- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

eBay beats Wall Street estimates in Q4

24 February 2022US e-commerce company eBay Inc. reported its Q4 2021 financial results after the closing bell on Wall Street on Wednesday.

The company reported revenue of $2.613 billion, narrowly beating analyst forecast of $2.603 billion.

Earnings per share also beat analyst expectations at $1.05 per share vs. $0.99 per share expected.

eBay also announced a quarterly dividend of $0.22 per share, a 22% increase from the previous quarterly dividend.

CEO of eBay, Jamie Iannone commented on the latest results: “Rounding out a very strong year, I’m proud of our team for delivering yet another solid quarter. By investing in our strategy to drive sustainable growth, we increased customer satisfaction, improved the seller and buyer experience, and returned value to our shareholders.”

“During the quarter, we completed our multi-year payments transition, and generated growth in both our advertising business and focus categories. As we continue to accelerate our strategy, we are well positioned for future growth,” Iannone added.

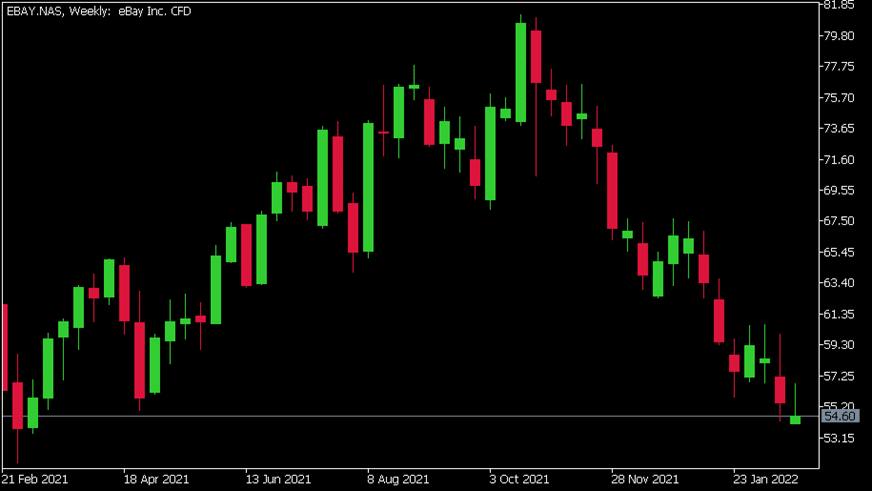

eBay Inc. (EBAY) chart (Weekly)

Shares of eBay down by 1.02% at the end of the trading day on Wednesday at $54.60 per share.

The stock fell in the after market trading hours by around 7%, as Q1 guidance fell short of analyst estimates.

The company expects revenue of between $2.43-$2.48 billion in Q1 vs. estimate of $2.61 billion by FactSet. eBay expects earnings per share of between $1.01-$1.05 a share in the quarter, compared with $1.08 a share expected by FactSet.

Here is how the stock has performed in the past year –

- 1 Month: -5.41%

- 3 Month: -24.87%

- Year-to-date: -17.91%

- 1 Year: -8.07%

eBay Inc. is the 554th largest company in the world with a market cap of $34.17 billion.

You can trade eBay Inc. (EBAY) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: eBay Inc., TradingView, FactSet, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tabcorp’s mixed results are in

Tabcorp is Australia’s largest gambling company. They operate three market leading businesses: Lotteries and Keno, Wagering and Media and Gaming Services. They currently employ more than 5,000 people. Like many companies, Tabcorp has fears that rising inflation can potentially negatively affect revenue, as higher cost of living can lead to a r...

February 24, 2022

Read More >

Previous Article

Origin brings forward the closure of Australia’s largest coal plant

Origin Energy is a major integrated electricity generator, and electricity and natural gas retailer. It operates Australia’s largest coal-fired powe...

February 24, 2022

Read More >