- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Chevron Q1 results are in

2 May 2022Chevron Corporation reported its latest financial results before the market open in the US on Friday.

The company reported revenue of $54.373 billion in Q1, coming in above $51.14 billion expected by the analysts on Wall Street.

Earnings per share reported at $3.36 per share vs. $3.41 per share expected.

Mike Wirth, Chevron’s chairman and CEO on the latest results: ”First quarter financial performance saw return on capital employed increase to 14.7 percent and our balance sheet strengthen further.”

”Chevron is doing its part to grow domestic supply with U.S. oil and gas production up 10 percent over first quarter last year.”

”Consistent with our plans, we’re investing to grow both traditional and new energy business lines.”

”While we continue to respond to the energy-related challenges of today, we are deeply saddened by the tragic events in Ukraine and hope for a peaceful resolution soon,” Wirth added.

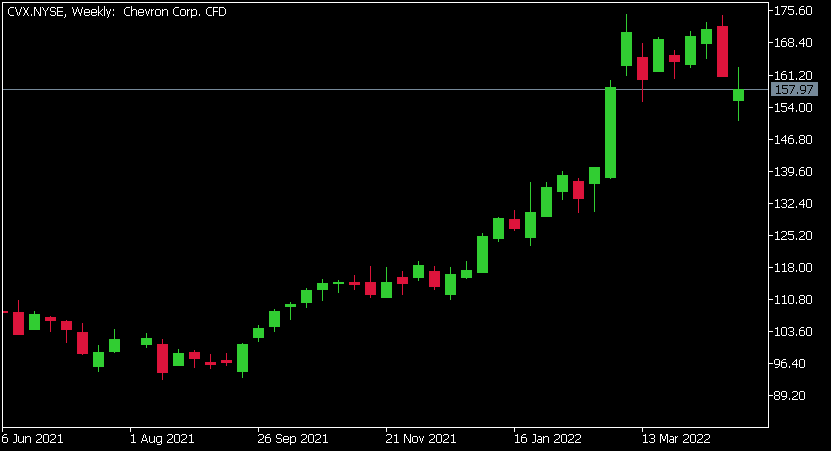

Chevron Corporation chart

Here is how the stock has performed in the past year:

- 1 Month -3.96%

- 3 Month +75%

- Year-to-date +39%

- 1 Year +01%

Chevron price targets

- Morgan Stanley: $188

- Wells Fargo: $184

- Citigroup: $145

- Barclays: $148

- JP Morgan: $169

- UBS: $192

Chevron Corporation is the 26th largest company in the world with a market cap of $309.56 billion.

You can trade Chevron Corporation (XOM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Chevron Corporation, TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Exxon Mobil latest results announced

Exxon Mobil Corporation reported its first quarter financial results before the opening bell on Wall Street on Friday. The oil and gas giant reported revenue of $90.5 billion in the first quarter of 2022 vs. $82.839 billion expected. Earnings per share came in below of analyst estimates at $2.07 per share vs. $2.23 per share expected. ''Th...

May 2, 2022

Read More >

Previous Article

NIO’s April delivery numbers are in

NIO Inc. reported its latest delivery numbers for April on Sunday. The Chinese electric vehicle company delivered 5,074 cars last month – a decre...

May 2, 2022

Read More >