- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrency

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Cryptocurrency

- What Gives Bitcoin Its Value?

News & AnalysisBitcoin hit a new all-time high (ATH) on July 14, rising to $122k for the first time in its history.

On this same day in 2010, a single Bitcoin was worth… $0.07.

This incredible rise from a near-worthless digital experiment to a $2.5 trillion asset class begs the question: What is it exactly that makes Bitcoin so valuable?

Bitcoin price 2012-2022

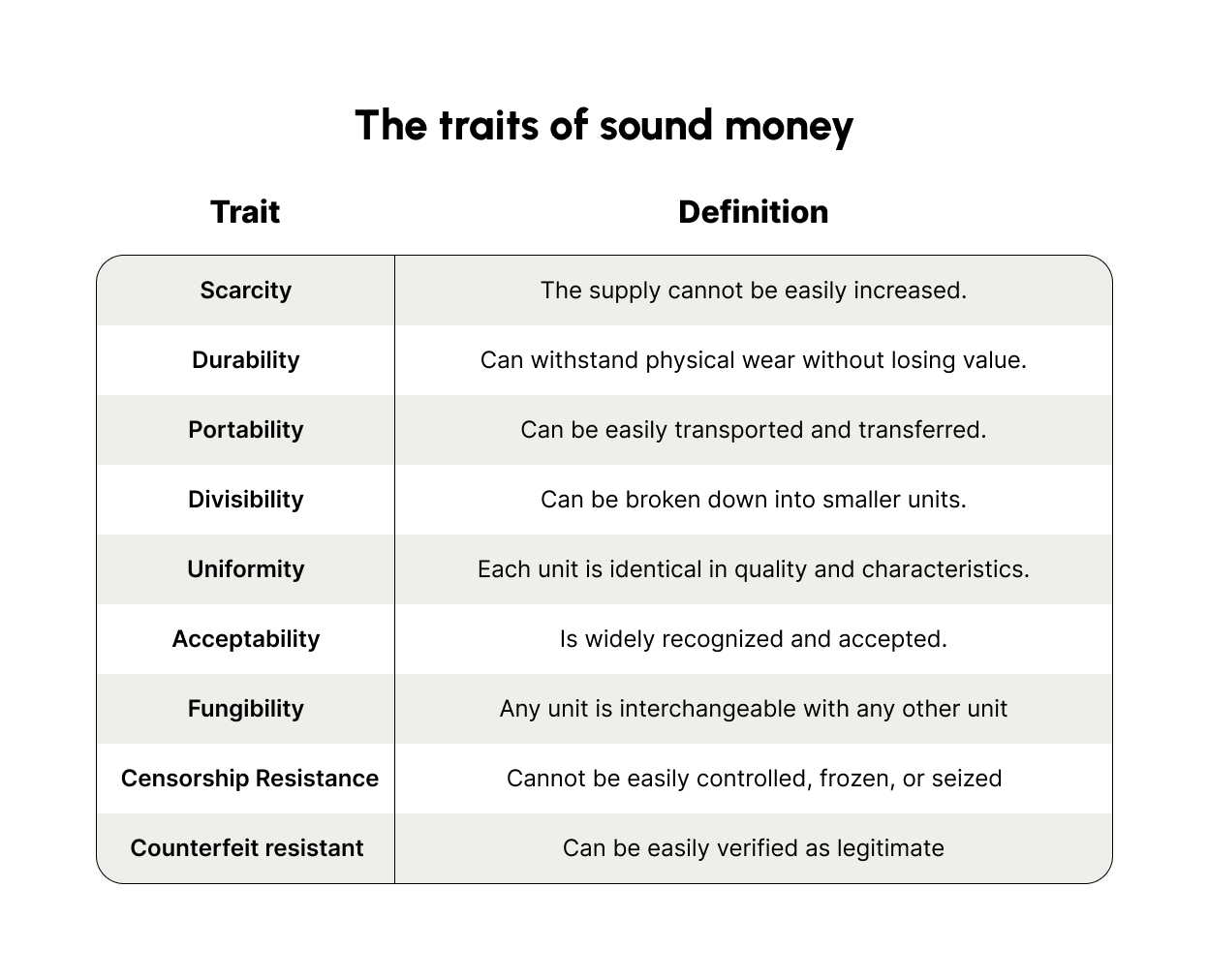

What Gives Any Currency Its Value?Since the dawn of organized trade, humans have searched for what economists call “sound money” — a currency that facilitates transactions while still maintaining value over time.

