Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

20 Years Strong

Celebrating 20 years of trading excellence.

Built for traders since 2006.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for high-volume traders and sophisticated investors.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Volatility headlines can encourage rushed decisions and for leveraged products like CFDs, acting without a plan can increase the risk of losses. During times like this, a pattern does emerge.

News shock → Emotional reaction → Impulsive trade → Higher risk of avoidable losses

This isn’t about being “wrong” so much as it’s about skipping the emotional reaction between headline and trade idea.

Translation: The headline isn’t your signal. Your process is.

Middle East flare-ups, sanctions, shipping disruptions, regional security shocks? This is your general checklist for assessing how geopolitical developments may affect markets.

Note: This article provides general information only and is not financial advice. It does not take into account your objectives, financial situation or needs. CFDs are complex, leveraged products and carry a high risk of loss. Consider whether trading CFDs is appropriate for you and refer to the relevant disclosure documents before trading.

Step 1. Identify the driver

Here’s the trap: “Iran” is not the driver. “Conflict” is not the driver. Those are categories useful for cable news but too broad for a risk-defined CFD trade. What moves markets is the mechanism that got worse today than it was yesterday. Separate the headline from the specific mechanism.

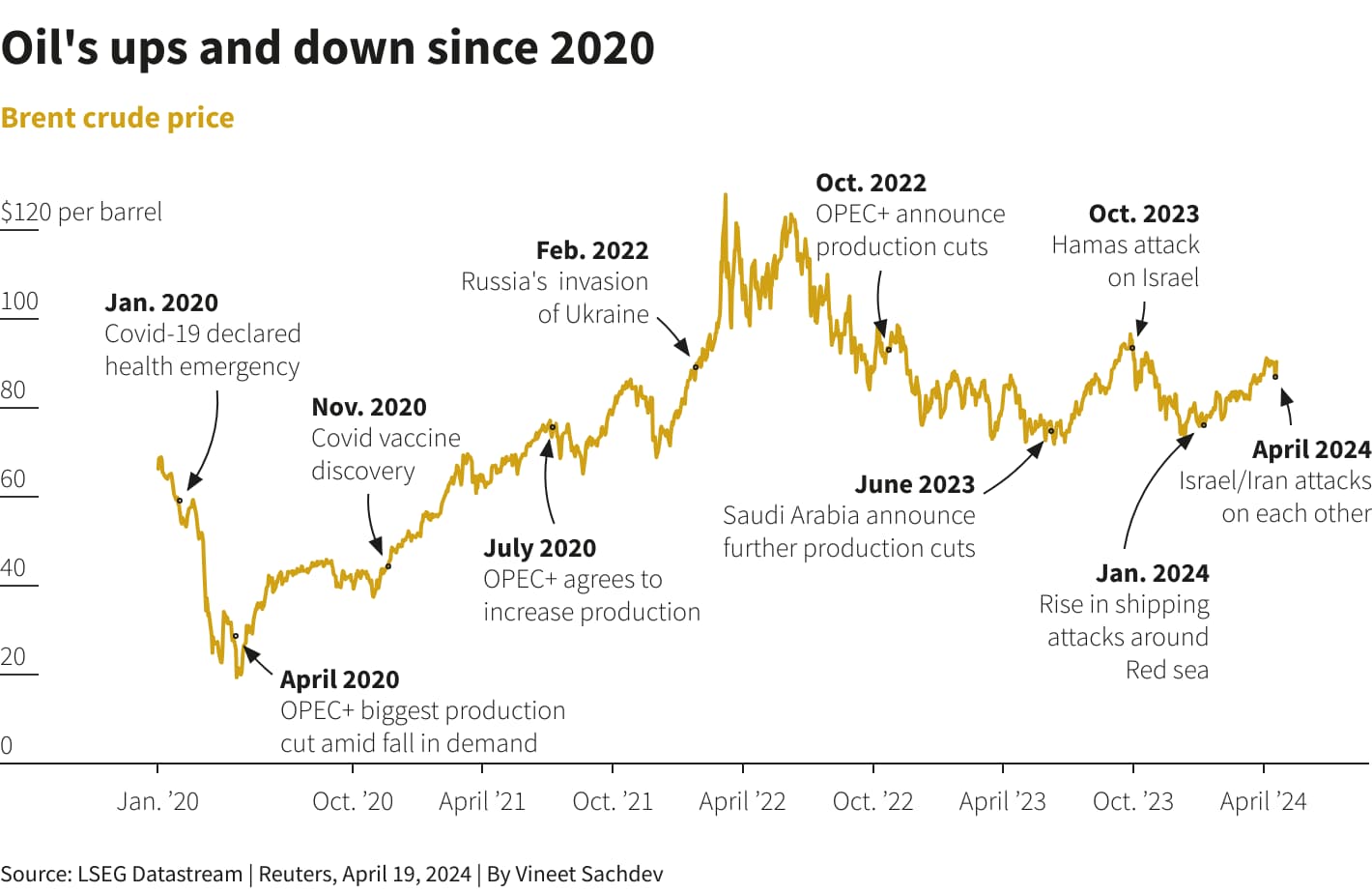

Driver A: Energy risk

This is the Strait of Hormuz, shipping lanes, insurance and rerouting story. In Iran flare-ups, markets care because the threat isn’t just “war,” it’s friction in oil logistics including tankers avoiding routes, insurance premiums surging and temporarily suspended transits. When Hormuz risk gets priced, oil prices may react quickly where markets perceive increased shipping or supply risk, which can influence inflation expectations.

Driver B: Supply risk

This is not “ships are nervous.” This is about production outages, infrastructure hits, refinery disruptions and export constraints. This driver tends to matter more when the headline implies physical damage or credible near-term capacity loss.

Driver C: Funding stress

This is the under-discussed engine of ugly CFD outcomes: the “who needs dollars right now?” problem. This is not “risk-off vibes,” this is liquidity tightening, the kind that makes markets move together and can coincide with wider spreads, slippage and faster price moves, which may affect execution.

In an Iran flare-up, funding stress shows up when participants stop debating the headline and start doing the mechanical work of de-risking: broad USD demand, carry trades unwinding and correlated selling across risk assets. And here’s the key filter that stops you from overreacting: the USD tends to strengthen persistently and broadly mainly during severe funding stress, not every routine fear spike.

