- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- Frequently Asked Questions

- How can I open a live trading account?

-

Please use the following link to begin your live trading account application – Open live account

- How long does it take to open a live trading account with you?

-

Most applications are processed automatically. For those with more complex setups, we aim to reach out within 24 hours.

- What is the main difference between Standard and GO Plus+ trading accounts?

-

You will enjoy tighter spreads on Forex products with a GO Plus+ account. However, there will be a commission for every Forex trade you place on a GO Plus+ account.

See here for a full comparison of the differences between trading account types. - What account base currency can I hold my trading funds in?

-

You can hold your funds in one of the following base currencies: AUD, USD, GBP, EUR, NZD, SGD, CHF, CAD, and HKD.

- How do I deposit funds into my trading account?

-

Please refer to our Funding and Withdrawals page for the list of acceptable deposit methods.

- How do I withdraw funds from my account?

-

Please login to your GO Markets Client Portal and follow the withdrawal procedures.

- How quickly do you process my withdrawal and how soon will I receive my funds?

-

We aim to process all withdrawal requests received before our cut-off time of 1pm AEST on the same day. Those withdrawals received after 1pm AEST will be processed the following day. While it largely depends on the recipient’s bank, local transfers may take 1-2 business days, and international transfers may take 3-5 days for your funds to be cleared.

- What is the starting deposit required to open a live trading account?

-

We don't have a minimum deposit requirement to open a live trading account. However, we recommend an initial deposit of $200 to ensure you have sufficient margin to start trading effectively.

- Do you charge any deposit or withdrawal fees?

-

GO Markets does not charge any internal deposit fees using Visa/Mastercard, PayPal, Skrill, Neteller and bank transfer.

GO Markets does not charge any internal fees for withdrawals, however, fund withdrawals to non-Australian banking institutions may be subject to bank fees from any intermediary bank involved in the transaction and may attract a receiving fee from your bank/institution. Please account for these fees when making withdrawals of a small amount. - How do I update my account details?

-

You can update your details via your Client Portal.

Alternatively, please email [email protected] or contact us via chat and we will update your account information for you.

Please note that if you are updating your address details, we require a recent bank statement or utility bill issued within 3 months and which shows your new address. - How do I change my password?

-

You can change your password on GO Markets’ Client Portal. Alternatively, you can change the password directly from your MetaTrader 4/5 trading platform. Click on Tools > Options and look for the Server tab. Click on the Change button to change your master or investor passwords. Please do not share your password with anyone.

- I have lost my password, can you reset it for me?

-

You can perform a password reset directly from the login page of the Client Portal. Alternatively, you can call GO Markets on 1800 88 55 71 (AU).

For security purposes, you will be required to provide some personal details to help verify your account. - Are you a regulated broker?

-

Yes, GO Markets is licensed and regulated by the Australian Securities and Investment Commission (ASIC), Australian Financial Services Licence (AFSL) 254963.

- Do you accept US clients?

-

We cannot accept US clients as CFTC regulation prevents US traders trading with non US brokers.

- Can I use your platform on my smart phones or tablets?

-

Yes. There is a MetaTrader 4/5 app for Google Android and Apple IOS. You can search for Metatrader 4/5 on either Google Play or Apple App Store. See here for more information on mobile trading platforms.

- Why do I receive a notification on the client portal with "Are your details up to date?

-

Legislation requires that we hold your current personal information. Please check your details and make any changes needed. If all the information is accurate, simply click on the submit button to proceed.

- I am a High Net Worth Investor; do I need to renew my eligibility as a wholesale client?

-

Yes. If you are a High Net Worth Investor, you will need to renew your Accountant certificate every 2 years from the date of issue.

- I hold a Corporate Account; do I need to renew my LEI?

-

Yes. A Legal Entity Identifier (LEI) is required for entities engaging in financial transactions. Entities such as corporate accounts, investment/trust funds, are among those who need to renew their LEI. Regulatory authorities often mandate its use for reporting purposes, so any entity subject to such regulations will need to ensure they renew their LEI.

- What is margin?

-

Margin in CFD trading refers to the amount of money required to open and maintain a leveraged position.

- How do I calculate my FX margin requirement?

-

To calculate the FX margin requirement, you will require the following formula:

(Market quote * Volume) / Leverage = Margin Requirement

Example

The current EURUSD price is quoted as 1.13729, and we would like to trade one standard lot (100,000) using our account leverage of 1:30

The calculation would be (1.13729 * 100,000) / 30 = $3,790.96 USD

Note: If your trading account’s base currency is not in USD, the margin will be converted back into your base currency. - What is a margin call?

-

Since margin is essentially the collateral required in order to open a trade, if the market moves against a client’s position and your overall account equity is reduced, then you may not have sufficient funds available to maintain this position.

If your Equity (Balance - running Profit/Loss) falls below 50% of the margin required to maintain an open position, then the system will begin automatically closing the largest losing position in an attempt to increase your equity. - What are your margin call and stop out levels?

