- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Charts to Watch in the Week Ahead – BoC rate decision, US CPI, RBNZ, UK wage and jobs data

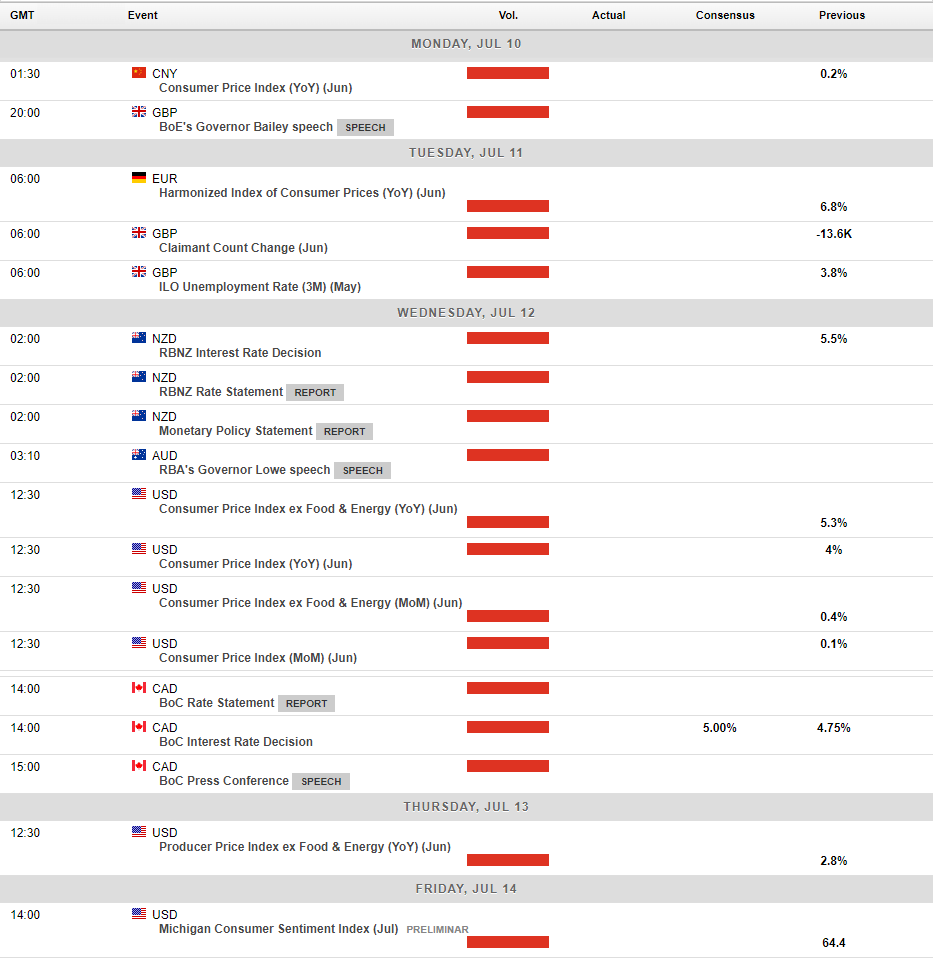

10 July 2023Central banks are back in action in the coming week with the Bank of Canada and RBNZ scheduled to release their latest monetary policy and official rate decisions, also some key data from the US and the UK which will go a long way to cement market expectations of the next move from their Central Banks.

Charts to watch this week:

