- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

FX Analysis – EUR Underperforms on ugly PMIs, Rally in UST Yields Support USD,CAD Up on Back of Oil Rally.

25 July 2023FX markets traded in a holding pattern on Monday to start the week ahead of a deluge of big data to come. EU PMI’s were ugly though, all missing expectations, indicating a slowing economy but with sticky prices, raising the spectre of stagflation again and weeing the Euro underperform.

FX WRAP

USD was firmer on Monday, with a rise in the US Dollar index aided by EUR and GBP weakness and a rebound in US Treasury yields. DXY hit a high of 101.42 and closing a session highs in low volatility session. USD traders showing caution ahead of key risk events later in the week, headlined by the FOMC monetary policy meeting tomorrow where a 25bps fully priced in. A rally in UST yields, up to 3.878% also bolstering the Dollar.

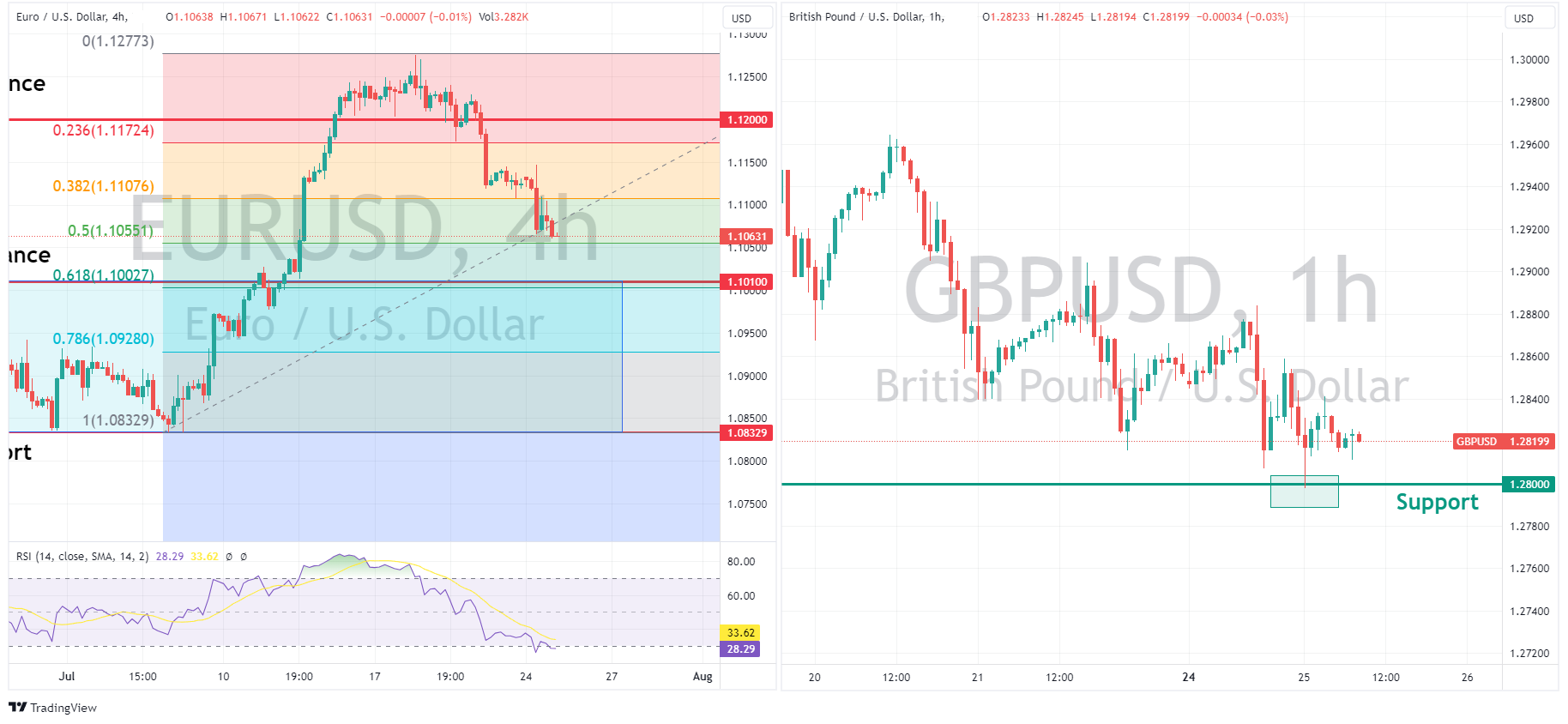

As previously mentioned, EUR was the G10 underperformer (with GBP not far behind) , after disappointing EU and UK PMIs where misses were seen across the board. EURUSD hitting a low of 1.1061 and testing the 50% fib retracement support level. The ECB meets on Thursday where a 25bps is also fully priced in, the question will be is another one coming in September. For GBP watchers, Cable hit a low of 1.2799, briefly breaching the major support and psychological level of 1.28 before bouncing to finish the session 20 pips above, this will be a critical level to watch.