Driver D: Policy amplification

This is not about tensions rising so much as the rules changing, the kind of change that outlives the headline cycle and forces real repricing because it alters incentives, access, or flows. The Iran conflict headlines won’t stay local if policy escalates them through sanctions (supply, payments, shipping, insurance), changes to retaliation rules, or shifts in central bank reaction functions as oil risk feeds into inflation risk. That can harden rate expectations.

This is where “geopolitics” stops being narrative and becomes policy constraint and policy constraints tend to create follow-through because they change what market participants can do, not just what they think.

Before acting on a headline

If you choose to monitor breaking news, consider pausing before trading and checking whether the development is new, whether there are observable real-world constraints, and how markets are reacting. Don’t ask ‘is this bullish for gold?’. Instead, consider:

- Is this a flow story, a barrel story, a funding story, or a policy story?

- Is it new information or a remix of what markets already knew?

- Is there evidence of real-world constraint (shipping behaviour, insurance, official measures), or just rhetoric?”

Step 2. Identify the key markets

Some traders stick to a small set of markets they know well, especially when headlines hit. Liquidity and spreads can change fast. If you try to watch everything, you may end up trading your own adrenaline rather than the market.

1) Oil (WTI or Brent proxy)

If the driver is energy flow risk or supply risk, oil is usually the first and cleanest repricing channel—risk premium, inflation impulse, and global growth expectations all run through here.

2) USD conditions (DXY proxy or your most tradable USD pairs)

Not because the USD is always “safe haven,” but because it’s the funding layer under everything. In true stress, you’ll see broad USD strength; in “headline stress,” you often won’t.

3) Gold

Gold is not “up on fear” by default, its fear filtered through USD and real yields. If USD funding stress ramps up, gold can be pulled in different directions and this is why traders get whipsawed: they trade the story, not the cross-currents.

4) A volatility gauge (execution risk, not ideology)

This can help gauge whether conditions may lead to wider spreads, slippage or faster moves.

5) The instrument you actually trade

For a lot of CFD traders, this is where the Iran shock becomes your problem in the form of local markets and local positioning and USD pairs.

Don’t map by habit, map by driver

- Energy flow risk? Oil first, then risk indices, then FX linked to risk/commodities.

- Funding stress? USD conditions first, then JPY crosses, then equities.

