- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Equities, gold, crypto and oil soar, Dollar dumps as Powell tilts dovish

28 July 2022As expected, the Federal reserve hiked rates 75bp on Wednesday as the Fed battles to control record inflation whilst attempting to avoid a deep recession. Markets were relatively behaving as expected on the decision and statement up until the Fed chair Powell’s presser anyway.

Whilst Powell reiterated the Feds mission to tame inflation statements such as “likely appropriate to slow increases at some point” and any further increases will be “data dependent.” Were seen as dovish pivot, resulting in rate hike odds and the USD tumbling while Stocks, Bonds, Gold, & Crypto soared as the market re-priced medium term interest rate expectations to the downside.

Source: Twitter

Powell gave no indication of what to expect in September, instead stating that future decisions would be “data dependant” and “meeting by meeting”, without this solid guidance it looks like “bad news is good news” again, weaker economic figures going forward will be seen by the market as bullish for equities on the expectation rate hikes will be curtailed.

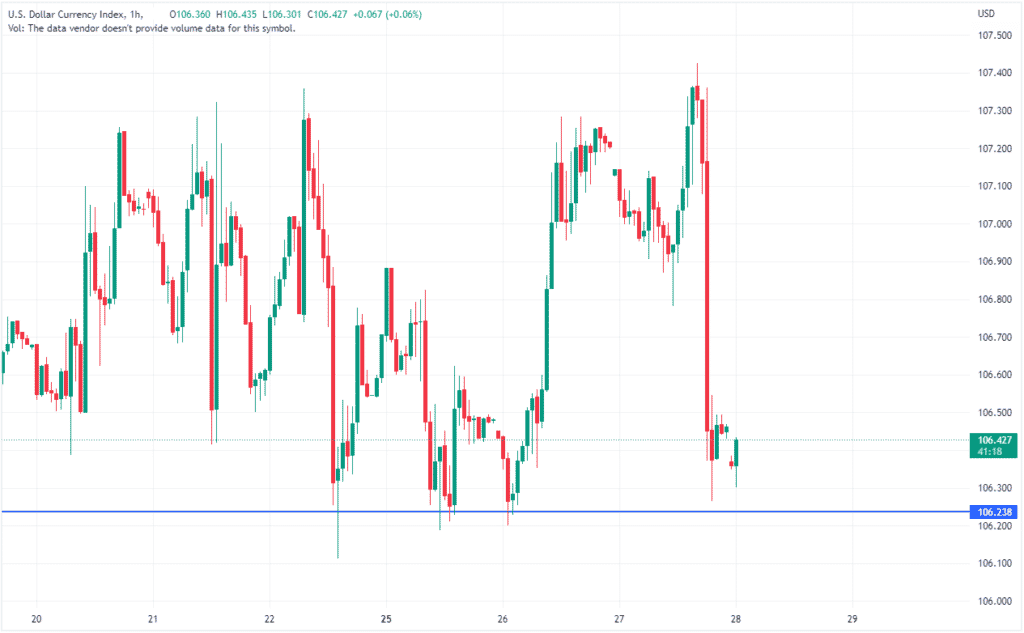

The US Dollar index gave back Tuesdays gains, testing the recent support level of 106.24