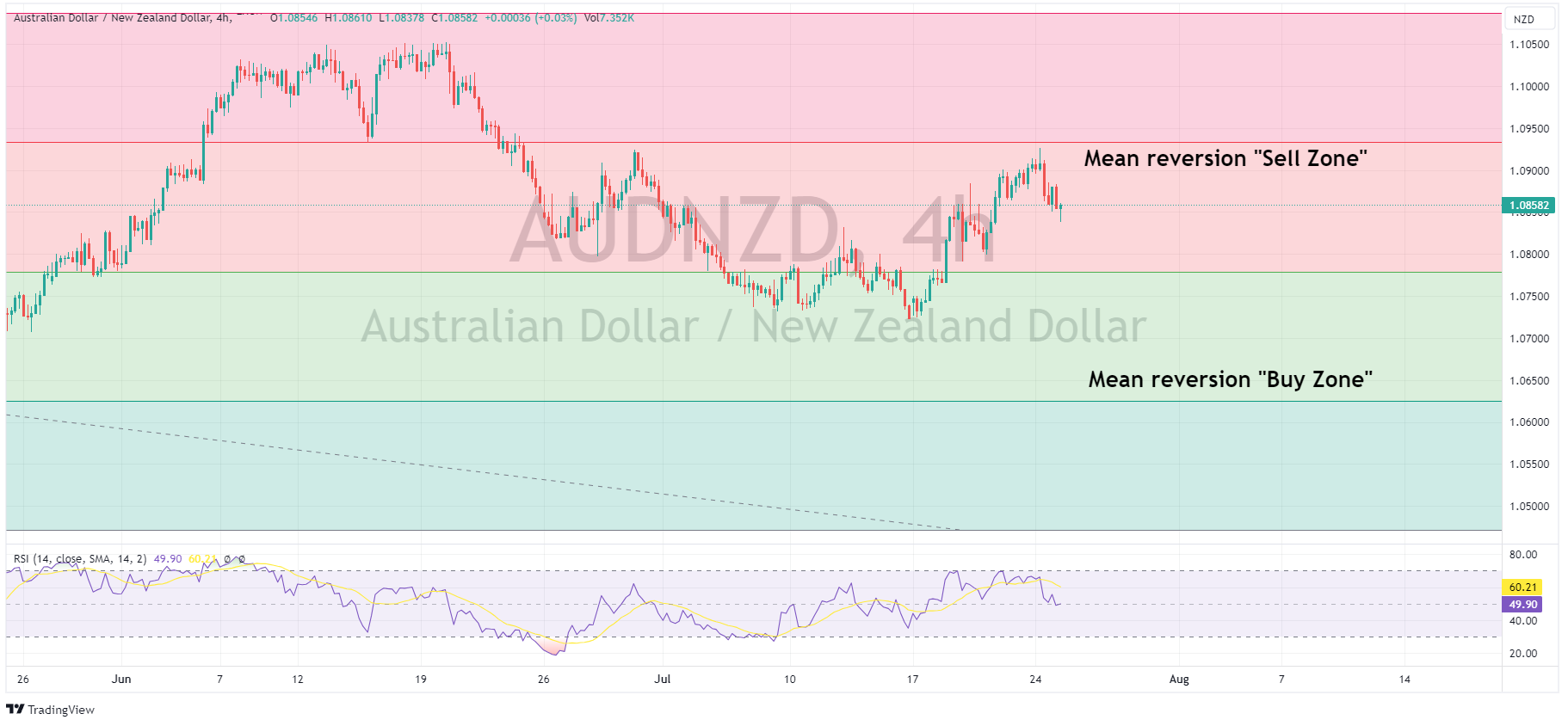

AUD and NZD were firmer, with the NZD continuing to outperform, mostly on AUD weakness rather than anything NZD specific. AUDNZD declined back below 1.09 after the AUD was undermined by declines in two out of three PMIs released on Monday. Aside from this, newsflow was light for AUD and NZD with a key Australian CPI figure released tomorrow the main risk event for AUD traders this week.

