- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Hot PMI Data Sees Dow Turn Negative For The Year As Stocks And Bonds Tumble

22 February 2023US Flash Services and Manufacturing PMI’s came out better than expected , showing the US economy remains resilient in the face of raising interest rates. The January narrative of a Fed pivot on fears of an economic slowdown has flipped 180 degrees in February as persistently strong figures have traders repricing markets for “higher for longer” rates, good news is bad news for equities and risk instruments in the current climate.

The Dow Jones had it’s biggest loss of the year, dropping almost 700 points , breaking through the 50 day MA (Where it has found recent support) and turning negative for 2023.

Bonds also took a battering as the markets repriced a Fed terminal rate above 5.35% (current cash rate is 4.75%) and barely any rate-cuts priced in at all for 2023, a huge shift in expectations from just a month ago. Higher Yields = Lower bond price, with the 10 Year price giving up all it’s gains in January and then some.

In FX, unsurprisingly the USD outperformed almost everything, with URUSD, AUDUSD and Gold all dropping against the Greenback, one major exception was Cable (GBPUSD). The GBP was bolstered by it’s own hot PMI figures out of the UK casting doubt on recent expectations of a hold from the Bank of England in their tightening cycle.

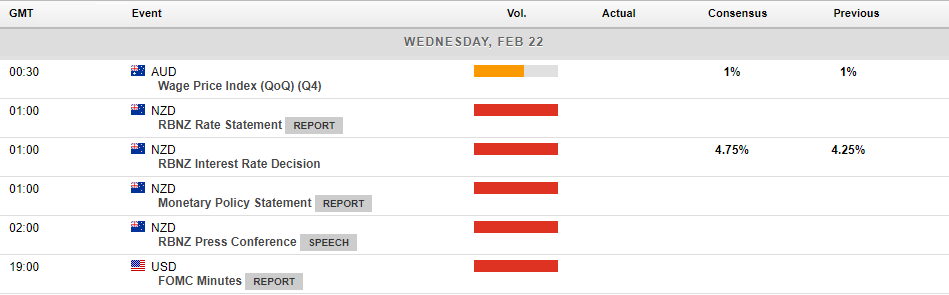

In todays economic announcements we have a busy Asian session, first up is the Australian Wage Price Index. The RBA has referenced wage growth many times in their statements accompanying their rate decisions, it’s not as important as it was when they were cutting rates, but a rising number would still encourage hawkish rhetoric from the RBA you’d think and be bullish for AUD.

Next is the RBNZ rate decision where 50bp is priced in and pretty much a certainty. Any volatility will come from the statement , whether it’s seen as hawkish or dovish for policy going forward.

In the US session we also have the FOMC minutes from their last policy meeting, traders will be reading these closely to gauge the mood of the Fed members and hints to future intentions.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Surprising PMI data for the UK

The Purchasing Managers Index (PMI) is a leading indicator of economic health where an expansion of the industry is indicated by a data release above 50, while a release below 50 indicates a contraction. On Tuesday, the Flash Manufacturing PMI was released at 49.2 (Forecast: 47.5) and the Flash Services PMI was released at 53.3 (Forecast: 49.2) for...

February 23, 2023

Read More >

Previous Article

Walmart Q4 and full-year results announced

Walmart Inc. (NYSE:WMT) announced Q4 and full-year financial results before the market open on Wall Street on Tuesday. World’s largest supermarke...

February 22, 2023

Read More >