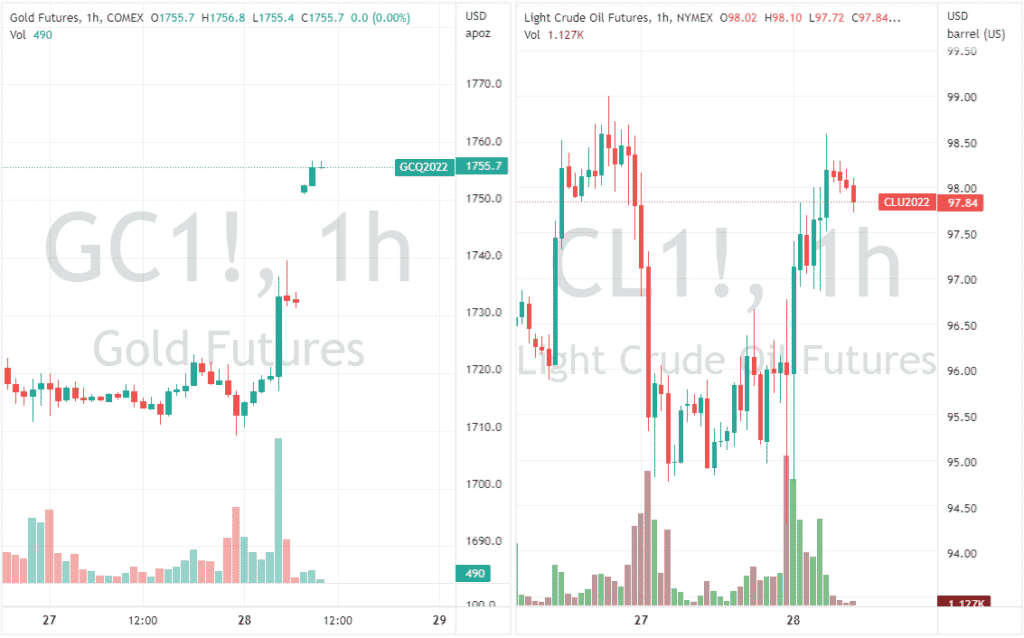

Gold and Oil both rallied strongly on lowered rate expectations and recession fears dissipating.

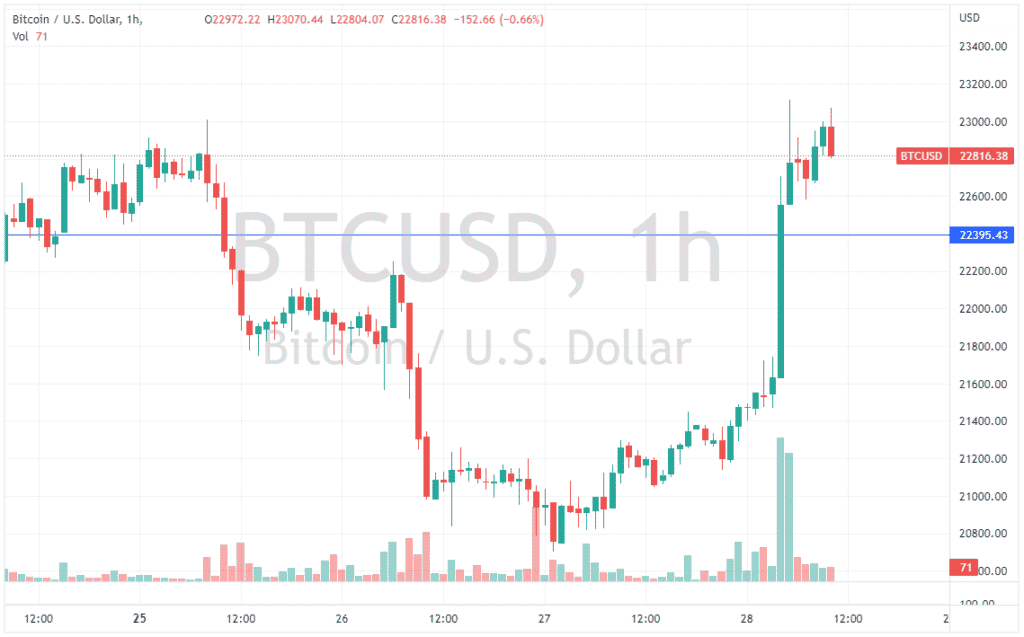

Risk on Bitcoin also saw a big jump following the Nasdaq which was the best performing US index.

Looking forward, today will see the Advance Q2 GDP released in the US, Chairman Powell stated last night he would be taking it with “a grain of salt” so it’s affect may be muted somewhat, though with “bad news being good news” an extremely weak figure could see the markets repricing rate hike expectations lower again.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Pfizer tops estimates for Q2

Pfizer Inc. (PFE) reported its Q2 financial results before the market open in the US on Thursday. World’s third largest pharmaceutical company topped both revenue and earnings per share estimates for the quarter. The company reported revenue of $27.742 billion in Q2 (up 47% year-over-year) vs. $25.487 billion expected. Earnings per share...

July 29, 2022

Read More >

Previous Article

Meta earnings results are in – the stock falls in the after-hours

Meta Platforms (META) announced its Q2 financial results after the closing bell in the US on Wednesday. The social media giant fell short of analys...

July 28, 2022

Read More >