- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

How to trade the Volatility Contraction Pattern

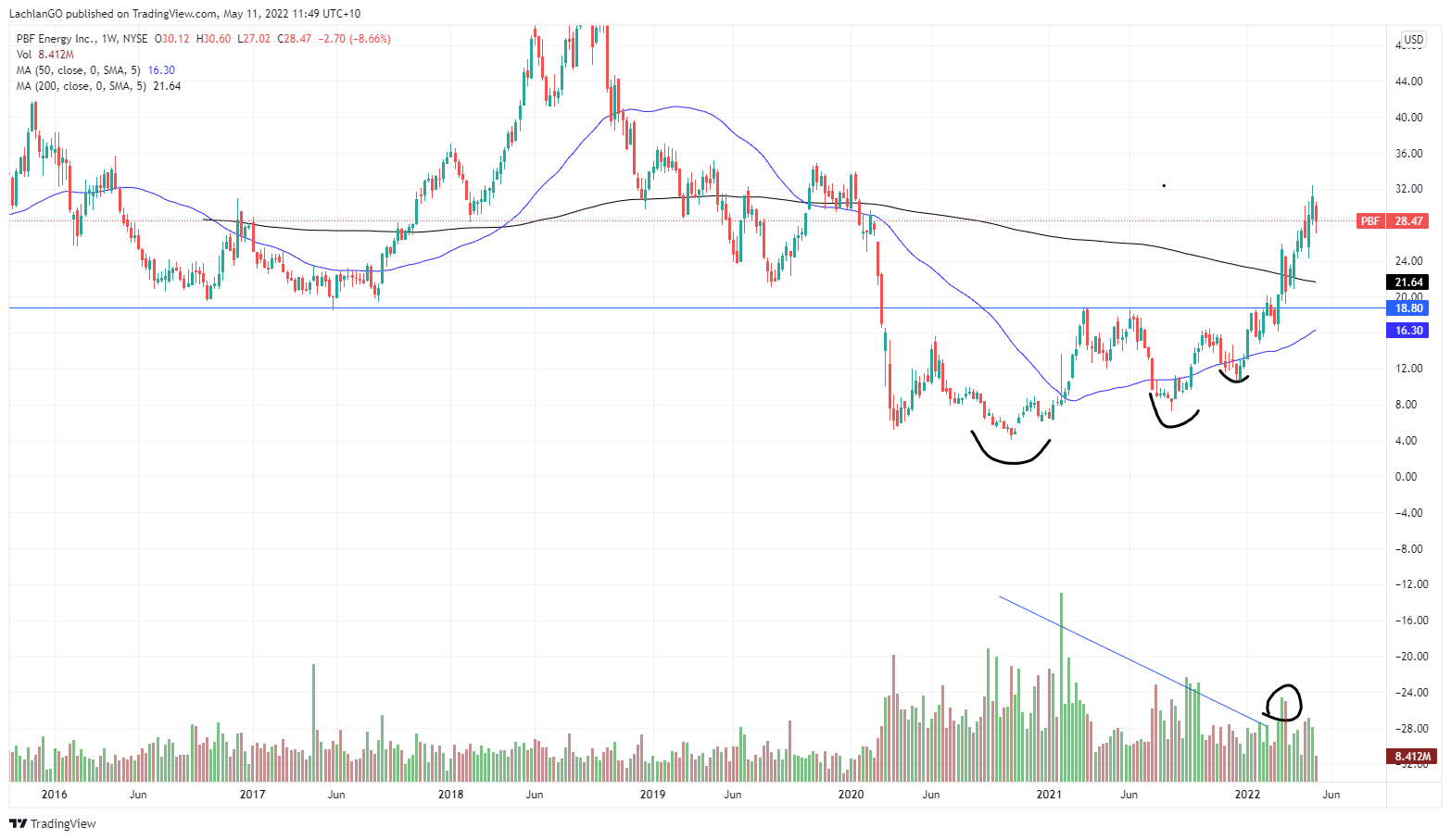

11 May 2022The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pattern is that stocks in long term up trends will pause and consolidate as some holders exit their positions and the stock is accumulated again by buyers in the market. The chart pattern can provide opportunities for powerful break outs and can be used across any time frame. This allows traders to jump in on potential moves before they explode.

