- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- How do I become a Money Manager?

-

After opening a trading account, log into the Client Portal and access PAMM from the menu. From here you will be able to register as a Money Manager.

- What platforms can I choose from?

-

PAMM is available on the MT4 and MT5 platforms. Money Managers can select their preferred platform when creating an account.

- What base currencies can I choose from?

-

PAMM is available in USD and EUR.

- How many accounts can I manage?

-

As a Money Manager, you can manage an unlimited number of accounts on one trading platform.

- How do PAMM rollovers work?

-

PAMM rollovers run periodically according to a schedule configured by GO Markets. Possible intervals are:

- Manual - only manual rollovers

- Every 5, 15, 30 minutes

- Every 1, 2, 4, 6, 8, 12 hours

- Daily

Each rollover consists of:

- Trade results distribution

- Execution of confirmed deposit, withdrawal, close account requests

- Trading account balance synchronisation (happens in case any errors occur)

- Terms and conditions

-

Read the full terms and conditions

PAMM: Invest Smarter, Trade Better

Leverage the expertise of seasoned Money Managers. PAMM allows you to invest your funds with experienced traders who manage your capital alongside their own, aiming to maximise returns while you maintain control over your investments.

What is PAMM and how does it work?

PAMM, or Percentage Allocation Management Module, is an investment service that allows investors to allocate their funds to a professional money manager, who trades on their behalf. The profits and losses from the trades are distributed among the investors based on their share in the managed account. Investors can choose a money manager based on their trading performance, and the manager earns a fee for their services. This system allows investors to benefit from professional trading without directly managing their own accounts.

Money Managers

Money Managers control multiple accounts using their master account. They trade with their own capital as well as the funds pooled from other investors to maximise opportunities.

Investors

Investors allocate a portion of their capital to the Money Manager's PAMM account, and each investor’s account is linked to the master account.

Funds Distribution

Any profits or losses generated by the Money Manager are distributed among the investors in proportion to their contributions.Ready to trade?

Simply open a trading account and select PAMM after logging into your Client Portal. Feel free to get in touch with our support team if you have any questions.

Open PAMM accountBenefits of PAMM

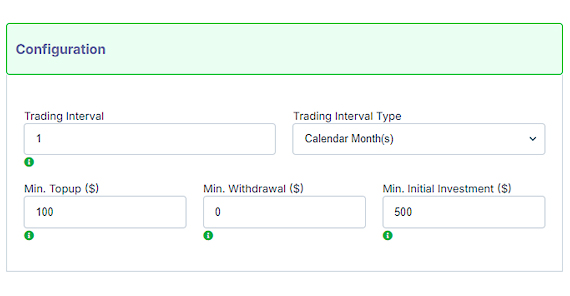

Custom Offers

Money Managers can create offers for Investors, with configurable options such as trading intervals, minimum investment, performance/management fees and commission.

Experienced Traders

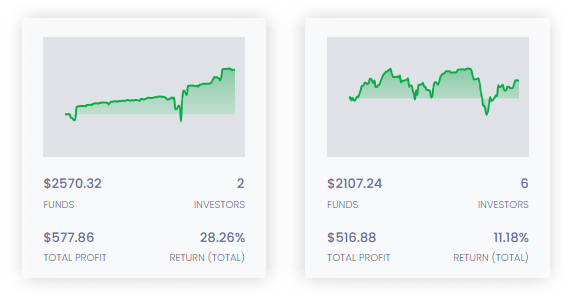

Select from a wide range of experienced traders to follow, see their total profit and returns as PAMM Money Managers, and compare offers before making your choice. Investors can also view more detailed information and previous history for each Money Manager.

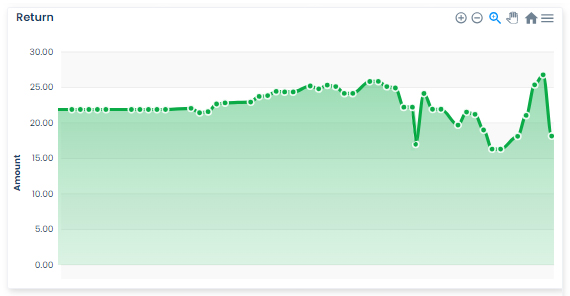

Detailed Statistics

Investors and Money Managers can access a wealth of comprehensive metrics providing insights into performance, risk management, and trading strategies.

Selecting the Right PAMM Money Manager

Choosing a PAMM Money Manager requires careful consideration of their track record, risk management approach, and trading strategy. That’s why we provide transparent, up-to-date performance data for each Money Manager, allowing you to assess critical factors like historical returns, drawdowns, and consistency. With this information, you can select a Money Manager within the GO Markets community who matches your investment objectives and risk appetite. Track the live performance of our leading Money Managers* and see how they’re managing client capital in real time. *PAMM performance data is updated continuously and may fluctuate with market conditions.

Ranking Name Total profit Total return Try PAMM today

If you're a skilled trader who can generate sustainable and consistent profits, we encourage you to become one of our registered Money Managers.

For those looking to walk in the shoes of experienced traders, simply open an account and select a Money Manager to follow as an Investor.Money Manager

Trade with pooled capital

Enhance returns

Earn performance fees

Register for PAMM and become a Money Manager today:

Open accountInvestor

Benefit from expert trading strategies

No need to manage your own trades

Great for beginners

Become an Investor and follow a Money Manager:

Open accountFAQs

Please share your location to continue.

Check our help guide for more info.