- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- ECB Preview – Euro steady ahead of rate decision – EURUSD analysis

- Home

- News & Analysis

- Articles

- Central Banks

- ECB Preview – Euro steady ahead of rate decision – EURUSD analysis

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisECB Preview – Euro steady ahead of rate decision – EURUSD analysis

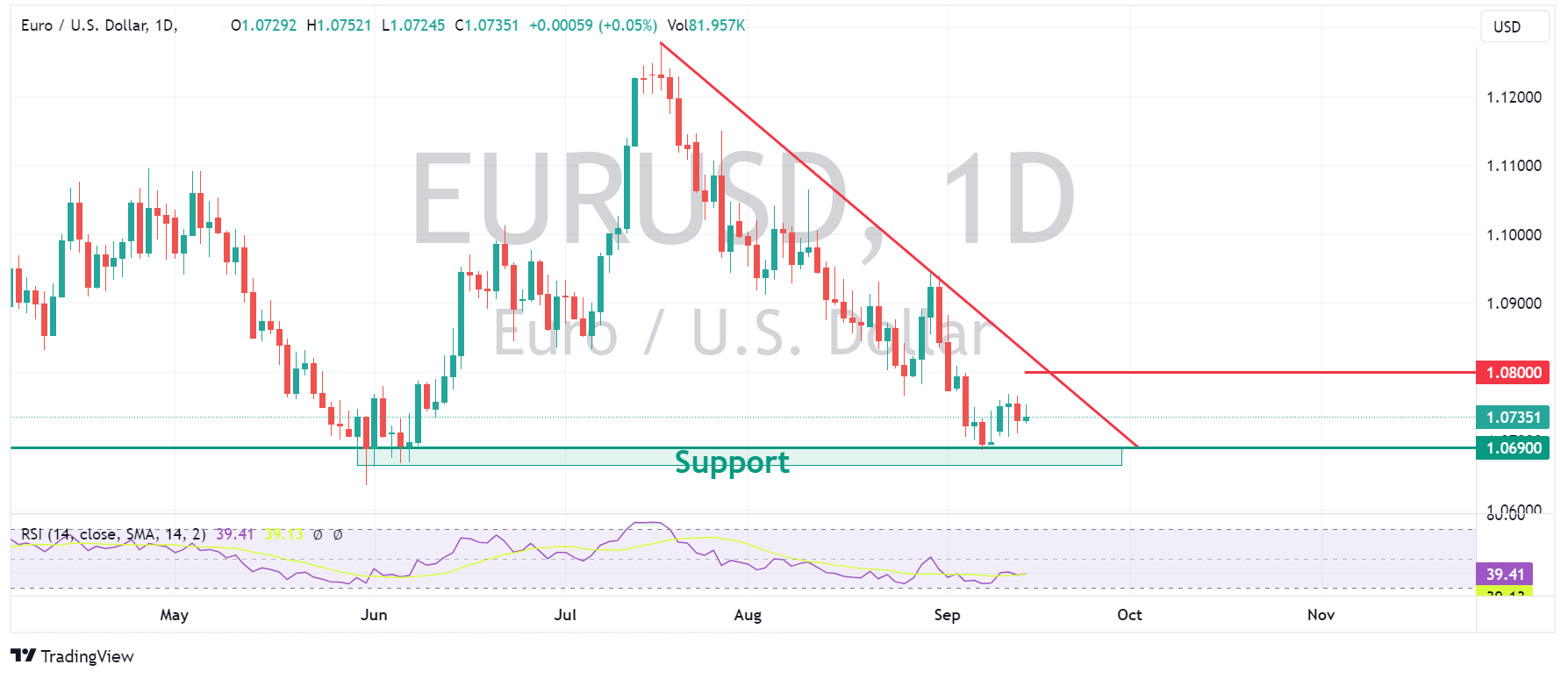

14 September 2023 By Lachlan MeakinEURUSD is heading into today’s knife-edge ECB rate decision lacking any real direction after Wednesdays CPI inspired choppy performance. Markets are split on today’s ECB rate decision with money markets pricing around a 65% chance of a 25bps rate hike, but a slight majority of economists polled by Bloomberg expecting a hold. Against this backdrop traders seem to be taking a wait and see approach with EURUSD unchanged, trading in a tight range in Thursdays APAC session and so far in EU session.

This will change at 12:15pm GMT as the ECB announces its rate decision, with a split market there will be almost certain volatility in EURUSD whichever way the ECB goes, with markets pricing in a 65% chance of a hike the risk on balance does seem skewed to the downside for EURUSD. A lot will also depend on the guidance released with the rate decision and the press conference 30 minutes after.

No hike and a statement anything less than ultra hawkish will likely see a sharp drop in EURUSD initially, possibly testing the June and September lows support zone just under 1.07. This will be a key area to watch after the initial reaction.

A Hike of 25bp will likely see an initial pop in EURUSD, but attention will then turn to the statement. The ECB is expected to stick with the data dependent narrative as to its future moves, but it will be hints of possible further hikes (hawkish) or hints that they may be at the peak (dovish) which will likely drive the Euro once the initial reaction is done. Even if we get the 25bp hike today money markets are pricing in 23bp of hikes this year already, this should cap any sustained rise in the Euro after a likely initial spike higher unless the statement hints strongly of more to come, which against a backdrop of a slowing EU economy seems unlikely.

The key level to watch to the upside is the psychological 1.08 level, which would also bring EURUSD up to its trendline resistance and would see hard going for further gains unless at a technical perspective.

The ECB rate decision will be released at 12:15 GMT with the presser at 12:45 GMT.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

EURUSD at key level going into US interest rate decision.

EURUSD is once again at an interesting technical level coming into key US data this week. After holding firm in a rising channel for most of 2023, price fell away in early September. This coincided with the price also falling below the 200 SMA which also acted as support multiple times in 2023 so far. After bouncing nicely on the first hori...

September 19, 2023Read More >Previous Article

WTI Crude Oil hits 10-month high, but there are some technical challenges ahead.

The WTI Crude Oil market is in an interesting spot on the charts, hitting a 10-month high in Wednesday's session. This strong performance comes after ...

September 14, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.