- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- FOMC Preview – One and Done, or More to Come? The Charts to Watch

- Home

- News & Analysis

- Central Banks

- FOMC Preview – One and Done, or More to Come? The Charts to Watch

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFOMC Preview – One and Done, or More to Come? The Charts to Watch

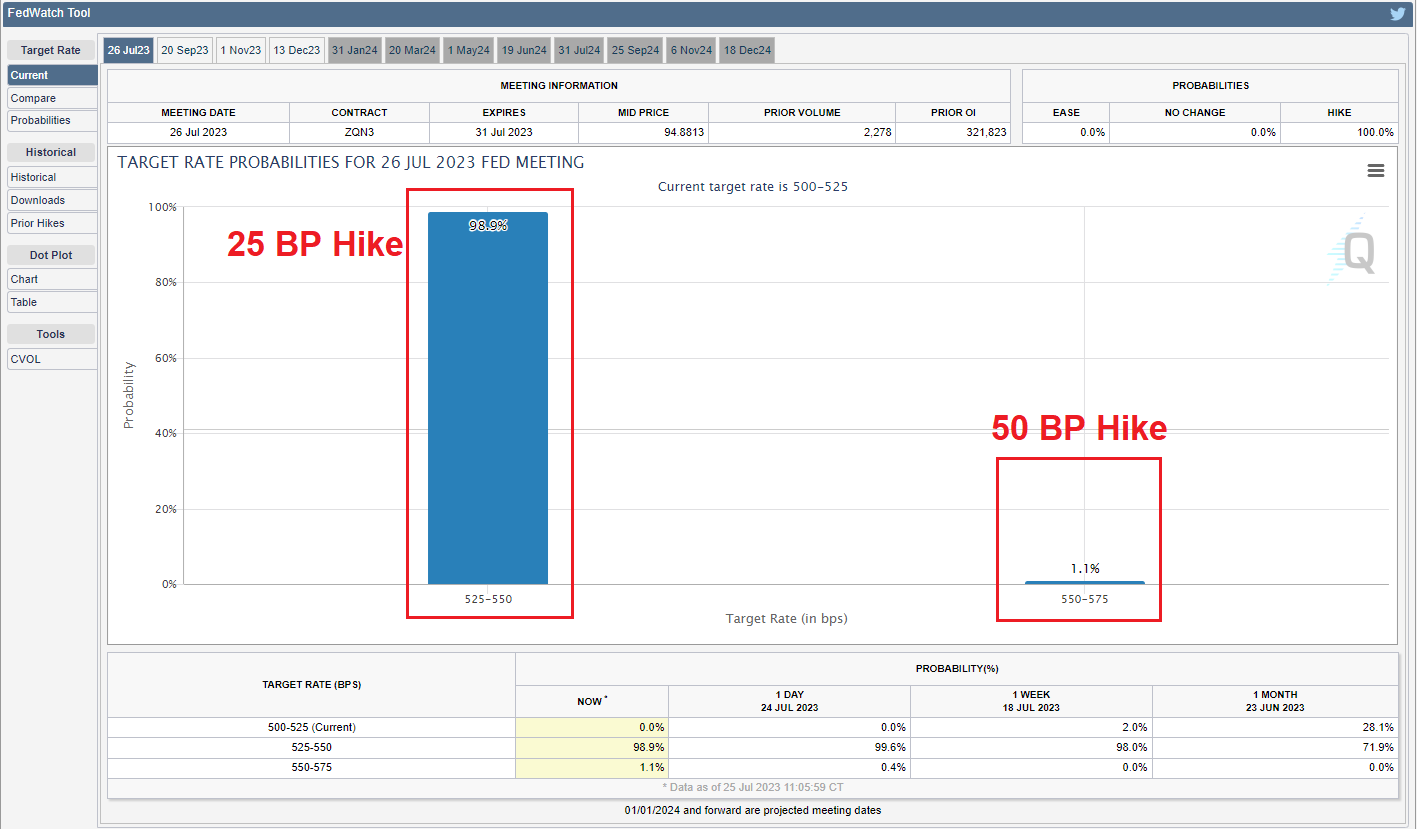

26 July 2023 By Lachlan MeakinThe long-awaited July FOMC meeting is finally upon us where rates markets are pricing in a sure thing for a 25bp hike (even a small chance of a 50bp), the question that traders will be looking for to be answered is “is this it?”. With a growing number of economists calling this the top in rates, butting up against the FOMC June statement and unwavering Fed speak since, giving guidance that there will be two more this year (including July if it happens).

This sets traders up with an intriguing FOMC meeting, with the accompanying statement and Powell Presser sure to see some volatility as traders look for clues as to what’s to come. With the background of recently cooling inflation, any language around the previously released June dot plots and whether they are still a reasonable estimate of future rate movements will likely be key.

Fed Futures odds:

Source: CME Fedwatch tool

Tis seta traders up with some unique opportunities as the battle between the Market and the Fed should see some real volatility in both direction as market participants digest the statement and then Powell’s presser, which in the past, has contradicted somewhat traders perception of the statement.

Charts to watch:

DXY – The US Dollar Index

It’s been straight up since mid-July after DXY bounced from extreme oversold levels, breaking through and holding the key S/R (and psychological) 101 level, which has held as support in the last couple of sessions. Despite this recent rally DXY is still in the oversold half of it’s daily RSI, a hawkish Fed pushing back against the market today would likely see DXY push to test the next major S/R level at 102.

A dovish Fed could see the recently established support at 101 seriously tested. In my opinion there is more chance of an upside surprise, given the market seems to be leaning towards pricing in a Powell capitulation.

US 10-year government bonds

Government bonds are an asset. I think a lot of CFD traders are missing great opportunities in, in the current climate of rates and inflation taking center stage they are one of my favourite markets to trade with some great range trading opportunities.

Looking at the chart of the US 10-year with the yields superimposed to see the negative correlation between the two (when you trade bonds, you trade the price, not yield) Over the last twelve months the yield on the 10-year has tested and subsequently struggled to stay above 4%, this turn lower in yields at this level gives a bond trader an opportunity by buying the bond price. Todays FOMC should see some volatility in yields, I recommend keeping an eye on these over the coming days for some good trading opportunities as yields hit pivotal levels.

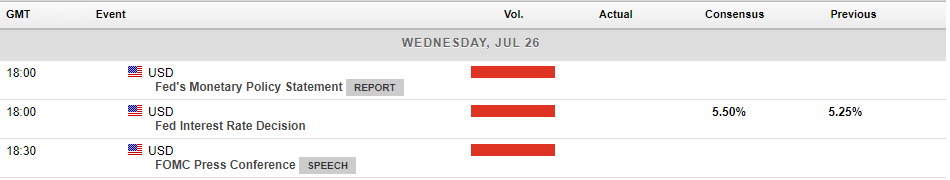

Today’s FOMC decision is due out at 18:30 GMT

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

US equity markets snapped a record-breaking run of up sessions in Thursdays trading, with the Dow Jones looking set to close in the green for a 14th straight session (for the first time since the Dow’s inception), before seeing a sell-off on rising yields after a report that the BoJ is looking to tweak their YCC at their meeting today. FX Mark...

July 28, 2023Read More >Previous Article

Gold eases heading into FOMC

After a fortnight of trending north, Gold has fallen over the past 5 days. It is currently trading at around $1960, showing a slight decline of approx...

July 26, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.