- Policy shock? Watch oil + USD together—policy can tighten both simultaneously.

Translation: For some traders, focus comes from watching fewer markets that are most relevant to the driver they’re assessing.

Step 3. Check the charts that matter

Before considering any trade setup, some traders do a quick ‘triage’ check. The aim isn’t prediction, it’s checking whether fast markets could mean wider spreads, slippage or sharper moves in leveraged products like CFDs.

Chart A: Oil

What you’re checking: Is the market pricing real disruption risk, or just reacting? In Iran-related flare-ups, “Hormuz risk” narratives tend to show up as a risk premium conversation in oil, often faster than it shows up in equities or FX.

Examples of chart features some traders look at include

- Is price breaking and holding above a prior structure level? (Not just spiking).

- Did it gap and then fill? (Often means headline heat > real constraint).

- Is the move continuing during liquid sessions, or only during thin hours? (Thin-hours moves are where CFD spreads can punish you the most).

Translation: Oil indicates whether the Iran story may become an inflation/flow story or just a screen-flash.

Chart B: USD

What you’re checking: Is this turning into a funding event? The USD doesn’t “safe-haven” on schedule. In some episodes of severe global funding stress, the USD has strengthened broadly and persistently, although this isn’t consistent across all headline-driven spikes.

Practical CFD filters:

- Broad USD strength across multiple pairs (not just one cross doing something weird).

- Commodity FX vs USD (AUD, CAD proxies) behaving like risk is truly tightening.

- JPY crosses as a stress indicator (carry unwind tells the truth quickly).

If USD is not confirming, that’s information. It often means: headline risk is loud, but global liquidity isn’t actually panicking.

Translation: USD indicates whether the Iran headline is “market stress”… or “market noise with wider spreads and higher execution risk.”

Chart C: Volatility

What you’re checking: How dangerous normal sizing has become.

Use a sizing governor that forces honesty:

- Normal ranges → normal size

- ~1.5× typical range expansion → consider half size

- ~2× range expansion → quarter size or stand aside

Some traders reduce position size or choose not to trade when ranges expand materially versus usual conditions. Any sizing approach depends on individual circumstances and risk tolerance.

Because in CFDs, volatility doesn’t just change directionality, it changes execution quality, stop distance, and how fast a loss becomes a margin problem.

Translation: Volatility is your permission slip or your stop sign.

Step 4. Choose a setup type

Geopolitics creates volatility but it doesm't guarantee trend.

Pick structure, not opinion

- Breakout: after the market forms a post-headline range.

- Pullback: once trend is established and liquidity steadies.

- Mean reversion: only if the spike stalls and structure confirms.

Common mistake: picking direction first, then hunting confirmation.

Translation: The setup is the response to price behaviour, not your worldview.

Step 5. Define risk

From a general risk-management perspective, traders often define that a trade idea is not complete until it has

- Entry condition: what must happen for you to participate

- Invalidation: where you are wrong

- Position size: based on dollars-at-risk, not conviction

- Session max loss: daily or weekly cap (protects you from spiral trading)

For CFDs specifically, regulators emphasise how leverage can accelerate losses, and why protections such as margin close-out arrangements, leverage limits and negative balance protection (where applicable) exist.

Markets enter this week facing a dense US data run alongside an early-month APAC growth check. With US equities still relatively elevated and gold holding above US$5,000 as of February 27, near-term price action may be particularly sensitive to any data-driven shift in rates, USD direction, and risk sentiment.

- US data cluster: ISM Manufacturing, ISM Services and ADP, non-farm payrolls (NFP), and retail sales are all expected this week.

- APAC growth pulse: China official PMI and Japan PMI, Australia GDP, and China Caixin PMI provide a regional activity read.

- Equities: Despite a pause at the end of the week, major US indices remain relatively elevated overall, potentially increasing sensitivity to negative surprises.

- Gold: Has moved back above US$5,000, keeping real yields and risk sentiment in focus.

- Geopolitics: Middle East geopolitics remain a background volatility risk.

United States: growth and payrolls

The US week is shaped by a tight sequence of activity, employment and consumer signals that can quickly shift near-term rate expectations.

Markets typically take their first cue from manufacturing sentiment, then look to services and private payrolls for a broader read on demand and hiring momentum.

The focal point is the labour report, with retail sales adding a consumer cross-check in the same window.

