- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Inflation fears leads to a Bearish equity market

17 March 2022Equity investors have gone through another rocky week. A week highlighted by the first post-pandemic interest rate hike by the US Federal Reserve, the on-going Russia and Ukraine conflict and the surging fuel prices that could potentially derail the global economic recovery.

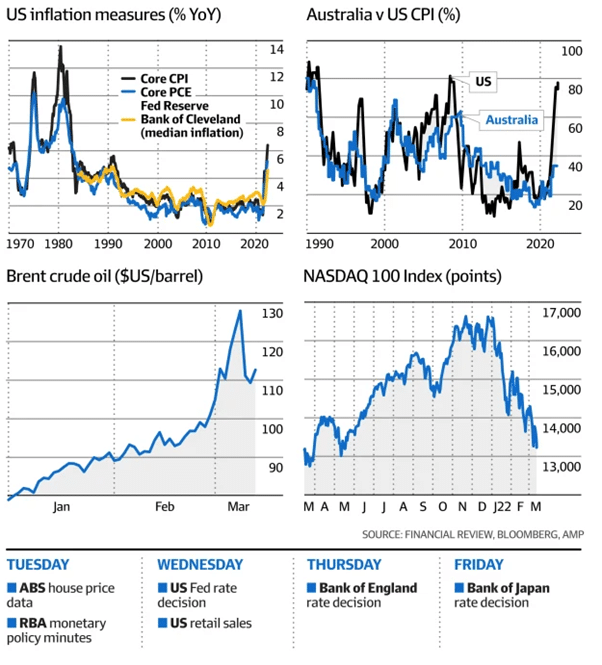

Australian equity futures increased 0.3% on Monday, despite the aforementioned risks. Energy and commodities businesses are looking to continue enjoying the price inflation, which has reached a 40 year high of 7.9% in the US.

The consensus forecast for the US Federal Reserve is to deliver a 25 basis point cash rate rise on Wednesday, which will bring it up to 0.50%. This is an initial effort to contain inflation. Some experts believe that the Russia and Ukraine conflict could push the rates up by 50 basis points. The US Federal Reserve ultimately decided to increase the interest rate by 25 basis points.

In Australia, interest rate traders have priced in multiple rate rises in 2022 from July to mean the cash rate could exceed 1 per cent by December. The next RBA interest rate meeting will be held on the 5th of April with the general consensus being split between no change and a decrease of 10 basis points.

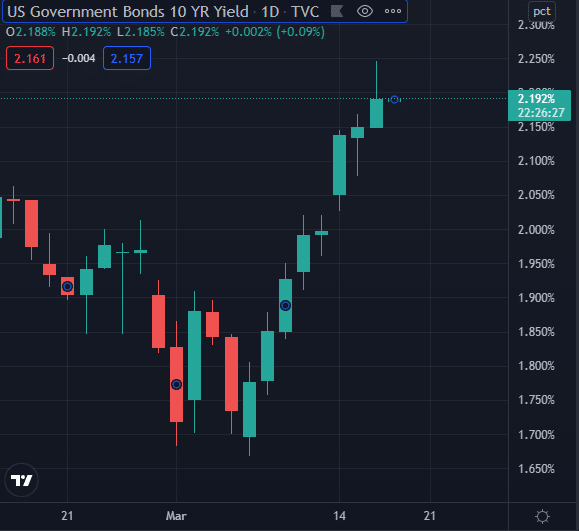

As bond traders pushed inflation and interest rate expectations higher, yields on benchmark US 10-year treasuries climbed sharply over last week to close at 2.190% on Wednesday.

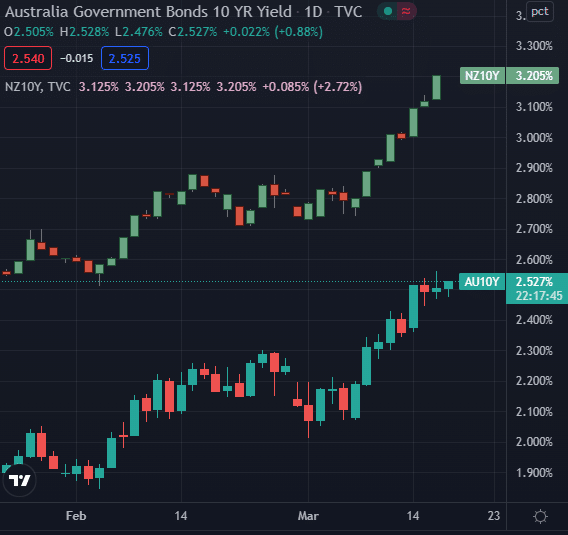

Yields on Australian 10-year bonds closed at 2.505%, the highest since December 2018. In New Zealand, 10-year yields topped 3.120% for the first time since 2018, according to Bloomberg.

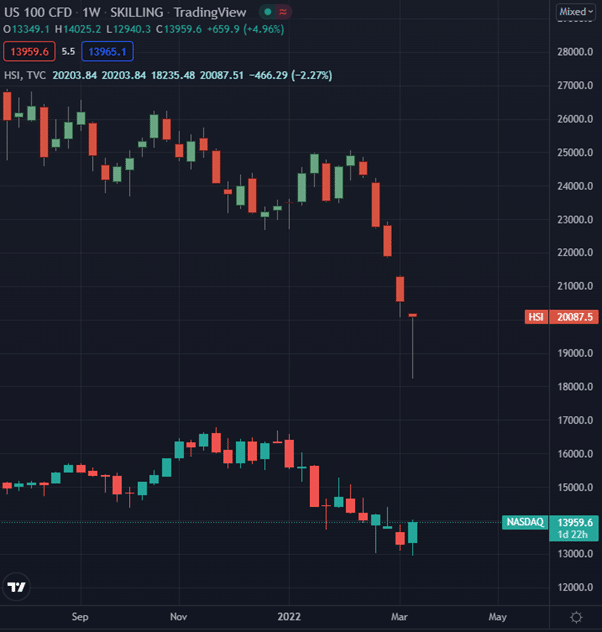

Last Friday’s close signaled a bear market for a couple of major indices. The Nasdaq index dropped by 2.1%, this is a part of a 20% decline since November. The Hang Seng Index had also dropped by 4.3%, its lowest level since 2016.

All in all, the current volatility is affecting the global equities markets. Inflation fears might be one of the contributing factors to current bearish markets. Traders will need to keep a close eye on governmental actions to combat inflation.

If you would like to take this opportunity to invest in the Index Markets and don’t already have a trading account, you can register for a CFD account at GO Markets.

Source: GO Markets, Tradingview, Bloomberg, FXstreet, AFR

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Markets continue to consolidate after the Federal Reserve increased interest rates

US markets continued their gains overnight as the market continued to rally on the back of the prior day’s Federal Reserve news. The Nasdaq finished up 1.33%. The Dow Jones Index closed 1.23% higher and the S&P 500 ended the session 1.23% higher as well. In Europe, the FTSE performed well finishing up and 1.28%, and the DAX closed at 0.36% lo...

March 18, 2022

Read More >

Previous Article

US indices have a bumper session on the back of positive direction given from the Federal Reserve

US indices had a bumper day of trading as the Federal Reserve increased interest rates by 25 basis points. The Reserve is also expected to raise rates...

March 17, 2022

Read More >