Mechanics of the pattern

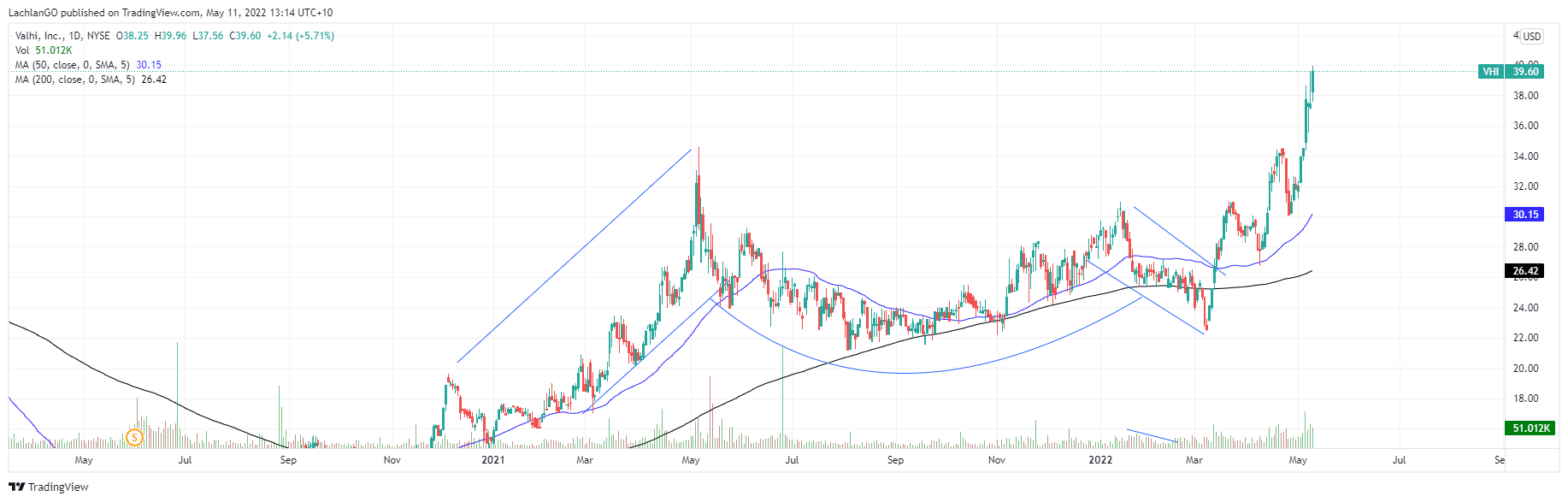

The background of the pattern is relatively simple. The stock has been previously rising in an uptrend and has found some resistance. It then moves into a period of consolidation categorised by 2-6 retracements with each one being smaller than the previous one. The volume should usually be decreasing as the chart moves to the right. The pattern culminates in a powerful break out that can often be long lasting.

The key for this pattern is that there needs to be a contraction of volatility as the chart moves from the left to the right. This highlights that the volume available is decreasing and becoming scarce. In addition, the more dramatic in volume, the more likely that the move will be explosive. Below the breakout is accompanied by an increase in the relative volume.

