- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Uber earnings have arrived

5 November 2021Uber Technologies Inc. (UBER) reported their third-quarter earnings after the closing bell on Thursday.

The company reported revenue of $4.8 billion (up by 72% year-over-year) vs. $4.4 billion expected by the analysts on Wall Street. Loss per share was above analyst predictions at $1.33 per share vs. $0.33 loss per share expected.

Gross bookings reached an all-time high of $23.1 billion, up 57% year-over-year.

Uber reported a net loss of $2.4 billion in the third-quarter mainly due to a decline in the value of its investments.

CEO, Dara Khosrowshahi commented on the latest results: ”Our early and decisive investments in driver growth are still paying dividends, with drivers steadily returning to the platform, leading to further improvement in the consumer experience.”

”This is especially important as Mobility reignites. Mobility Gross Bookings are up 18 percent over just the last two months and this Halloween weekend surpassed 2019 levels.”

”While we recognize it’s just a step, reaching total-company Adjusted EBITDA profitability is an important milestone for Uber,” said Nelson Chai, CFO.

”Not only did our Mobility business recover to pre-COVID margins this quarter, our core restaurant delivery business was profitable on an Adjusted EBITDA basis for the first time as well, bringing the full Delivery segment close to breakeven.”

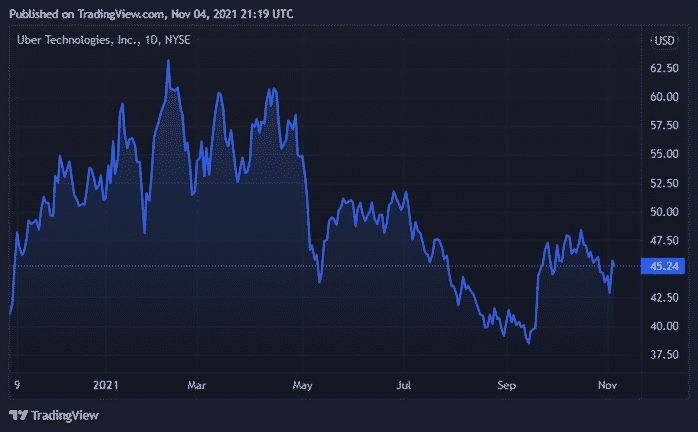

Uber chart (1Y)

Share price of Uber trading 1.75% higher in the after-hour trading after ending the trading day on Thursday at $45.24 per share. The stock is up by 10.44% in the past year.

Uber is the 183rd largest company in the world with a total market cap of $ $87.72 billion.

You can trade Uber Technologies Inc. (UBER) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Uber, Refinitiv, TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Moderna doesn’t get the boost – Q3 earnings fall short

Moderna (MRNA) reported their Q3 financial results before the opening bell on Thursday. The pharmaceutical company posted disappointing results below Wall Street analyst expectations. The company reported total revenue of $4.97 billion vs. $6.21 billion expected. Earnings per share at $7.70 a share vs. $9.05 a share expected. It also downgrad...

November 5, 2021

Read More >

Previous Article

Q3 results give Pfizer a boost

Pfizer posted their third-quarter financial results before the opening bell on Tuesday. The pharmaceutical giant beat Wall Street estimates. Pfizer...

November 3, 2021

Read More >