- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Advantages and disadvantages of using an Expert Advisor (EAs)

3 March 2022

What is an Expert Advisor (EA)?

Expert Advisors (EAs) are trading software that automatically run and trade based on their preprogrammed rules for initiating, managing, and exiting trades in the market. These automated trading systems are very popular among traders and are widely used on the Metatrader 4 and 5 platforms. For most traders, EAs are primarily used for Forex, although they can be used on any market that’s available on the platform. These can be purchased prebuilt online from a developer or created to automate an existing strategy being used.

There are many reasons why traders use them, and I will explain some of the main advantages and disadvantages.

Advantages of using an EA:

Discipline – these programs are set to certain parameters and will manage your positions based on the programmed strategy. Using a set of yes/no triggers it will make trading decisions and act on them instantly without changing their decisions like humans would do. It will also manage risk based on your risk settings, so you do not overexpose your account.

Timesaving – there is only so much time a trader can look at the charts for trading opportunities before getting tired while the markets are open. An EA can monitor the charts 24 hours per day and open and close positions or even provide alerts which can save time.

Emotionless – this plays a huge role in the decision making for traders. When trading with real money traders tend to make emotional decisions and break their strategy from fear or greed. An EA removes this element and will stick to the original plan although manually intervention can still be done.

Backtesting – you can backtest an EA to see whether the strategy has been profitable in the past on multiple markets. Although these can give you confidence to use them, it’s important to keep in mind that past performance is not an indicator for future performance.

Disadvantages of using an EA

Technical failures – for an expert advisor to work, your platform needs to be open and running at all times which means if you experience technical issues such as a crash, software update, power outages, connection problems then this will effect the EA.

Additional cost of VPS – this is a dedicated private server which allows you to remove some of the technical challenges when using an expert advisor. There are benefits of lower latency and faster execution and also the peace of the mind that the EA is running on a private server which can be accessed from any location. It typically costs around A$30 per month to have this access.

World events – an EA is programmed to trade based on technical parameters, which means should there be an unexpected world event or news announcement, this would have an impact on your trades as the the market moves in response to them.

Doesn’t teach how to trade – these are coded to trade certain parameters therefore unless you understand how to code, you can only watch. Although there are many EAs which make money for people who can’t trade, if they are unprofitable then it’s back to the drawing board; that could mean finding another EA or learning to trade.

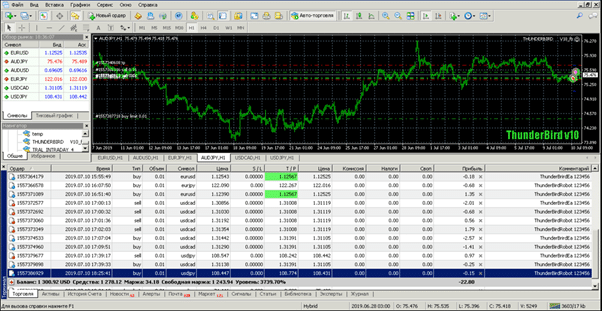

Here are example how an Expert Advisor looks running on MT4 platform:

If you are interested to use an Expert Advisor and seeing how these can perform and the results, you can find them on MQL5.com. This is the largest community for developers and signal providers to showcase their systems. You will find some for free and some that will need a monthly subscriptions to have access to them.

You can run expert advisors on a GO Markets trading account. If you need any help setting them up please contact our support team.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Energy crunch sees coal, oil and gas soar.

Coal and Gas prices have surged and joined gold and oil as demand surges due to the supply shortages stemming from the Russia and Ukraine conflict. The global indices were up overall as the market still remains unsure of how to react to the unfolding crisis. In Europe, the FTSE provided strength with a 1.36% gain and the DAX provided a small bou...

March 3, 2022

Read More >

Previous Article

Salesforce record fourth quarter and Slack expectations

Salesforce the worlds #1 customer relationship management (CRM) platform has just announced record fourth quarter and full fiscal 2022 results exc...

March 3, 2022

Read More >