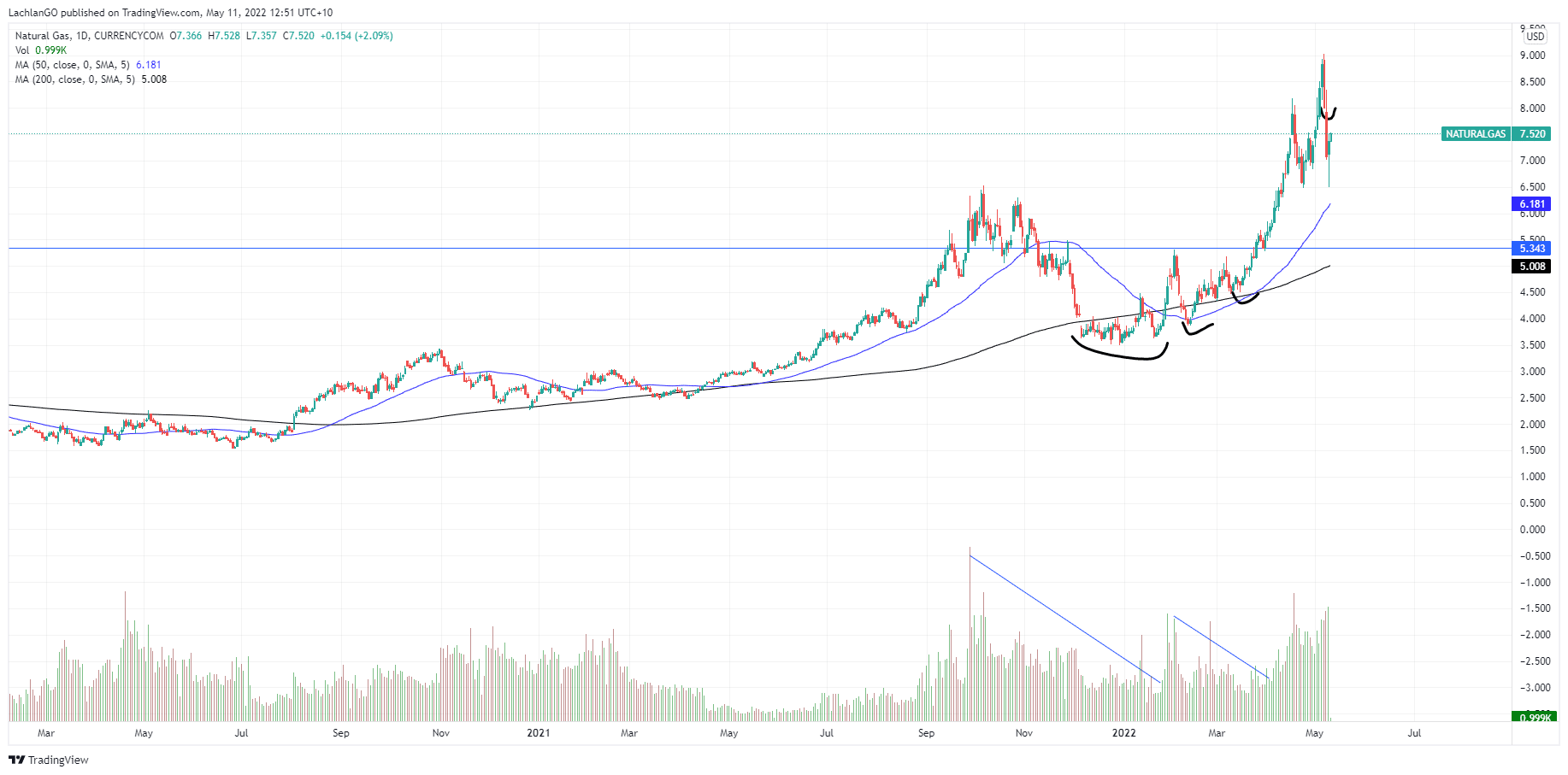

In the chart below for Natural Gas, the decrease in volume can be associated with the contracting candlestick pattern. This occurs prior to the break of the long-term resistance. The breakthrough was also associated with a large amount of buying volume.

The VCP can manifest itself in other patterns such as a cup and handle patterns. The key is that the candlesticks must be decreasing volatility.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Myer announces first dividend payout since 2017

Myer is an Australian mid-range to upscale department store chain. It trades in all Australian states. Myer retails a broad range of products from clothing and cosmetics to homewares and electronics. Myer has recently released their <a href="https://www2.asx.com.au/markets/company/myr">half-year results</a>. In the first five weeks o...

May 11, 2022

Read More >

Previous Article

How to find stocks to trade?

Identifying Trade Opportunities Having a successful trading system requires a mix of different cogs working together in harmony to achieve successf...

May 10, 2022

Read More >