This combination could be relevant for Treasury yields, USD pricing and equity sentiment, especially with indices still sitting at relatively elevated levels.

Key dates

- US ISM Manufacturing PMI: 2:00 am, 3 March (AEDT)

- US ISM Services PMI: 2:00 am, 5 March (AEDT)

- US ADP employment: 12:15 am, 5 March (AEDT)

- US Employment Situation (NFP): 12:30 am, 7 March (AEDT)

- US Advance Monthly Retail Sales (Retail Trade): 12:30 am, 7 March (AEDT)

Monitor

- Treasury yield reactions to ISM and payroll surprises.

- USD sensitivity to rate repricing.

- Equity index performance, particularly within large-cap technology.

- Changes in trade policy, with tariff uncertainty potentially influential.

APAC: early growth signals

The early-month APAC calendar provides a fast read on whether regional activity is stabilising or softening.

China’s PMIs (official and Caixin) offer complementary perspectives across state-linked and private-sector firms, while Japan’s PMI can feed directly into JPY sentiment through growth expectations.

Australia’s GDP adds a broader macro check that can influence local yield pricing and AUD direction. Taken together, this cluster sets the tone for regional risk appetite and could spill over into commodities and base metals.

Key dates

- Japan PMI: 11:30 am, 2 March (AEDT)

- Australia GDP: 11:30 am, 4 March (AEDT)

- China official PMI: 12:30 pm, 4 March (AEDT)

- China Caixin PMI: 12:45 pm, 4 March (AEDT)

Monitor

- AUD and local yield sensitivity around GDP.

- JPY response to PMI data.

- Regional equity and commodity reactions to Chinese activity trends.

Gold and cross-asset sensitivity

With gold holding above the US$5,000 level, it could be highly reactive to shifts in real yields, USD direction and broader risk appetite.

Macro surprises that move front-end rates can quickly translate into gold volatility, while geopolitical developments that influence oil and inflation expectations could also amplify moves.

In practice, gold may act as a real-time barometer of how markets are digesting growth, inflation and policy uncertainty through the week.

Monitor

- US real-yield movements.

- USD direction.

- Equity volatility and safe-haven flows.

Welcome to 2026. Inflation is still sticky, real yields still matter, and markets can reprice fast when policy, geopolitics, and risk sentiment shift.

With the next RBA decision approaching, the ASX can feel less like a local story and more like a window into the broader macro regime.

- The next rate decision is about balancing inflation control, growth risks, and how the Australian dollar (AUD) responds to yield differentials and risk sentiment.

- Lenders can act as real-time signals for household and small and medium enterprise (SME) credit conditions as funding costs and competition shift.

- Names like MQG and GMG can be highly sensitive to global liquidity, risk appetite, and changes in discount rates. That can amplify moves when conditions change.

1. Commonwealth Bank (ASX: CBA)

CBA is often viewed as a bellwether for domestic mortgage and funding conditions. It can react to funding costs and any early hints of arrears pressure, rather than just the “rates up/rates down” trigger.

Traders track the yield curve and bank funding spreads as it’s often the first tell when the story flips from net interest margin (NIM) to credit (bad debts).

In a higher-for-longer setup, banks may rally first on “better margins” until the market starts pricing credit risk instead.

In the past, CBA hit record highs in early 2026, up roughly 11% year to date (YTD), before a mid-February pullback amid broader market volatility.

What traders watch

- Broker handling: Every broker call listed is on the bearish side: 4 Sells, 1 Underperform, and 1 Underweight.

- Targets and implied move: Target prices range from A$120 to A$140. Using the “% to reach target” column, that implies a last close of about A$178.68, which equates to roughly 22% to 33% downside versus the targets shown (targets are estimates, often set on a 12-month basis, and are not guarantees).

- Broker tone: Citi stays Sell (“in-line quarter/limited revisions”), while Morgan Stanley argues the hurdle is higher after the stock’s outperformance, as “good” may no longer be good enough.

Risks: 2:30 pm (AEDT) event gaps, sharp reversals, and quick sell-offs when too many traders are on the same side.

2. National Australia Bank (ASX: NAB)

NAB is where you look when you’re trying to figure out whether the engine room of the economy is purring or quietly overheating.

When policy stays tight, lenders can look fine right up until they don’t. Margins can defend, deposit competition can bite, and the comfort line, “defaults are contained”, gets stress-tested by reality.