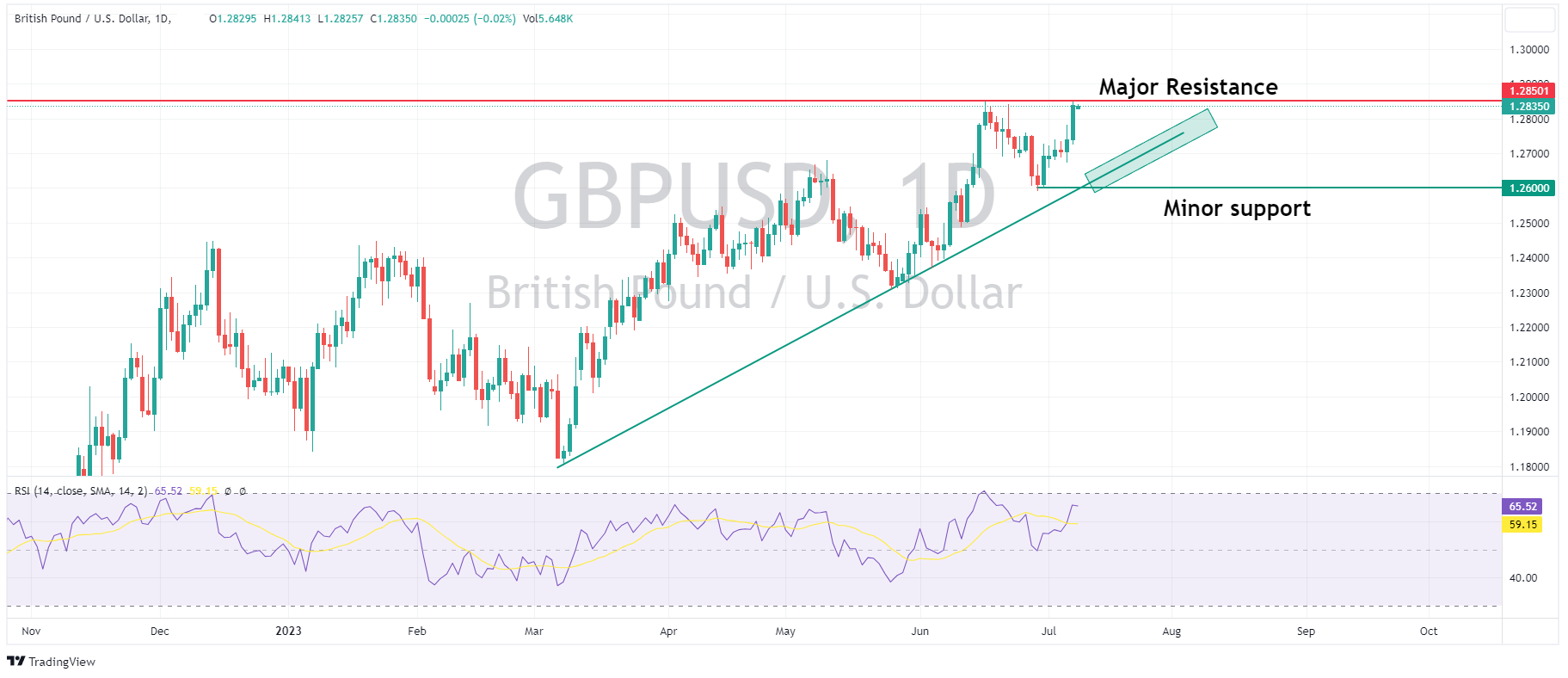

GBPUSD : UK wage data will point to the size of BoE August rate hike

With less than a month until the Bank of England’s August meeting, rates markets are split on the size of the hike, with a 50bp hike the slight favourite at the moment. This week’s jobs and wages data is one of only two key data points (along with the CPI print on 19th July) that is likely to have any bearing on its decision, with GBPUSD continuing to push higher in a strong uptrend since March, now testing the major resistance at 1.2850, there are some big levels at play over this announcement.

Levels to watch:

