- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Less-Dovish Central Bank

13 February 2019The Reserve Bank of New Zealand (RBNZ) made its first interest rate decision and monetary policy, but it was not what the market participants expected. The Central Bank did not follow the same dovish theme seen by other central banks. The Official Cash Rate (OCR) was left at 1.75%, as widely expected, and the RBNZ expects to keep the OCR at this level through 2019 and 2020.

“The direction of our next OCR move could be up or down.”

Governor Adrian Orr has downplayed the odds of a rate cut but has not entirely removed it off the table. Given the global risks and uncertainties, the chance of a rate cut is not eliminated but has not increased either.

- NZDUSD jumped on the signals to hold on to rates though to 2020 while the AUDNZD dropped by almost the same extent. We saw movements above 100 pips following the Rate Statement.

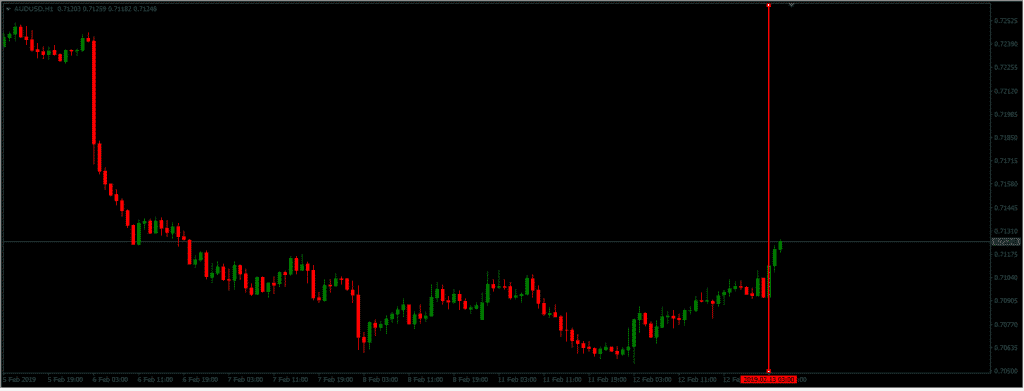

- AUDUSD, which is highly correlated with the NZDUSD, added a few pips and built on gains from the uptick in the Westpac Consumer Confidence released before the RBNZ’s interest rate decision.

The RBNZ strikes a “data-dependent” approach and says that they are comfortable with the inflation target and mid-point pressures. The Governor stretched that “they need data from the financial markets around how they are pricing and seeing the risks as well.” When asked about the rise in unemployment, Orr mentioned that “the surveys are not reflecting what we hear about the business tables”, and that “employment is near its maximum sustainable level”. Overall, the big picture here is that the RBNZ appears more confident that other central banks on its outlook for the New Zealand economy. The Central Bank noted that the low-interest rates and expected government spending would eventually support a pick-up in Gross Domestic Product over 2019.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

National Emergency

By Deepta Bolaky President Donald Trump has declared a national emergency over the US-Mexico border swiftly after the spending bill was approved. It is not the first national emergency the US will face. Other situations of emergency were triggered by former Presidents like Barack Obama or George W Bush, but it was primarily for purposes of add...

February 18, 2019

Read More >

Previous Article

Margin Call Podcast – S1 E5: Andrea Marani | CEO of OpenMarkets

Andrea Marani (Linkedin) is the CEO of OpenMarkets and longtime operator in the financial services space. A South African at heart, the now Aussie...

February 13, 2019

Read More >