NAB tends to trade more like an invoice: what businesses are paying, what they are delaying, and how fast conditions change when confidence turns.

What traders watch

NAB is up about +15.46% YTD, with the stock recently around A$49. In the latest print, traders are watching how NAB’s A$2.02 billion Q1 cash profit shows resilience even as expense inflation starts to creep in.

- Broker handling: Mixed but skewed cautious. 3 Sells (Morgans, Citi, Ord Minnett), 1 Equal-weight (Morgan Stanley), 1 Outperform (Macquarie), 1 Buy (UBS).

- Targets and implied move: Targets run from A$35.00 to A$50.50, and the implied last price is about A$49.10, so most targets sit below the market, with UBS as the modest upside call.

- Broker tone: UBS is the lone Buy with a A$50.50 target (about +2.85%). Macquarie is Outperform, but its A$47.00 target is still below the implied last. Citi, Morgans and Ord Minnett stay Sell, with targets clustered A$35.00 to A$39.25. Morgan Stanley sits Equal-weight at A$43.50.

Risks: margin squeeze from deposit competition, a turn in business credit quality, and fast repricing if “contained defaults” stops being credible.

3. Macquarie Group (ASX: MQG)

Macquarie is what you get when you blend markets, asset management, deal-making, and a global appetite for volatility... and then you hand it a very expensive suit.

Macquarie doesn’t just listen to the RBA; it listens to the entire room. Global rates, risk appetite, and market plumbing often matter as much as anything said in Martin Place.

What traders watch

While Macquarie is about +1.93% since Jan 1, traders are watching global yields, volatility regime shifts, plus any read-through to deal flow and trading conditions.

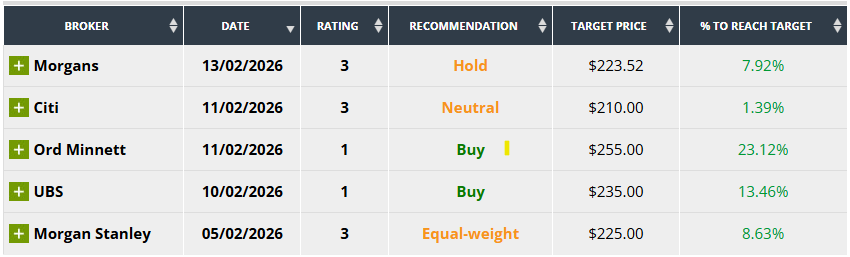

- Broker handling: The table shows a mostly supportive mix, with no outright sells.

- Targets and implied move: The implied last price is about A$207.12. The average target across the brokers shown is about A$229.70 (around +10.9%), with targets ranging A$210.00 to A$255.00.

- Broker tone: Ord Minnett and UBS sit at Buy, Citi is Neutral, Morgans is Hold, and Morgan Stanley is Equal-weight. Supportive, but not unanimous.

Risks: liquidity shocks, volatility “air pockets,” and a fast downgrade cycle if global conditions sour.

4. QBE Insurance Group (ASX: QBE)

Insurers can look unusually “clean” in higher-rate regimes because their float finally earns something again. When yields rise, investment income can start doing real work and can offset a lot… until the world reminds everyone why insurance exists in the first place.

QBE is a tug-of-war between higher rates helping the portfolio and catastrophe risk plus claims inflation trying to take it back with interest.

What traders watch

QBE is about +10.06% since Jan 1, and in the latest print, traders are watching investment yield trends, catastrophe loss headlines, and any sign that the pricing cycle is cooling.

- Broker handling: The broker calls shown lean positive: Outperform (Macquarie), Buy (Citi, UBS), Overweight (Morgan Stanley), plus two upgrades to Buy from Hold (Ord Minnett, Bell Potter).

- Targets and implied move: The table implies a last price around A$21.89. Targets range from A$21.80 to A$26.00. The average target across the brokers shown is about A$24.06 (around +9.9%).

- Broker tone: Ord Minnett has the highest target at A$26.00 (about +18.78%). Bell Potter is also shown as an upgrade to Buy, but with a target fractionally below the implied last (-0.41%).

Risks: major catastrophe events, claims inflation and the market pricing “peak rates” too early.

5. Goodman Group (ASX: GMG)

Goodman Group is where the rate story meets the valuation story. When yields rise, long-duration equities get repriced as the discount rate stops being theoretical.

