- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Bristol-Myers Squibb exceeds Q1 expectations

2 May 2022US pharmaceutical company Bristol-Myers Squibb Co. reported first quarter financial results on Friday, beating analyst expectations.

The company reported revenue of $11.648 billion (up 5% year-over-year) vs. $11.349 billion expected.

Earnings per share reported at $1.96 per share (a 13% increase year-over-year) vs. $1.91 per share estimate.

”We continue to execute against our strategic priorities, deliver solid revenue and earnings growth and advance our product pipeline,” company CEO, Giovanni Caforio said on the results.

”Thanks to our team’s hard work and dedication, we achieved regulatory approvals of Opdualag and Camzyos, our new first-in-class medicines for patients living with metastatic melanoma and symptomatic obstructive hypertrophic cardiomyopathy, respectively. These milestone achievements, combined with our promising product pipeline and strong financial flexibility, provide a solid foundation that will enable us to deliver sustained growth and long-term benefits for our patients,” Caforio concluded.

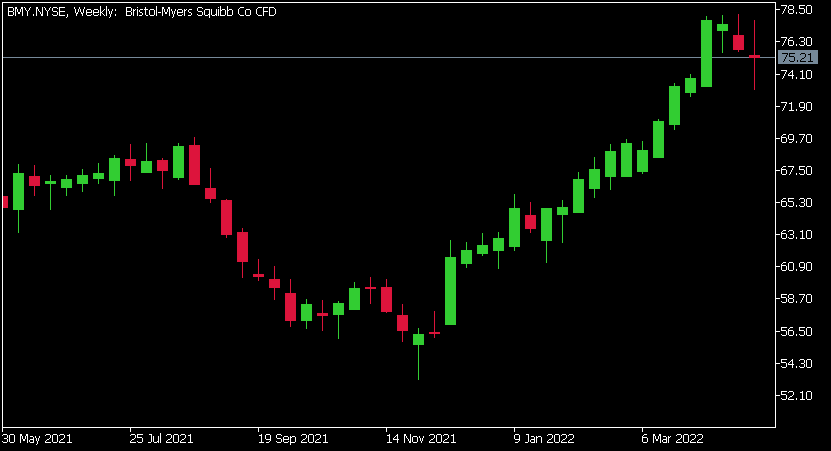

Bristol-Myers Squibb Co. chart

The stock was down by 2.5% on Friday at $75.21 per share.

Here is how the stock has performed in the past year:

- 1 Month +1.96%

- 3 Month +96%

- Year-to-date +72%

- 1 Year +59%

Bristol-Myers Squibb price targets

- Morgan Stanley: $64

- Wells Fargo: $65

- Goldman Sachs: $72

- Barclays: $66

Bristol-Myers Squibb Co. is the 65th largest company in the world with a market cap of $160 billion.

You can trade Bristol-Myers Squibb Co. (BMY) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Bristol-Myers Squibb Co., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NIO’s April delivery numbers are in

NIO Inc. reported its latest delivery numbers for April on Sunday. The Chinese electric vehicle company delivered 5,074 cars last month – a decrease of 28.55% year-over-year. Production and deliveries were impacted by supply chain issues and other constraints caused by COVID-19 outbreaks in China, according to the company. The deliveries in...

May 2, 2022

Read More >

Previous Article

Amazon falls short in Q1

Amazon.com Inc. announced its first quarter results after the market close in the US on Thursday, falling short of Wall Street analyst expectations. ...

April 29, 2022

Read More >