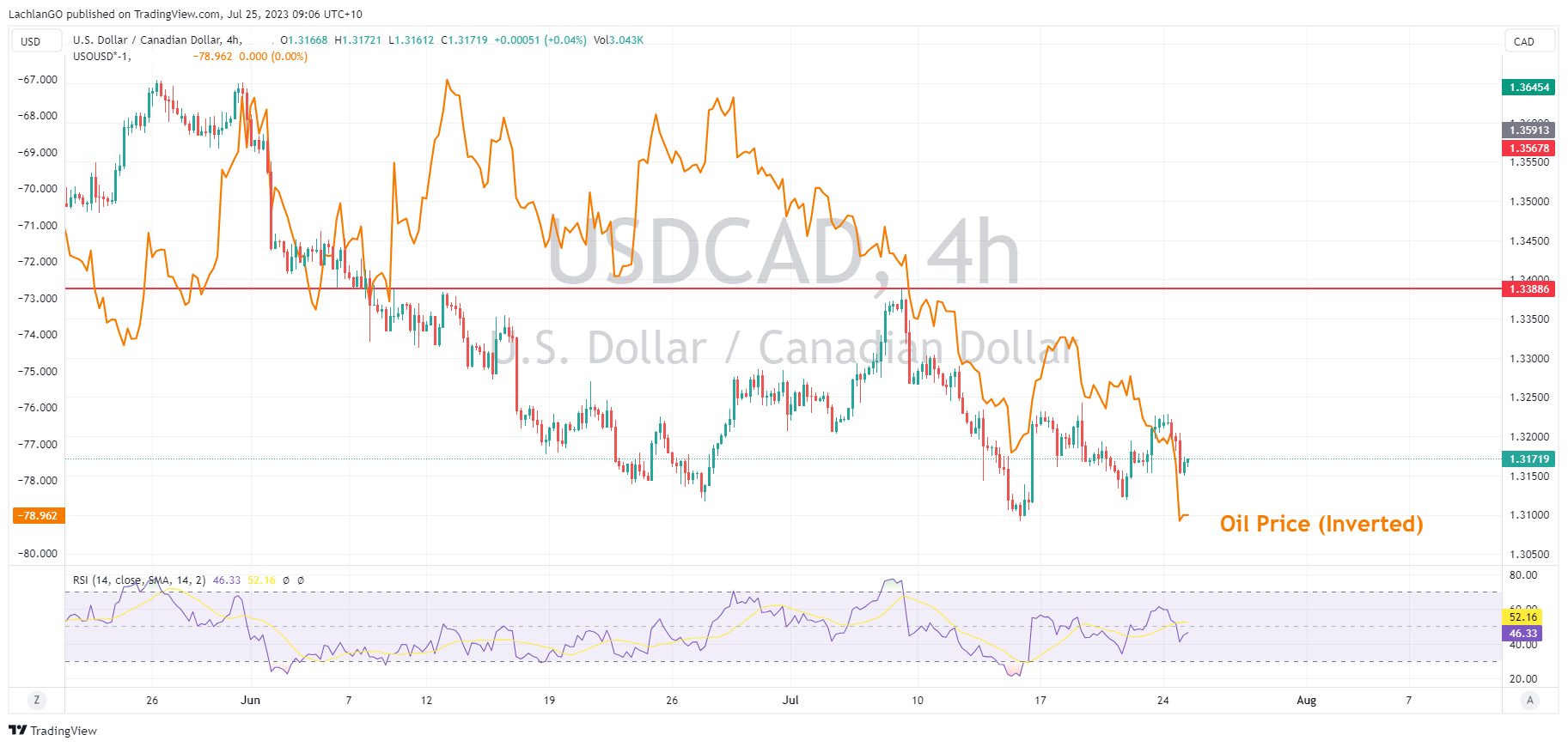

CAD saw marginal gains vs the USD and with a lack of anything CAD specific, seemed to be aided by a jump in crude oil prices on China stimulus tailwinds. USDCAD testing Fridays lows at 1.3150 before finding some support and marginally rebounding.