GMG can still execute operationally, but the stock often trades like a referendum on the cost of capital, cap rates, and whether the market thinks the future is getting cheaper or more expensive.

What traders watch

GMG is about +2.86% YTD with traders watching 10-year yields, cap rate chatter, funding conditions, and data-centre narrative momentum.

- Broker handling: The broker calls shown skew positive, with no sells. 3 Buys (Bell Potter, Citi, UBS), plus Accumulate (Morgans), Outperform (Macquarie), Overweight (Morgan Stanley), and 1 Hold (Ord Minnett).

- Targets and implied move: Targets range from A$31.25 to A$41.50. The implied last close is about A$28.42, and the simple average target in the table is about A$36.35 (around +27.9% above the implied last close).

- Broker tone: Morgan Stanley is the most bullish on target price at A$41.50 (+46.02%). Citi is also constructive at Buy with A$40.00 (+40.75%). Ord Minnett is the cautious outlier at Hold with A$31.25 (+9.96%).

Risks: valuation compression if yields rise, refinancing narratives, and cap rate repricing.

6. JB Hi-Fi (ASX: JBH)

JB Hi-Fi tends to move with the mood of the household budget. When the consumer is steady, and promotions stay manageable, the story can look simple.

When spending tightens and discounting ramps up, the market quickly shifts to margin risk and guidance risk.

What traders watch

As JB Hi-Fi is about -12.64% since Jan 1, traders are keenly watching sales momentum vs consumer confidence, promo intensity, and margin resilience.

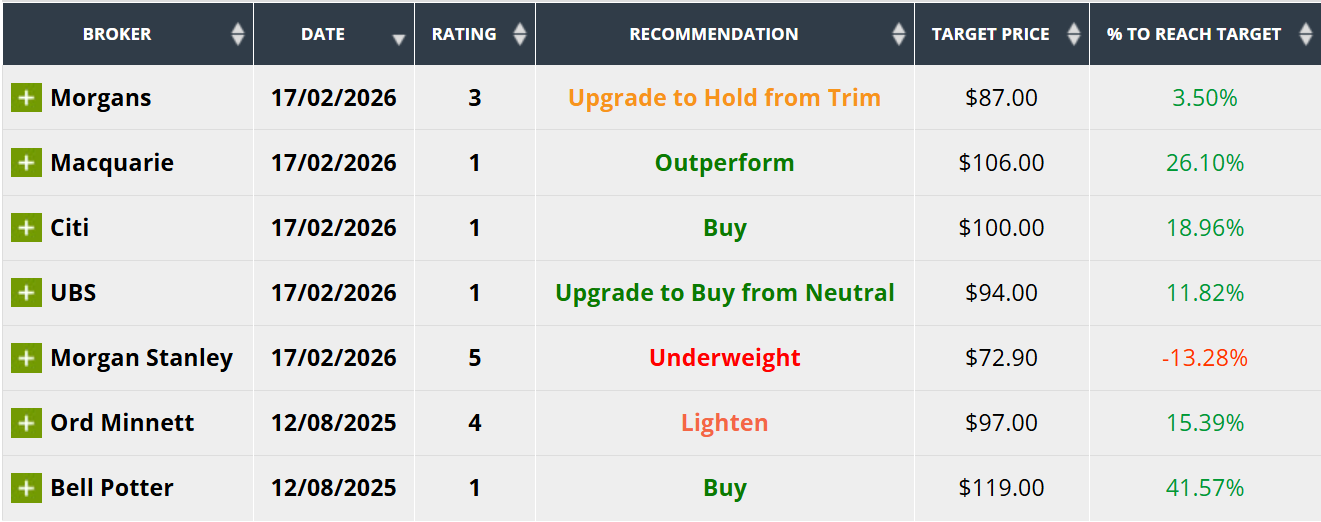

- Broker handling: The mix is constructive overall, but not unanimous. The table shows 2 Buys (Citi, Bell Potter) plus 1 Upgrade to Buy from Neutral (UBS), 1 Outperform (Macquarie), 1 Upgrade to Hold from Trim (Morgans), and two more cautious calls, Underweight (Morgan Stanley) and Lighten (Ord Minnett).

- Targets and implied move: Targets range from A$72.90 to A$119, with the implied last close about A$84.06. The simple average target in the table is about A$96.56 (around +14.9% above the implied last close).