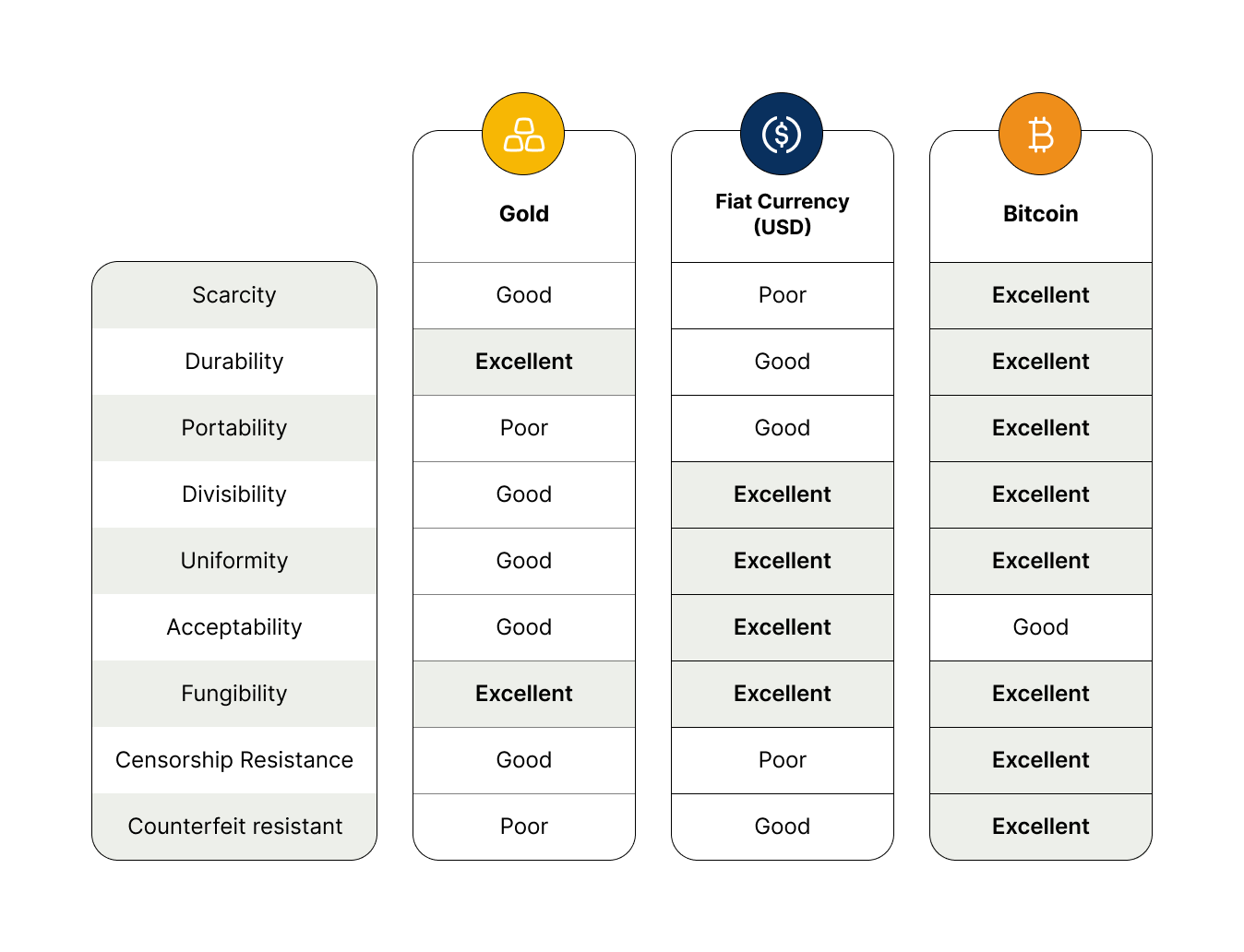

After centuries of trial and error, gold eventually emerged as the universally accepted currency. Its scarcity, durability, and divisibility made it great for storing and transferring value.

But physical gold wasn’t able to satisfy all the traits of sound money — it was heavy, difficult to transport, and vulnerable to theft during long-distance trade.

To address these limitations, a new solution was found — countries began issuing paper currency guaranteed by the government, backed by gold reserves.

This paper currency is (more or less) the currency we know today. And for the past few hundred years, it was the currency that satisfied the most requirements for sound money.

However, as we entered the digital age, the idea that a “digital currency” could be created to satisfy all sound money criteria began to gain traction.

This is where Bitcoin comes in.

The Bitcoin Breakthrough

Multiple attempts to create a digital version of sound money were made throughout the 1990s and 2000s. But they all ran into the same problem: double spending.

The inherent issue with anything digital is that it can be easily copied. There needed to be a way to prevent people from simply copying a digital currency file and “double-spending” it in multiple places.

This created a situation where the last two traits of sound money — Censorship Resistance and Counterfeit Resistance — could not be satisfied simultaneously.

To satisfy Counterfeit Resistance, double spending had to be prevented. To prevent double spending, a central authority was needed to verify transactions, which opened up the currency to censorship.

It wasn’t until 2008, when a paper named “Bitcoin: A Peer-to-Peer Electronic Cash System“ was innocuously sent to a cryptography mailing list, that a solution was discovered.

Instead of relying on a central authority, Bitcoin proposed a distributed network where every participant keeps a copy of every transaction that has ever occurred.

This shared ledger (now better known as “the blockchain”) is maintained by a network of thousands of computers (nodes) around the world.