-

Our margin call and stop out levels are 80% and 50%, respectively.

- What is leverage?

-

Your account leverage is multiplier used to calculate the size of trades you can open on forex and XAUUSD symbols. The higher the leverage value the lower amount of margin required for your trades.

Example

If you have leverage of 30:1, you can control a large position of $300,000 on EURUSD with a margin of $10,000. - How can I change my leverage?

-

Retail clients can trade with up to 30:1 leverage on Forex and XAUUSD.

Wholesale clients can trade with up to 500:1 leverage. Please consider which leverage rate is appropriate for you. It is important to understand the concept of leverage and how it may impact your trading. Some less popular currencies can attract a higher margin rate irrespective of your account leverage. To change to your leverage please login to our Client Portal and select Change of Leverage on the desired account. - What is the maximum leverage I can have?

-

The maximum leverage for retails clients is 30:1. If you upgrade to a wholesale account you can access 500:1 leverage.

- Where are the swap rates located?

-

You can view the current swap rates directly on the platform under the product specifications.

- Why are FX swaps tripled on a Wednesday?

-

If you hold a position overnight on a Wednesday, the swap is multiplied by three (3) times. This accounts for the settlement of your open position(s) for the proceeding weekend. This is because it takes two days for forex transactions to settle in the underlying market.

- What time does the rollover occur?

-

Overnight financing costs are applied during the New York close which equates to 00:00 platform time.

- Why is my order close price different to the take profit or stop loss I set?

-

Take profit and stop losses are classed as pending orders. Unfortunately, it may not always be possible to fill these orders at the desired levels due to price volatility or unforeseen market events. Once triggered, pending orders then become market orders and are subjected to whatever market liquidity is available at that time.

- Where do you get all your prices from?

-

Our pricing is derived from top tier liquidity providers who stream prices to our platform.

- How do the charts on MT4/5 work?

-

MT4/5 always use bid price to construct the chart in all available periods.

- What is the chart time you set on your platform, and can I change it?

-

The time on our platforms is shown as Eastern European Time (EET).

During Daylight-Saving Time, EET is 3 hours ahead of Greenwich Mean Time (GMT +3).

During Standard (Winter) Time, EET is 2 hours ahead of GMT (GMT +2). It cannot be changed on your platform. - I had a short position and the chart price appeared to reach my Take Profit, but it did not trigger. Why?

-

The charts will display the BID price by default which is the (SELL) price. When you enter a short position, you open at the bid price and to close this trade you need to close at the ask price. The ASK/BUY price is not reflected on the historical charts.

- Can I trade using EAs (Expert Advisors) or trading robots with the platform?

-

Yes. You can use EAs (Expert Advisors) available from third party providers. As GO Markets is not associated with any of these providers, we cannot provide additional support for these automated strategies and suggest you contact the source directly should you experience any difficulties related to settings or methodology.

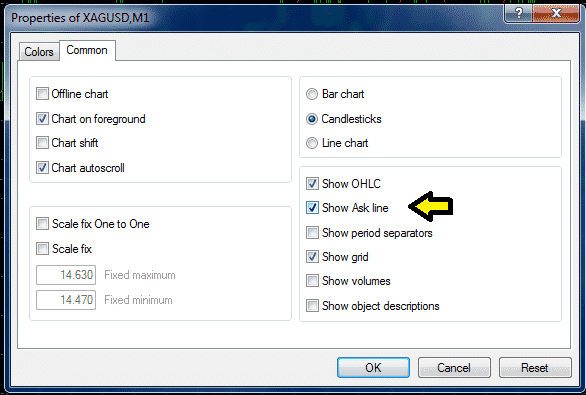

- How can I include the ASK line to view the spread on the chart?

-

The BID price is shown on the chart by default, to include an ASK line to display the current spread, please use the following steps:

Step One

Press F8 on the keyboard, select the “Common” tab and make sure the “Show Ask line” box is checked.

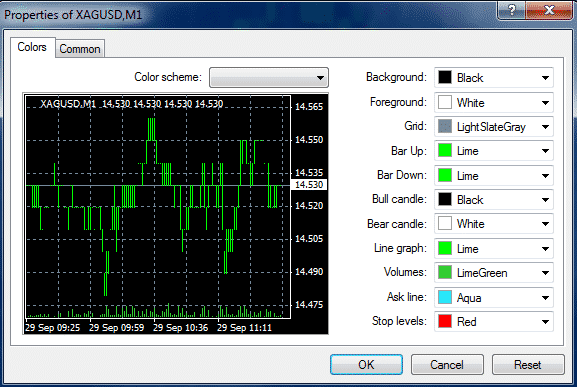

Step Two

Select the “Colours” tab and make sure the ASK line colour is something bright such as Aqua in the example below.

Step Three You should then see something like this with both the BID and ASK price displayed in the example below.

- What currency pairs and instruments do you offer?

