- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Cyclical assets stumble on hawkish Fedspeak and BoE recession forecast

5 August 2022US stock Indices were mixed and ultimately little changed overnight with growth concerns taking centre stage after the Bank of England’s sustained recession forecast and Fed governor Mester again reiterating the central banks resolve in bring down inflation. Mester stated that she sees it as not unreasonable to see a 75bps hike in September and expecting rates to continue rising through HI 2023.

Crude Oil tumbled on recession fears spurred by the BoE comments, dropping below it’s 200 day SMA and giving up all the Ukraine invasion gains.

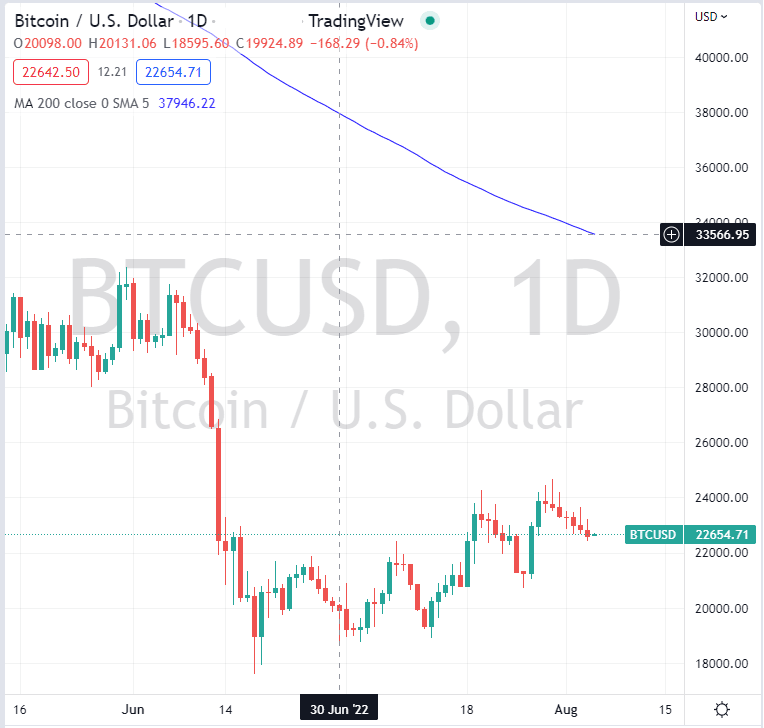

Bitcoin extended the weeks loss, down for a 7th straight session

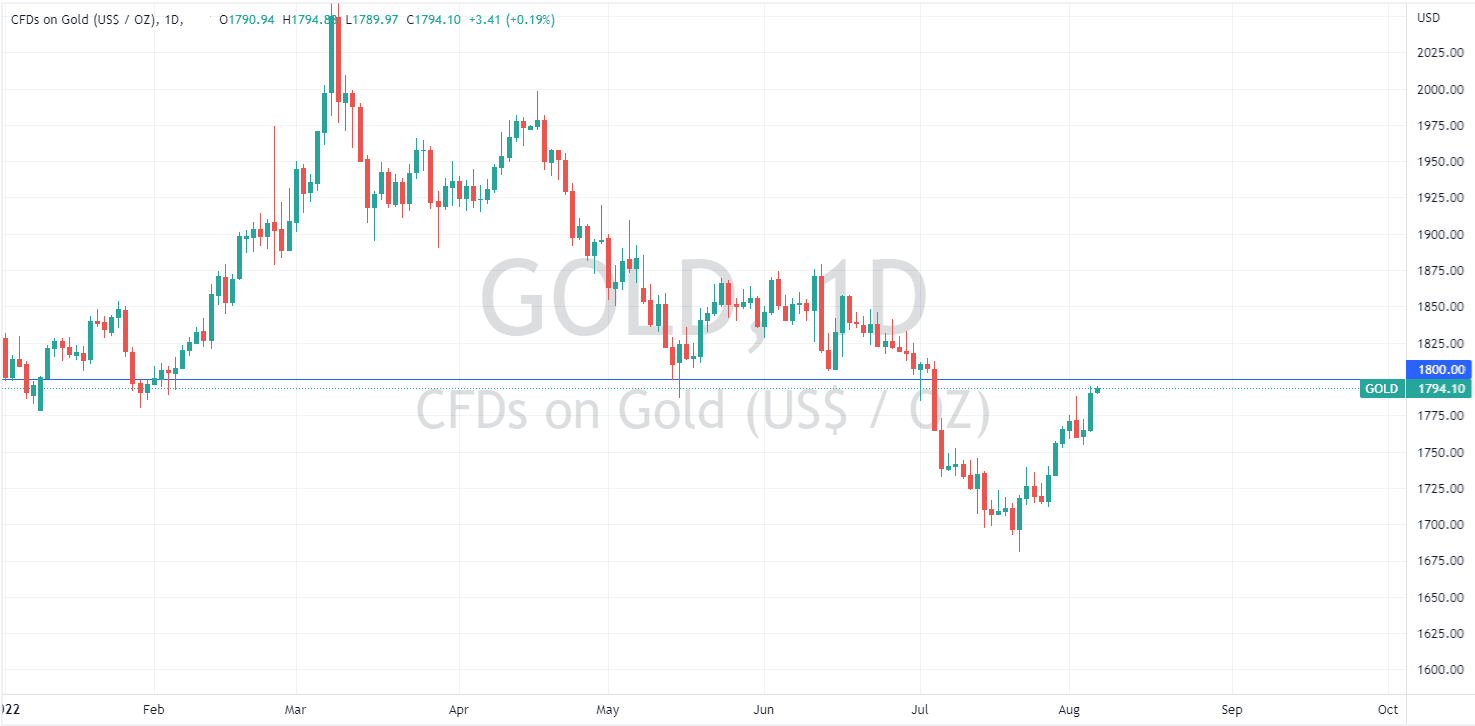

A weak US dollar (with Chinese military exercises new Taiwan being a headwind) bond yields dropping and a flight to safety saw Gold outperform, the spot price pushing towards the psychological $1800 USD an Oz level which has provided strong support and resistance in the recent past.

Looking ahead, we have the closely watch Non Farm Payroll employment result from the US today where 250k jobs are expected to be added in July. With the Fed being in a data-dependent, meeting-by-meeting mode traders will use the data to shape expectations of how the Fed will set policy at its September meeting, expect some big moves in the FX market at the release of these figures released at 12:30 PM GMT (10:30 pm AEST)

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

BNPL sector showing signs of a reversal after monstrous selloff

The Buy Now Pay Later, (BNPL) sector has seen a resurgence after a long and brutal sell-off. The reason for, much of the resurgence is not related to any specific catalyst but rather, changing sentiment within the broader market. The sector rose significantly before and during the Covid-19 pandemic. However, as the pandemic came...

August 8, 2022

Read More >

Previous Article

Alibaba posts better-than-expected results

Alibaba Group Holdings Limited (BABA) reported its latest financial results before the market open on Thursday. The Chinese e-commerce gi...

August 5, 2022

Read More >