- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- A frightened Hawk – The RBA needs to come clean

News & AnalysisWe know that this is slightly contrary to the consensus views but we think it needs to be said. The communication from the RBA (Reserve Bank of Australia) is unusually unclear, confusing and conflicted.

The view conveyed in statement, press conference and minutes currently we would argue counter each other. And the reason for this we believe is because the RBA is a reluctant hawk and is frightened to act.

Let us now present why we think this and what it will mean for FX and yields in particular.

The RBA has just completed a mass review of its operations and one of the key changes was to improve transparency. This included press conferences, extended meetings, and more public discussions from members. The catch with this has been the mixed communications.

Take for example the statement which was extremely ambiguous. It was filled with terms like uncertainty, mixed signals, and complexity. It explains why the statement has this line: ‘the path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.’

That’s fair – things are complex and we understand why the board is waiting for more data.

That was countered with this: ‘The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.’ Historically, whenever the Board has included such a resolute statement in its communications, they followed up with a cut or a hike in the preceding meetings – the frightened hawk is there and strongly suggests that a rate hike is likely.

The initial AUD reaction to the statement we think shows why the communication is mixed.

Then take the press conference – Governor Bullock’s were much stronger than the statement, indicating a significant stance, not really clear in the statement.

As mentioned, the Board stated they are not ruling anything in or out, but in reality, they have dismissed the possibility of rate cuts. That was confirmed when Bullock was asked on this exact point and confirmed that rate hikes were the only things discussed. There was no ongoing discussion about cuts in the near or medium term as they do not expect inflation to reach their target by mid-2026.

The Board’s concern is that inflation is notably higher than expected, employment is solid and that overall demand is still generating inflation.

The reaction to all this was clear here:

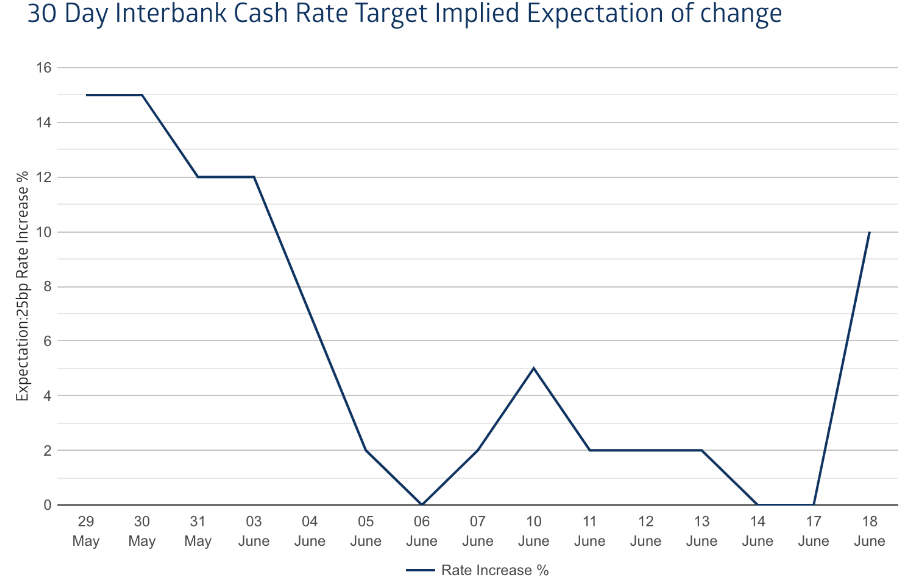

The next notable reaction was the interbank market. All though it doesn’t appear like much in this chart.

Please understand this change is actually from a ‘cut’ to ‘hike’ so yes there is a 10% chance of a hike, that is from a 10% chance of a cut.

July will be crucial with substantial data releases, including the second quarter CPI (July 31), GDP figures, and the wage price index.

Current forecasts suggest that inflation and employment are performing better than expected, raising concerns about the need for a potential harder landing in the economy to return inflation back to target.

The focus is now shifting towards slowing down the economy further despite the per capita recession because in the RBA’s view the impact on the household’s price power in the future from high inflation is still too high.

Future Rate Decisions

All things being equal – with the RBA turning itself in knots and trying so hard to stay the course the RBA’s commentary suggests it still has preference to hold rates if possible.

The big issue as it acknowledges is the possible need for near term tightening due to a lack of progress towards inflation targets.

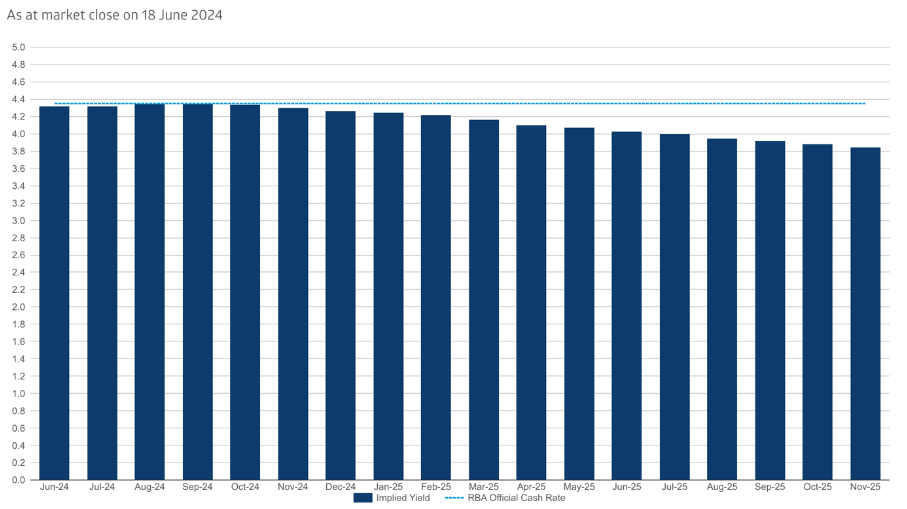

Here is the market’s forecast for rates post the meeting on Tuesday

Which probably explains the AUD/USD reactions in the following 24 hours

It flatlined – thus the market is telling us that it needs a catalyst, and those catalysts are clearly coming in July.

So to finish what’s the key?

A significant upside surprise in the RBA’s core inflation measure could lead to a rate hike, despite slowing demand and labour market conditions. We get the monthly inflation data next week, this will be the first strike then the July 31 quarterly read. This will be huge and will be the biggest AUD mover outside of an RBA meeting. We will be providing as much information on this release the closer we get to the release.

However as shown the RBA is a terrified hawk and without this inflation beat, the risk of further tightening diminishes, with expectations for the RBA to remain on hold until potentially the first rate cut in February 2025.

The next RBA meeting on August 6 it’s going to be an interesting 6 weeks for AUD traders ahead of what is a likely live event.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Trading the Inflation bumps – The May surprises and what to do with it

The consensus for the monthly Consumer Price Index (CPI) is for a rise to 3.8% annually in May, the range being 3.6% to 4.0%. This would be the fourth consecutive rise in yearly inflation and would show that not only is inflation ‘sticky’ it could be considered ‘entrenched’ Monthly CPI indicator YoY% This headline will cause large...

June 25, 2024Read More >Previous Article

When less is more – Why one cut in 2024 was good news?

We have been scratching our heads as to what exactly drove some of the strong price action in pairs, equities and bonds off the back of a further hawk...

June 14, 2024Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.