1.2850 to the upside – major resistance

1.2600 to the downside – minor support

1.2600 – 1.2700 upward trendline support

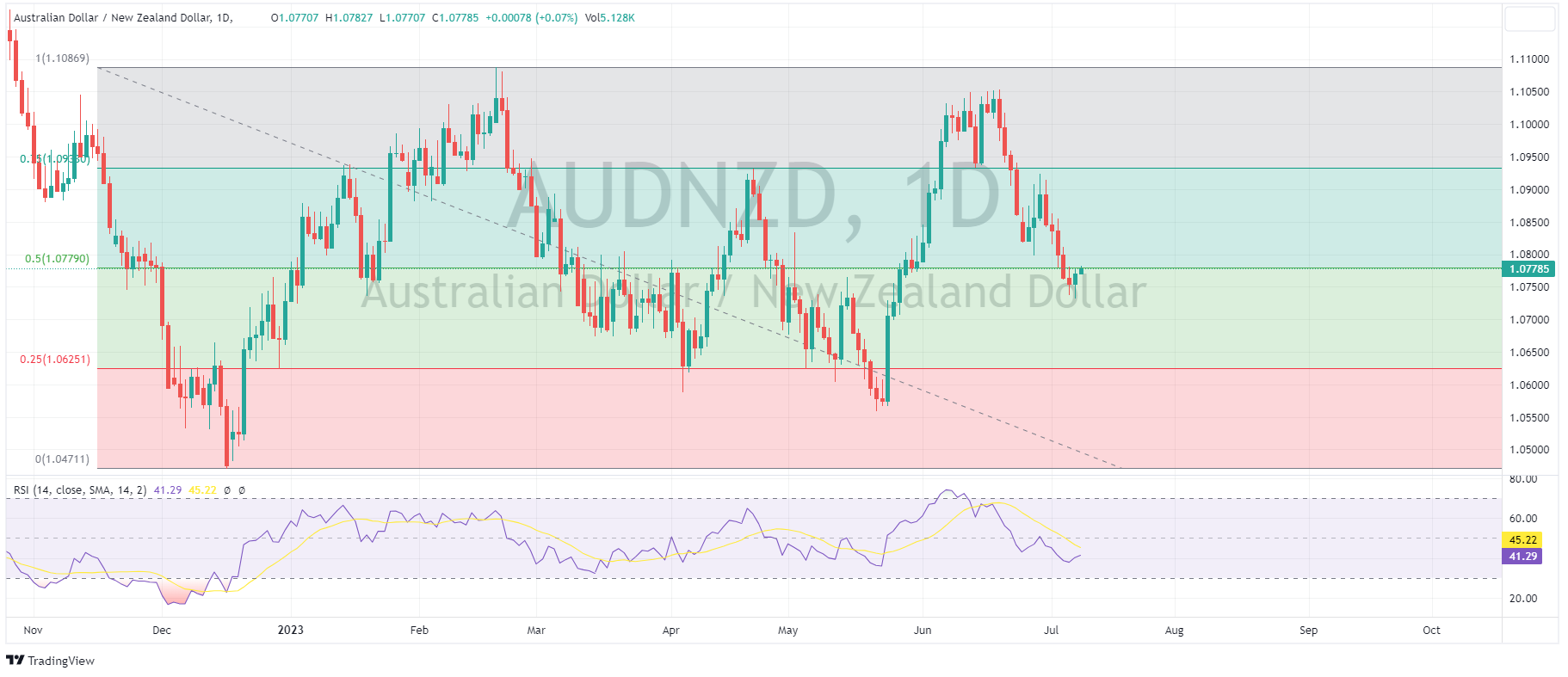

AUDNZD: RBNZ rate decision – likely hold

The RBNZ meeting on Wednesday has market pricing in a 91% of a hold from the RBNZ, leaving their cash rate at 5.5% and possibly indicating an end to their hiking cycle. The decision itself won’t be the driver for NZD volatility, it will be the accompanying statement where clues of whether this is a pause or an end to hiking is where we’ll see the volatility. AUDNZD will be the chart to watch, with a recent sharp pullback putting this pair into oversold territory and looking attractive to mean reversion traders.

Levels to watch:

1.0780 – the 50% level of AUDNZD 2023 range, breaks above or below this level would indicate overbought or oversold territory for mean reversion traders.

USDCAD: Bank of Canada set to hike

Markets are somewhat split on the Bank of Canada rate decision on Wednesday, with futures currently indicating a 67% chance of a 25bp hike. The BoC restarted rate hikes last month after a pause since January and it would be hard to see them settling at one hike in this cycle. USDCAD has seen a break lower from it’s 2023 range recently before pushing back into this range. Oil prices which have recently found strong support and pushing higher, also a big factor in CAD strength as can be seen by the strong negative correlation between USOUSD and USDCAD.

Levels to watch:

1.3275 – Bottom of the 2023 range support – a break and hold above could indicate the resumption of that range trading. A break and hold below on BoC and/or continuing price rise in Oil could see a new downtrend form in this pair and see 1.3275 act as resistance.