When someone wants to send Bitcoin, they need to broadcast their transaction to the network. The computers then work together to verify that the sender actually owns the Bitcoin and hasn’t already spent it elsewhere.

If everyone has a complete record of all transactions, double spending becomes impossible. You can’t spend the same Bitcoin twice because the entire network can see your complete transaction history.

This breakthrough meant, for the first time, a form of currency existed that could (theoretically) satisfy all the traits of sound money.

However, the fact that Bitcoin satisfies these traits does not automatically make it valuable.

Bitcoin’s “sound money” breakthrough was just a novelty; it still needs practicality with a clear fundamental value add to justify having any worth.

What Gives Bitcoin Its Fundamental Value?

It created a new technology. The blockchain solution was far more reaching than just preventing double-spending. Blockchain introduced a way to create permanent, tamper-proof records without requiring a central authority to maintain them.

This unlocked possibilities across virtually every industry. Everything that previously required a trusted middleman to verify, record, or enforce agreements could now be rebuilt on this trustless infrastructure.

It has absolute scarcity. Bitcoin’s supply is permanently capped at 21 million coins, written into its code and enforced by the network. This creates predictable, verifiable scarcity. Unlike gold, where new deposits can be discovered, Bitcoin’s scarcity is mathematically guaranteed.

It is censorship-resistant. Bitcoin transactions cannot be blocked, reversed, or frozen by governments or financial institutions. This makes it valuable for those living in countries where traditional money systems might be unreliable or compromised.

It is globally accessible. Anyone with internet access can send or receive Bitcoin anywhere in the world, 24/7. This makes it particularly valuable in regions with limited banking infrastructure or restrictive governments.

Bitcoin is decentralized and secure. Because the Bitcoin network operates through thousands of nodes worldwide, it means no single entity can control, manipulate, or shut down the network.

