- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Hot PPI and Hawkish Fed Speak Hit Stocks, Gives USD a Boost

17 February 2023A hotter than expected PPI figure combined with hawkish statements from Fed members and a fall in jobless claims saw risk assets take a hit in Thursdays US session.

Headline PPI came in at an increase of 0.7% month on month (0.4% expected) while a drop in unemployment claims showed how resilient the US economy is despite the Feds recent tightening cycle, dampening expectations the Fed will pivot anytime soon.

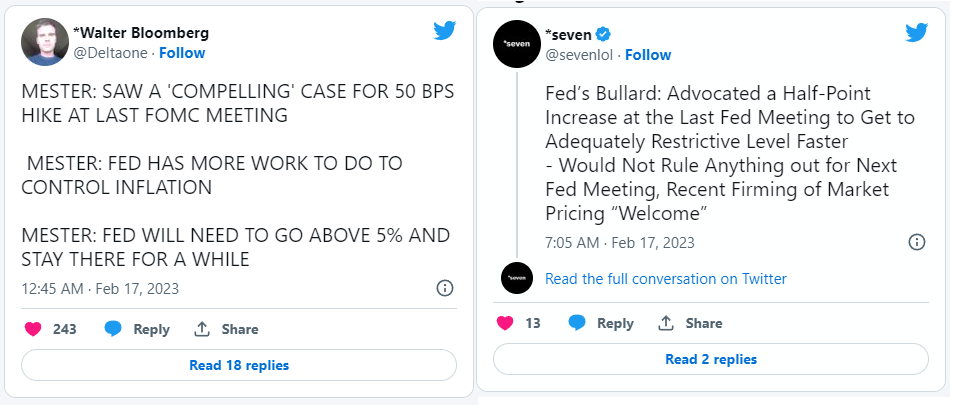

Adding to the mix were know Fed hawks Mester and Bullard advocating for higher rates for longer to fight inflation and not ruling out the Fed reverting to oversized 50bp hikes if needed.

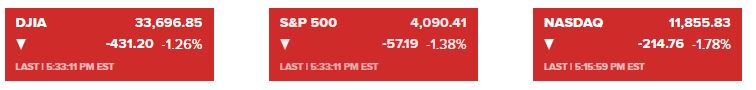

Unsurprisingly as rate markets repriced near term predictions of the Feds rate trajectory to the hawkish side, stocks took a hit, led down by the more risk and rate sensitive Nasdaq.

With Tesla (TSLA.NAS) being the big loser, tumbling initially on the news of a recall then on the broader market.

..And the US dollar rallied, with AUDUSD briefly breaking through the 0.6860 major support level.

In Crypto, Bitcoin continued it’s rally early in the session, touching on the 25k USD per token (its highest level since June 2022) major resistance level before being forcefully rejected.

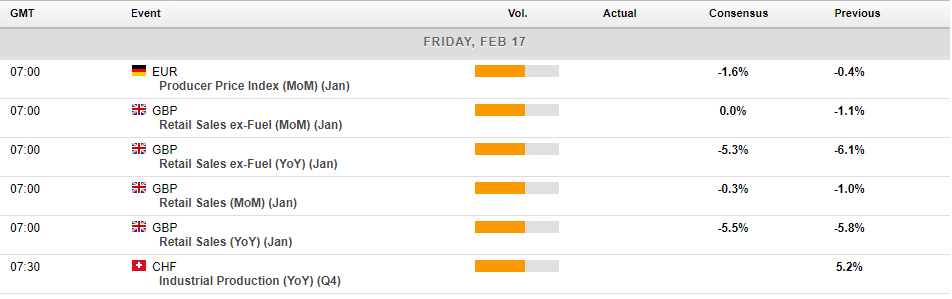

Todays economic calendar takes a breather after an exciting week, with a handful of mid level figures out of Europe and the UK which will likely have little impact on markets..

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Why did the CBA share price sink 5%?

Australia’s biggest lender has suffered a dropped in price the last few days. Shares in the bank fell as much as 5.7% in early trading in Sydney while the broader market (.AXJO) fell 1.0%, amid concerns of a weaker mortgage business in the high interest rate environment and the bank's lending margins peaking. Key points Brokers thin...

February 17, 2023

Read More >

Previous Article

Strong breakout potential on the EURJPY

The EURJPY has been trading under the 142.70 resistance area since the end of December 2022. With the price failing to break through over several occa...

February 17, 2023

Read More >