- Broker tone: Bell Potter is the most bullish on target price at A$119.00 (+41.57%). Macquarie is also positive at Outperform with A$106.00 (+26.10%). On the cautious side, Morgan Stanley is Underweight with A$72.90 (-13.28%). The latest change notes in the table show UBS upgraded to Buy from Neutral and Morgans upgraded to Hold from Trim (both dated 17/02/2026).

Risks: unemployment surprises, margin damage from discounting, and fast sentiment reversals around consumer data.

7. Judo Capital (ASX: JDO)

Judo Capital is the cleanest expression of “small and medium enterprise (SME) credit plus funding competition” you can put on a screen.

It is a focused lender, a floating-rate loan book, and growth that looks heroic right up until funding costs and defaults decide to start a conversation at the same time.

In an RBA-sensitive tape, Judo can move like a thesis you cannot pause. Spreads, deposits, credit quality, and sentiment all reprice in real time.

What traders watch

Judo is down about -0.58% since Jan 1, meaning traders are watching net interest margin (NIM) versus deposit competition, SME arrears and default signals, and any shift in funding pressure.

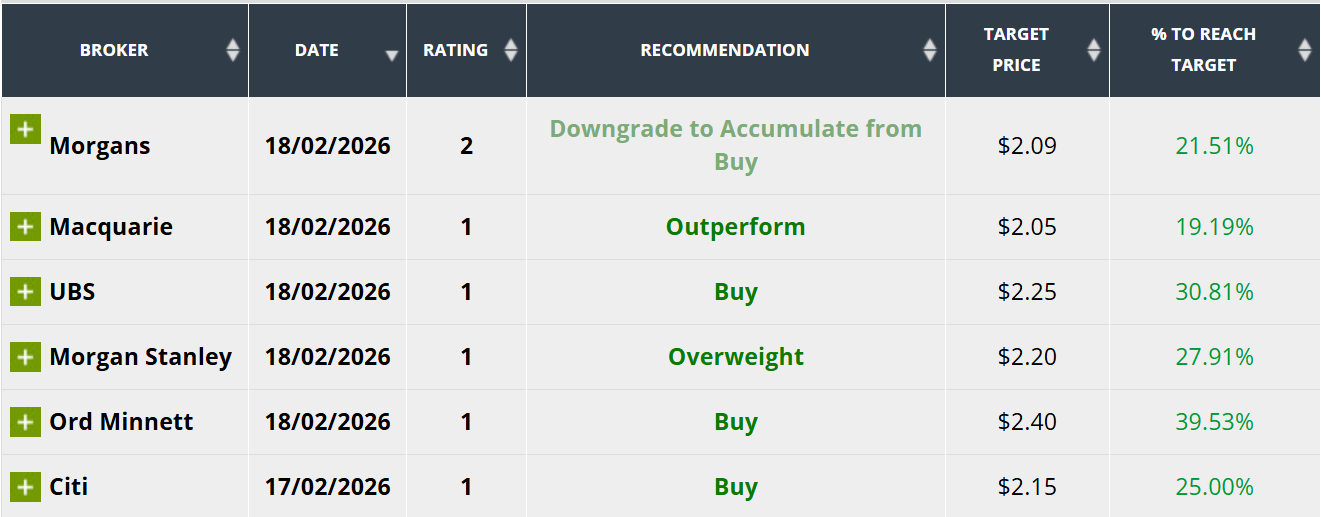

- Broker handling: The calls shown are all positive. Morgans is Accumulate (noted as a downgrade from Buy). Macquarie is Outperform. Morgan Stanley is Overweight. UBS, Ord Minnett, and Citi are all Buy.

- Targets and implied move: Targets range from A$2.05 to A$2.40, the implied last close is about A$1.72. The simple average target in the table is about A$2.19 (around +27% above the implied last close).

- Broker tone: Ord Minnett is the most bullish on target price at A$2.40 (+39.53%). UBS is Buy at A$2.25 (+30.81%). Morgan Stanley is Overweight at A$2.20 (+27.91%). Citi is Buy at A$2.15 (+25.00%). Morgans sits at A$2.09 (+21.51%) after the downgrade to Accumulate. Macquarie is Outperform at A$2.05 (+19.19%).

Risks: SME credit turns quickly in a slowdown, and funding competition can squeeze spreads faster than loan yields reprice.