It is transparent and auditable. Every Bitcoin transaction is recorded on its public ledger that anyone can verify. This ledger has been running with 100% uptime for over 12 years, with its only two minor downtime events occurring early in its formative years.

How Much of Bitcoin’s Value is Speculative?

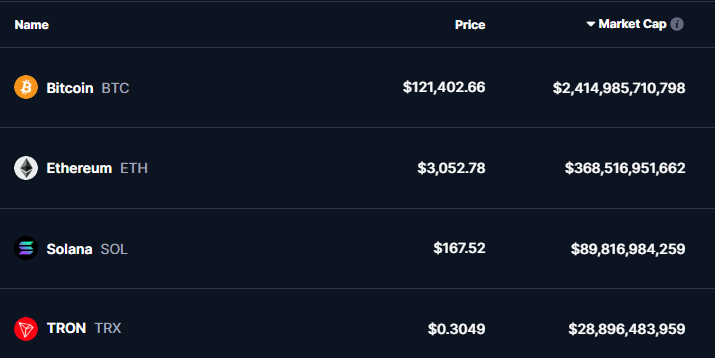

So, Bitcoin has a good fundamental value proposition, but does it justify its nearly $2.5 trillion market valuation?

The short answer is no. Just like gold, if you valued it only on its practical usability, its market cap would be significantly lower.

Other cryptocurrencies like Ethereum, Solana, and Tron all have a far superior tech stack, yet Bitcoin has a valuation over five times these assets combined.

However, like gold, if you start to derive Bitcoin’s value from beyond its core functionality, its huge market cap begins to make more sense.

Bitcoin has achieved institutional adoption well beyond any of its counterparts. Major corporations, hedge funds, and even nation-states have added Bitcoin to their balance sheets. The most notable of which is MicroStrategy, with current holdings of 597,325 BTC.

US Spot Bitcoin ETFs went live in January 2024, the first-ever crypto spot ETF in the US. They have seen over USD$50 billion in combined inflows since launch and generated the biggest first-year inflows on record (beating out Gold ETFs’ long-standing record).

And Donald Trump has signed an executive order to create a US Strategic Bitcoin Reserve — turning Bitcoin into a national stockpile asset alongside Gold and Oil to help prop up the US Dollar.

More nuanced value can also be derived from things like Bitcoin’s 15-year track record of resilience, its community network effects, and the anonymity of its creator — Satoshi Nakamoto.

Sculpture of Satoshi in Switzerland that vanishes from certain angles

All these factors, combined with its fundamentals, make a strong case for a high Bitcoin valuation. Whether that valuation is as enormous as $2.5 trillion is up for debate. Still, we can be confident that Bitcoin is not a purely speculative asset, like many critics have touted in the past.Summary

Bitcoin has legitimate technical and economic properties that create genuine value. It is the first form of truly sound money, and it has introduced fundamental innovation that is revolutionary in many ways.

However, like many new technologies, the market is still feeling out what it’s actually worth. The $2.5 trillion valuation could be justified, or it could be a bubble, or both at different times.

What is clear is that Bitcoin isn’t going away. Whether it becomes a major part of the global financial system or remains a niche asset, it has established itself as a permanent fixture in financial markets that can’t be ignored.

Start trading Bitcoin and 38 other Cryptocurrency CFDs on GO Markets today.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How Starting with the Exit Can Transform Your Trading Approach

Most traders follow a familiar routine when planning trades: They scan for a setup — a candlestick pattern, a moving average crossover, or a favourite indicator alignment. When they find one, they take the trade, set a stop somewhere "logical," and target a multiple of their risk. And, there is nothing wrong with this! It is systematic...

July 21, 2025Read More >Previous Article

Is a Successful Scalping Strategy Possible?

Every serious trader has “had a go” at scalping at some point in their journey. The idea of rapid and high-frequency entries, quick profits, with ...

July 14, 2025Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.