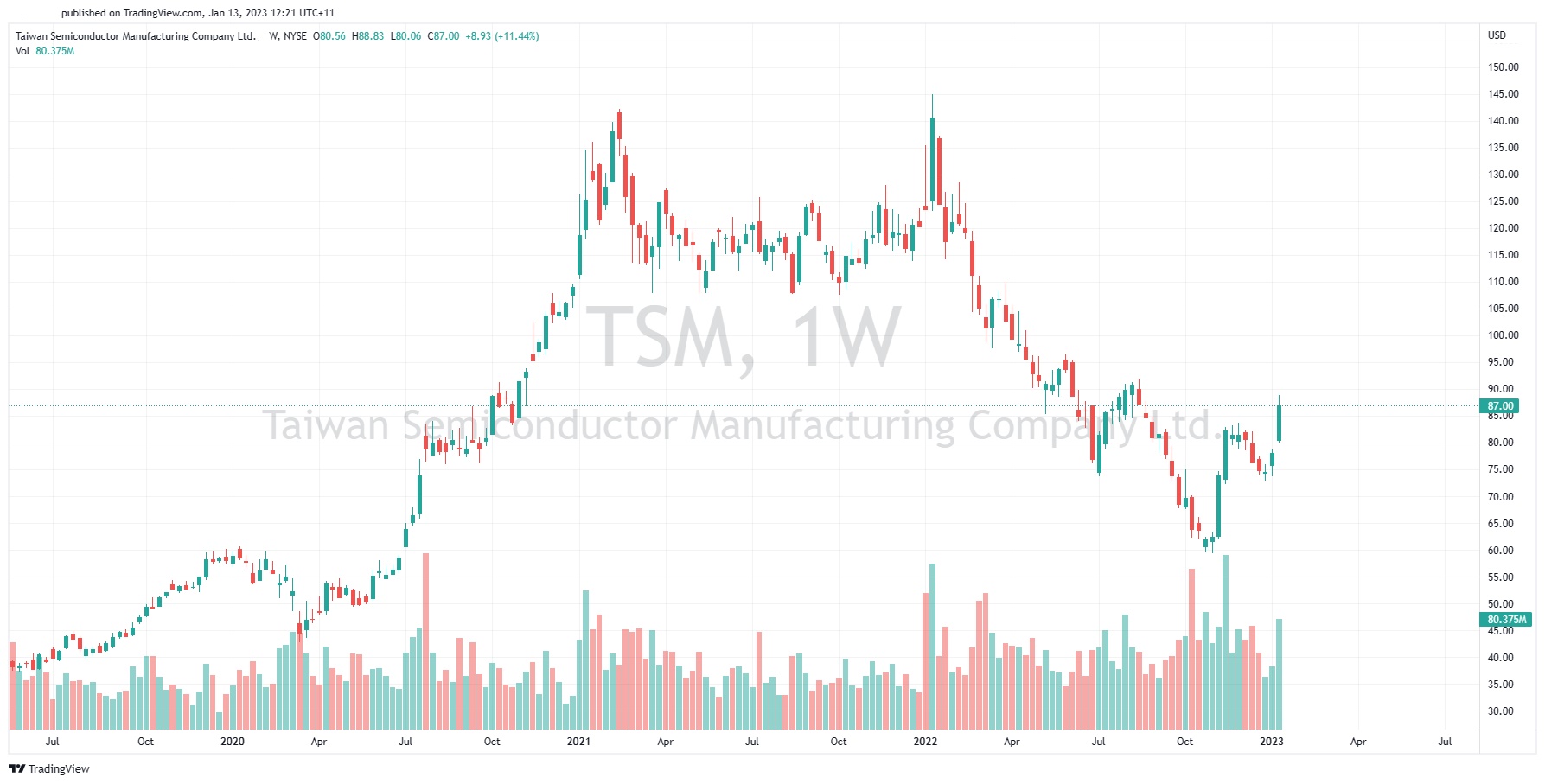

TSMC posts strong Q4 results – the stock is rising

13 January 2023TSMC posts strong Q4 results – the stock is rising

Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) reported Q4 financial results before the market open in the US on Thursday.

The Taiwanese company reported revenue of $20.554 billion for Q4, falling slightly short of Wall Street estimate of $20.574 billion.

TSMC reported earnings per share (EPS) of $1.875% for the quarter, higher than $1.795 EPS expected.

CFO commentary

”Our fourth quarter business was dampened by end market demand softness, and customers’ inventory adjustment, despite the continued ramp-up for our industry-leading 5nm technologies,” Wendell Huang, VP and CFO said after the results.

”Moving into first quarter 2023, as overall macroeconomic conditions remain weak, we expect our business to be further impacted by continued end market demand softness, and customers’ further inventory adjustment,” Huang looked ahead.

The company expects the revenue of between $16.7 billion and $17.5 billion for Q1.

Stock reaction

Shares of TSMC were up by over 7% on Thursday at $88.07 a share.

Stock performance

- 1 month:

- 3 months:

- Year-to-date:

- 1 year:

TSMC price targets

- Susquehanna: $88

- Atlantic Equities: $170

- Cowen & Co.: $120

- Argus Research: $150

- Goldman Sachs: $55

Taiwan Semiconductor Manufacturing Company Limited is the 10th largest company in the world with a market cap of $454.97 billion.

You can trade Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Taiwan Semiconductor Manufacturing Company Limited, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The US equities market at a tipping point after CPI data

The US markets are at a tipping point after CPI figures point to slowing growth and a potential pivot from the Federal reserve. The US released its updated CPI figures overnight as the data pointed to lower inflation and slowing growth. The Federal reserve may be buoyed by this data as it highlights that its interest rate hikes have been working to...

January 13, 2023

Read More >

Previous Article

Bitcoin showing early signs of another sell off?

Bitcoin had a tumultuous 2022 with the leading cryptocurrency seeing an aggressive sell off. Lead by catalyst such including the collapse of Celsius a...

January 12, 2023

Read More >