-

We have over 1000 markets to trade ranging from forex, metals, indices, shares, cryptocurrencies and bonds across a variety of platforms. We are expanding the list as markets evolve.

- Can I trade micro lots?

-

Yes, you can trade 0.01 lots on forex which is a micro lot.

- Do you prohibit any trading styles and how long do I at least have to hold a trade for?

-

No, we do not prohibit any trading styles and you can open and close your positions as often as you like so as long as it is in line with our T&C’s.

- Do you offer guaranteed stop loss?

-

No, we do not.

- I am neither buying the physical share on a US exchange, nor am I a US resident. Why are you withholding tax?

-

The US internal Revenue Service (IRS) mandate that holders of US equity derivates (which include US CFD shares) are taxed in accordance with Section 871(m) of the US Tax Code.

- What is the rate in which tax is withheld?

-

The rate varies and depends on the country in which you reside. If you reside in a country that is subject to a tax treaty with the US, a rate of 15% is withheld. Non-tax treaty countries are subject to the highest rate of 30%.

- How do I get access to Australian and Hong Kong CFD Shares?

-

You can add the Australian and Hong Kong CFDs to your MT5 platform via the Client Portal.

- I am getting 'OLD Version Error Code' on your MT4 Platform; what do I do?

-

If you are seeing this error message on your MT4 platform (bottom right-hand corner), you can download a new platform directly from our website. If you require further assistance, please contact our support team.

- Why can’t I login to my demo account?

-

Our demo accounts last for 30 days. You will not be able to access it once it expires. If you need to extend your trial before opening a live account with us, you can always register for another demo account.

- Why do I see “No connection” or “Invalid Account” on my MT4 status bar?

-

Most of the time, it simply means the platform is not able to log you in or is not connected to the trading server.

To reconnect, you can click on File > Login to Trade Account and follow the prompts to log in. If you need to reset your password, you can do this via the Client Portal. - I do not see some of the symbols, what do I do?

-

If you do not see the full list of symbols on Market Watch, right click on one of the symbols, and click Show All.

- Can I use your MT4 platform on my Mac computer?

-

Yes. We packaged a Mac version MT4 with WINE for our traders to use.

- Why have I not received my trading statements?

-

A daily statement is only sent out if you have some trading activity on the previous day or are holding any open positions. You may also want to check your spam folder as sometimes they may be miscategorised by your email service provider. You can also consider adding our email address to your email whitelist.

- How do I generate account statements?

-

On your trading platform, you can head to your account history tab, right click on the display area or one of the closed trades, select the period you want. Once the records show, right click again and select ‘Save as Report'.

- Can I login to the same account from multiple devices at the same time?

-

Yes, our platforms support multiple simultaneous logins to the same account. So, you can leave your desktop logged on and sign in using your mobile phone while you are away.

- How do I install multiple instances of MT4/MT5 for my trading accounts?

-

When you are running the installer, there is a settings button on the same page of the licence agreement. Click on the button and rename the destination folder and continue. It will then install another copy of MT4 on your computer.

- How do I install my custom indicators and expert advisors on MT4/MT5?

-

Click on File > Open Data Folder and open MQL4/MQL5 folder. There are Experts and Indicators folders within it, and you will need to copy the mq4 or ex4 files into their respective folder. Most custom indicators and expert advisors will have their own installation manual.

- Can I alter the time on my MT4/5 charts to reflect local time?

-

No. The trading platform time is set by default and cannot be changed. It may be possible to obtain local time indicators directly from the Meta-Quotes community.

- How do I update my platform?

-

The update is done automatically whenever there is a new build released by Metaquotes. All you need to do is allow the program to make changes to your computer when it starts up. You may also try running it as administrator to grant the program sufficient access level to perform any update.

- Where are your trading servers located?

-

Our trading servers are located in New York.

- What do I do If I need to close my trades but cannot log in?

-

Should you experience any problems with closing your positions either by not being able to log in or technical issues, contact our support team at your earliest convenience who can close your positions for you. You can contact support 24/7 via mailto:[email protected] or reach out via Live Chat.

Frequently Asked Questions

Forex Trading FAQs

Knowing where to find the information you need and having the confidence that you can find the answers to your trading questions could be very helpful with your day-to-day trading. Use these comprehensive Forex Trading FAQs to learn all the basics as well as the more advanced topics in forex trading. We’ve covered the lot from how to open a forex trading account to how to use the MetaTrader trading platform, Forex trading system and more. Whether you’re new to trading FX or you have several years of experience trading currencies, you will find a lot of useful information in these FAQs.

Below you will find an extensive list of answers to your Forex trading questions.

How Can We Help You?

General Trading TechnicalStart trading with GO Markets

1. Confirm your identity

In just minutes we can verify your identity and create your account.

2. Fund your account and trade

Deposit via debit card or bank transfer, and place your first trade.

3. Ready to start?

Open an account today, or try a free demo.

Please share your location to continue.

Check our help guide for more info.