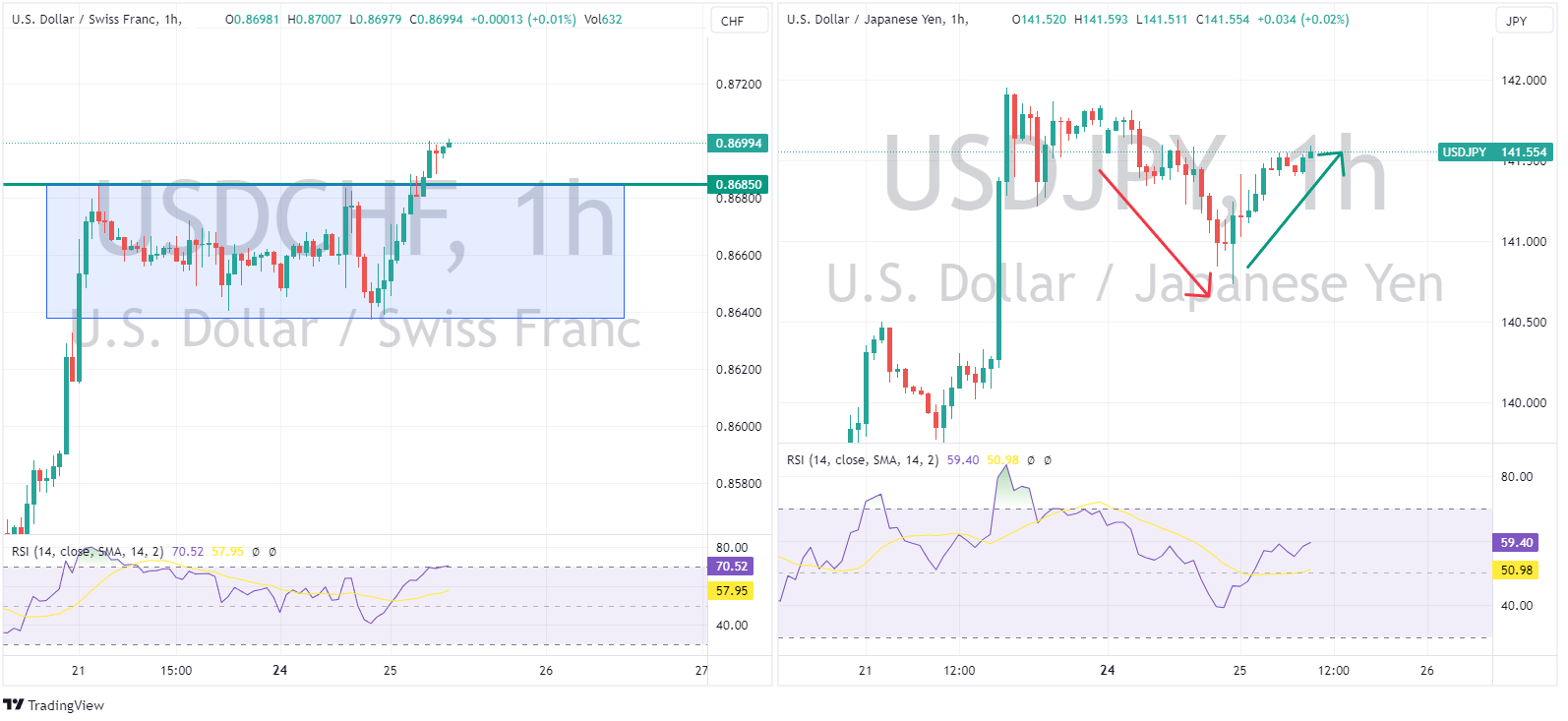

Safe-havens were mixed. JPY firmed early in the session, with USDJPY hitting a low of 140.73, before reversing course as US Treasury yields recovered, ending the session mostly flat. Like the EU and US JPY traders have a pivotal Central Bank meeting this week, with the BoJ monetary policy update released on Friday. CHF was also weighed on by the comeback in UST yields, with USDCHF breaking out of it’s recent range to the upside, to touch on 0.87.

A light calendar today with no Tier one data to be released, a calm before the storm from Wednesday onwards.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Gold eases heading into FOMC

After a fortnight of trending north, Gold has fallen over the past 5 days. It is currently trading at around $1960, showing a slight decline of approximately 1.35% from its recent high of $1987.53. Price is currently trying to break out of the downward channel that it has been in since late last week, so something to keep an eye on going into th...

July 26, 2023

Read More >

Previous Article

The Week Ahead – FOMC, ECB, BoJ Rate Decisions, Aussie CPI Headline a Big Week in Markets

Global markets are heading into a bumper week of tier one economic releases, with the eagerly awaited rate decisions from the Federal Reserve, Europea...

July 24, 2023

Read More >