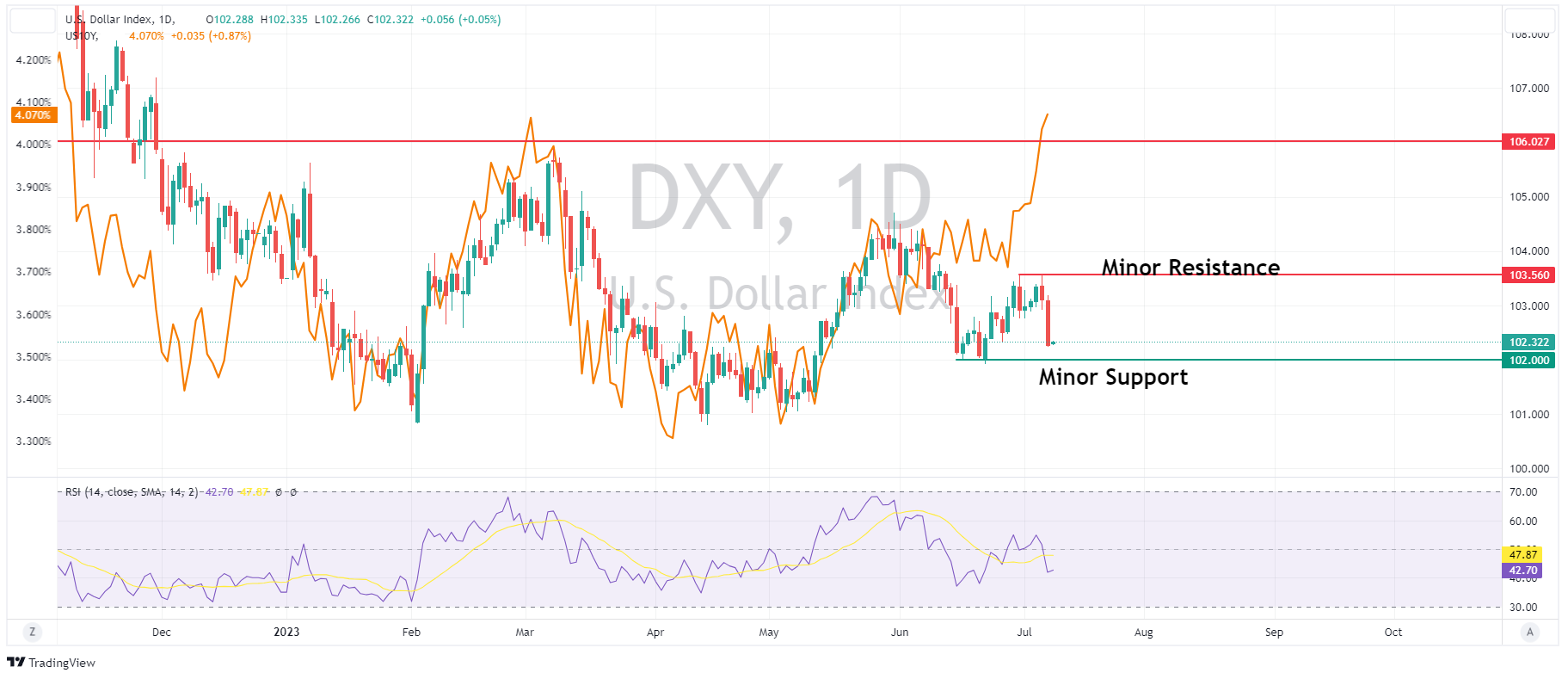

US Dollar Index: US CPI pointing to inflation continuing to cool

Wednesdays US CPI figure is expected to show a continuation in US inflation cooling, with the YoY figure forecast to drop to 3.1% from the previous reading of 4%. The Next Fed meeting is seemingly a done deal with a 25bp hike fully priced in, so this figure is unlikely to change that, but future hikes will come into question if the figure does come in as expected, putting pressure on the USD. The Dollar Index (DXY) looks to have further upside capped as well due to 10 year Treasury yields getting over 4%, a level they have struggled to hold for the last couple of years. a drop in yields from here, a bearish sign for USD.

Levels to Watch

102.00 – to the downside – minor support and an important psychological level.

1.03.56 – to the upside, last week’s highs formed as minor resistance.

US10 year yield – 4% level – any further upside to yields would be hard going from recent history.

This week’s full calendar below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Equities Eke out a Gain, Dollar Battered, Bonds Bid

Major US indices finished in the green in Monday’s session as lowered inflation expectations saw treasury yields come off the recent highs, bolstering stocks but seeing the USD take a big hit. The Russell 2000 was the clear outperformer (+1.64%) while the Nasdaq squeaked into the green after spending most of the session in negative territory, ...

July 11, 2023

Read More >

Previous Article

FX markets analysis – DXY, JPY, AUD, MXN, CNH, EUR

USD rose on Wednesday with participants returning from the long weekend pushing the Dollar Index above the key 103.00 level. FOMC minutes from the Jun...

July 6, 2023

Read More >